Summary:

-

Bank of Canada hike rates as expected

-

CAD rallies on hawkish outlook

-

ZAR falls back after budget misses

There’s been a strong move higher in the Canadian dollar in the past few minutes after the Bank of Canada announced another interest rate hike. The move higher of 25 basis points to 1.75% for the overnight rate was widely expected with markets giving such an event as high as a 93% probability beforehand. GIven this the hike itself isn’t likely to be the cause of the pop higher in the Loonie, rather it is a clear hawkish shift in the accompanying statement. Perhaps the biggest takeaway is the dropping of the word “gradual” from the statement when describing how rates will be increased going forwards, implying that the pace may well be faster going forward. In addition the bank also upgraded its outlook for investment and exports and committed to raising rates to a neutral setting.

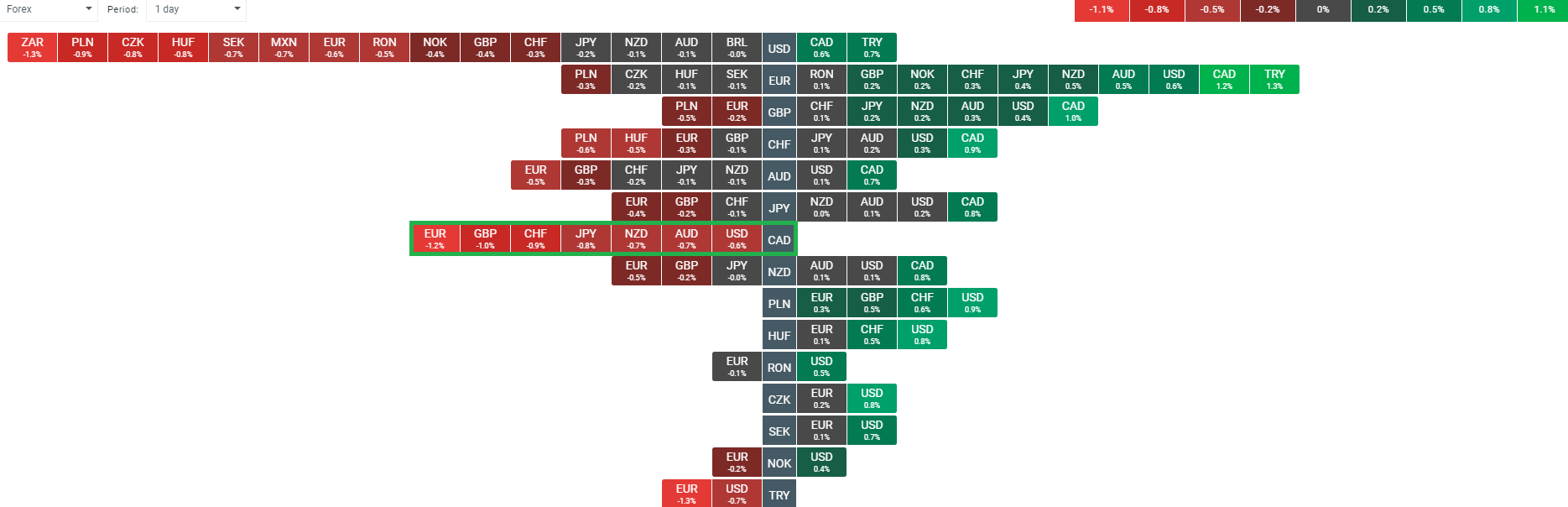

The Canadian dollar has rallied since the release and is higher on the day against all of its peers. The largest gains are seen against the Euro (1.2%) and the GBP (1.0%). Source: xStation

It should be pointed out that the press conference with Governor Poloz and Deputy Governor Wilkins is still to come, so there could be a change in narrative, but if this doesn’t occur then this looks like it will provide a big boost for the Loonie. The USDCAD has broken back below the 1.30 since the release and in doing so the market appears to remain in the falling channel which dates back to early summer. 1.3075 had provided some support in recent session but the break below there is significant and this is now the first level to look to as resistance should price rise. If the market continues lower then there’s not much by the way of swing support until the 1.2885 level and if this move gains traction then further downside to the lower bound of the channel (currently around 1.2730) is possible.

USDCAD has fallen sharply in the past 25 minutes and while the press conference may throw up a surprise, it appears for now like the upper channel has been respected once more and the path of least resistance is lower. Source: xStation

While the Canadian dollar is one of the best performing currencies today, it’s a different story for the South African Rand which is coming under pressure after the latest budget missed targets. Finance Minister Tito Mboweni said government debt will peak two years later, and at a higher level, than previously forecast as the fiscal gap will widen further and state revenue will continue to undershoot. This is not surprisingly negative for the ZAR and there was a pretty swift drop of almost 1% against the USD when news broke. Government bonds also sold off with the 2026 issue climbing three basis points to 9.18%, erasing an earlier drop of 10 basis points.

USDZAR has bounced strongly today on the fall in the Rand and the market has now respected the longer term support around 13.98 once more and is threatening to breakout of a falling trendline going back to the highs in early September. Source: xStation

USDZAR has bounced strongly today on the fall in the Rand and the market has now respected the longer term support around 13.98 once more and is threatening to breakout of a falling trendline going back to the highs in early September. Source: xStation

NFP preview

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.