- US Core PCE Price Index YoY Actual 3.0% (Forecast 2.9%, Previous 2.8%)

- US PCE Price Index MoM Actual 0.4% (Forecast 0.3%, Previous 0.2%)

- US Q4 advance GDP +1.4% vs +3.0% expected

- GDP Price Index: 3.6% (est 2.8%; prev 3.8%)

- Personal Consumption: 2.4% (est 2.4%; prev 3.5%) -

- Core PCE Price Index(Q/Q): 2.7% (est 2.6%; prev 2.9%)

Growth slowed while inflation remained slightly higher than forecasts.

US GDP grew at an annualized rate of just 1.4% in Q4 2025, well below forecasts, hampered by a record-long government shutdown, weaker consumer spending, and a trade deficit, following 4.4% growth in the previous quarter. Full-year growth was a solid 2.2%, despite an initial decline in Q1, and the BEA estimated that the shutdown subtracted about 1 percentage point from the quarterly result; Trump even claimed a 2 percentage point loss just before the release. Despite the slowdown, the data closed the year on a positive note thanks to Trump's easing of tariffs and Fed rate cuts, which supported the stock market and consumption by the wealthy. Core PCE inflation rose 0.4% m/m and 3% y/y in December, signaling price pressure, which is becoming crucial ahead of the midterms.

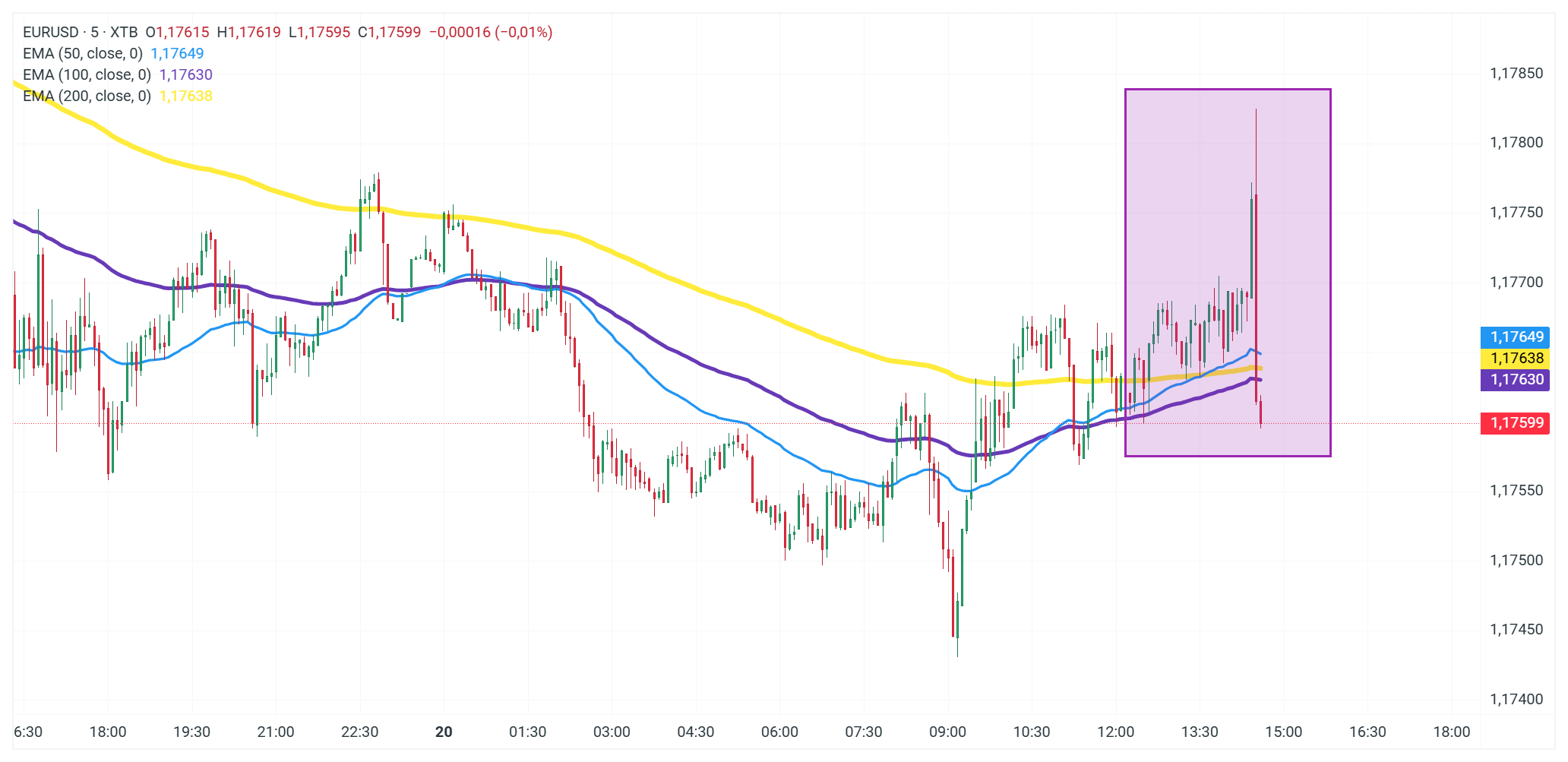

GDP above. Source: XTB

PCE data above. Source: XTB

President Donald Trump claimed the prior year's government shutdown cost the US at least two GDP points, posting this just before the Q4 growth data release amid very weak US economic expansion figures. He blamed Democrats for repeating a "mini" shutdown, criticized Fed Chair Jerome Powell, and demanded lower interest rates. The remarks coincide with a partial shutdown of the Department of Homeland Security, tied to Democratic demands for stricter immigration controls after violent incidents in Minnesota. This fuels political tensions as sluggish GDP growth underscores broader economic fragility.

BREAKING: TRUMP’S GLOBAL TARIFFS STRUCK DOWN BY US SUPREME COURT 🚨🏛️

Market Wrap: Europe is back to green 🇪🇺 📈 Business activity finally accelerating ❓

BREAKING: European flash PMIs stronger than expected 📈EURUSD ticks higher

US500: US stocks lose momentum despite the strongest S&P 500 revenue growth in 3 years 📊

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.