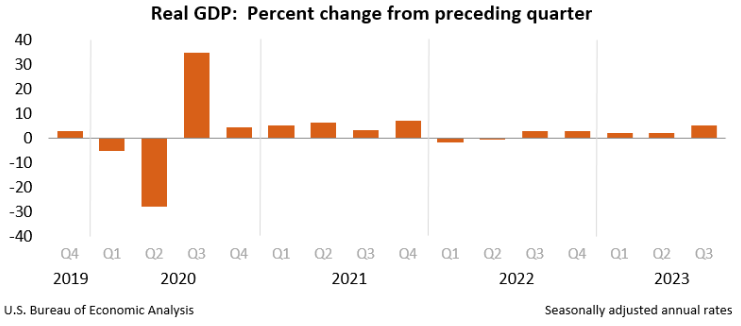

1:30 PM GMT - US Q3 GDP revision

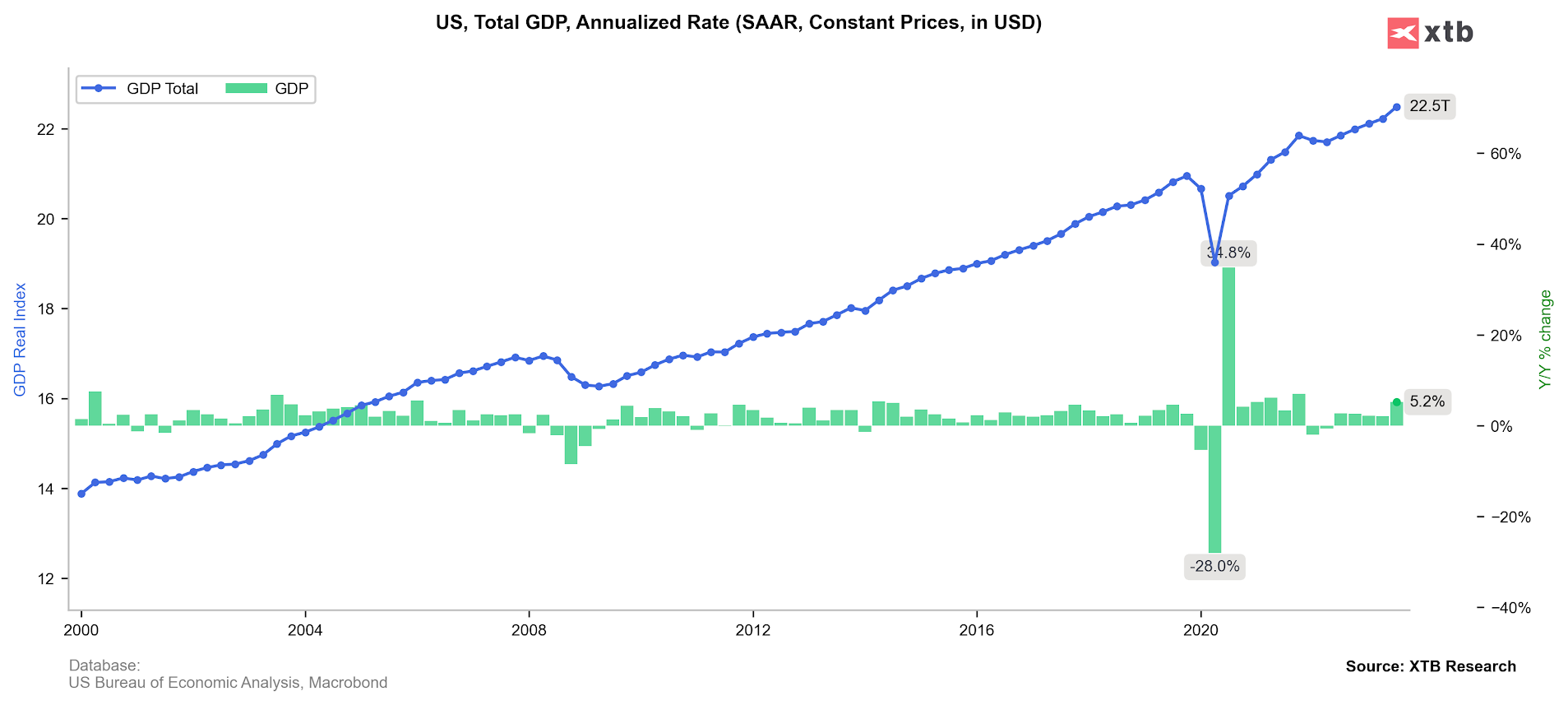

- GDP (annualized): 5.2% vs 4.9% previously

- GDP Deflator. 3.6% vs 3.5% previously

- US GDP Price Index: 3.6% vs 3.5% previously

- US Core PCE: 2.3% vs 2.4% previously

- US Consumers spending: 3.6% vs 4.0% previously

- US Wholesale inventories: -0.2% vs 0.2% previously

- US Advance Goods Trade Balance: -$89.84 billion (flat q/q)

- US Real Inventories (Ex-Auto): -0.9% vs 0.4% previously

US prelim Q3 PCE services price index ex-energy/housing: 3.4% vs 3.6% previously

US prelim Q3 PCE price index ex-food/energy/housing: 1.6% vs +1.8% previously

In first reaction strong GDP reading supported US dollar, weakening Wall Street sentiments slighlty.

Source: xStation5

Source: xStation5

Source: XTB Research, US Bureau of Economic Analysis, Conference Board, Macrobond

Source: XTB Research, US Bureau of Economic Analysis, Conference Board, Macrobond

Source: XTB Research, US Bureau of Economic Analysis, Conference Board, Macrobond

Source: XTB Research, US Bureau of Economic Analysis, Conference Board, Macrobond

Economic Calendar: U.S. Unemployment Claims in spotlight (12.03.2025)

BREAKING: EURUSD muted after stable US CPI report 🇺🇸 📌

Market Wrap: Market awaits Middle East resolution and US CPI🕞

Economic calendar: US CPI inflation the key release 🔎

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.