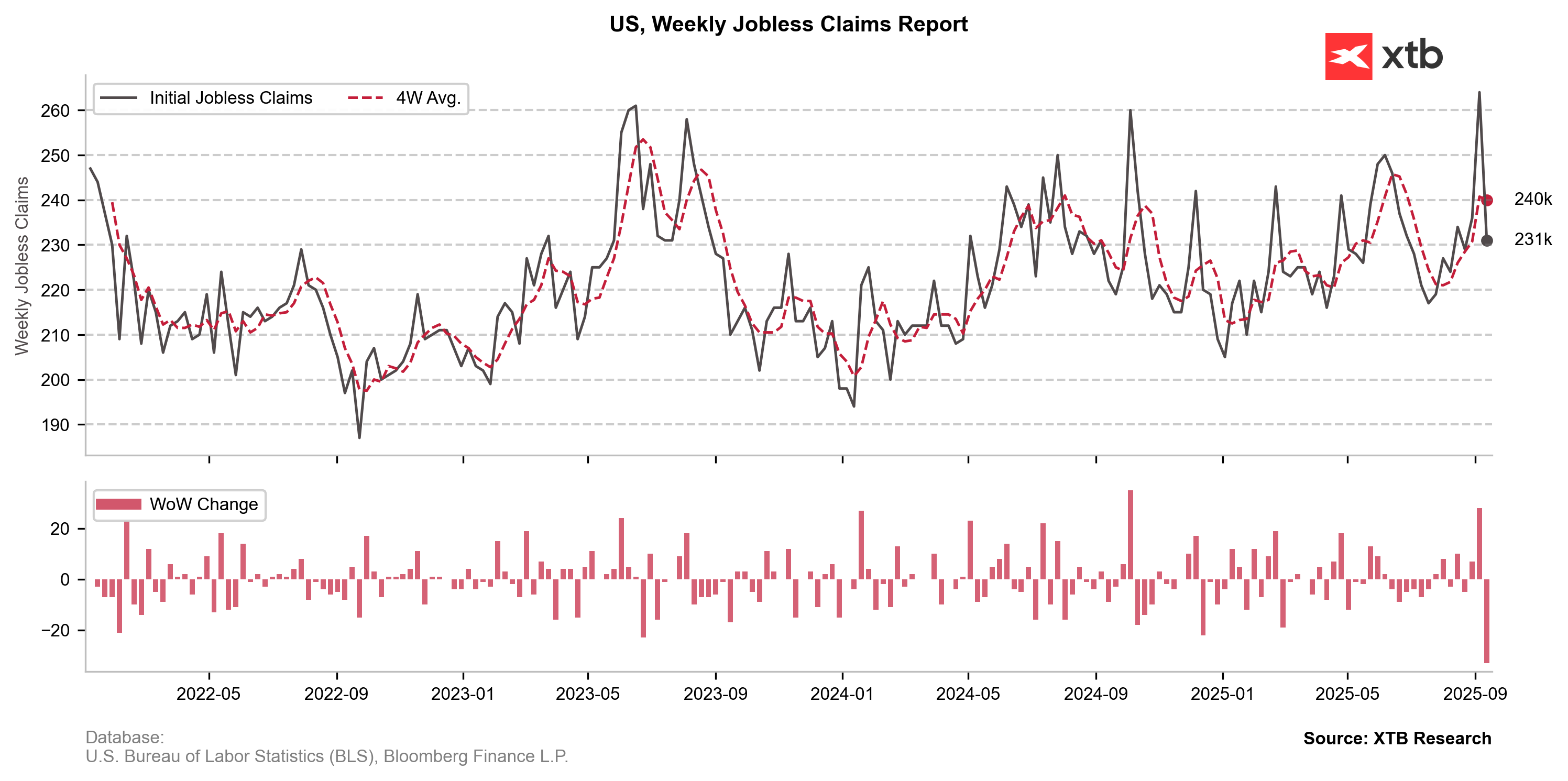

- Initial Jobless Claims: 231k (Forecast 240k, Previous 264k)

- Philadelphia Fed Manufacturing Index: 23,2 (Forecast 1,7, Previous -0,3)

Jobless Claims and the Philadelphia Fed index both came in stronger than expected, signaling resilience in the labor market and broad economy. This could reinforce the case for tighter monetary policy.

Dolar is appreciating and US bond Yields are falling across the board. This however puts minor pressure onto US futures.

Source: US Bureau of Labor Statistics

⏬EURUSD softens ahead of the US CPI

Market Wrap: Dollar accelerates before CPI. Mixed earnings from French giants (13.02.2026)

BREAKING: Oil prices plummet amid rumors of further OPEC production increases 🚨

Chart of the Day: USD/JPY highly volatile ahead of US CPI

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.