The HSCEI futures are down 1.1% as risk appetite plunges. Anticipation of a series of key US labor market releases is generating caution worldwide, while geopolitical tensions are adding further pressure on Asian indices.

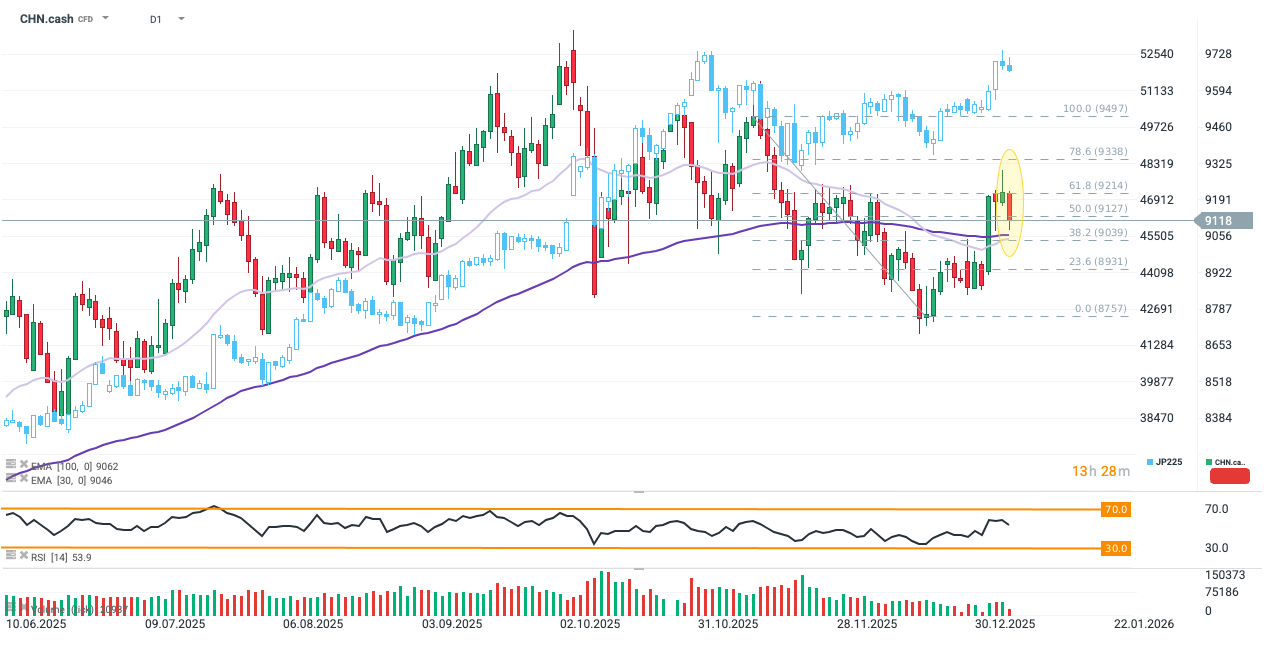

CHN.cash is trading below the 50% Fibonacci retracement of the last downward wave, but the sell-off has halted near the 100-day exponential moving average (EMA100; dark purple). Holding above this level will be crucial for continuing the rebound that began at the turn of 2025–2026. The blue line shows the Nikkei 225 futures, also under pressure from Beijing’s actions. Source: xStation5

What is driving CHN.cash today?

-

China has halted exports of certain rare earth metals and dual-use goods to Japan, citing national security following comments by Japanese Prime Minister Sanae Takaichi on Taiwan. The restrictions took effect immediately and could disrupt supply chains in key sectors, including electronics, aerospace, and defense. China also launched an anti-dumping probe into Japanese chemicals used in semiconductor production.

-

Beijing’s decision has rattled sentiment across the region. Chinese rare earths accounted for a staggering 63% of Japan’s imports in 2024, and the restrictions could seriously disrupt production in electronics, automotive, and defense sectors. For Chinese firms, this means losing a significant customer base, while investors face increased uncertainty across the supply chain and pressure on strategic component prices.

-

CHN.cash is also weighed down by a slowdown in AI-driven optimism. Risk appetite is clearly declining as investors prepare for key US labor market data, which will be particularly relevant for Fed policy in the coming months. Expectations for Friday’s NFP report are relatively high – the market anticipates labor market stabilization and further job growth following months of mixed readings. Preludes to the report include today’s ADP and JOLTS releases, which are expected by consensus to confirm a stable employment narrative, though demand for new hires remains subdued.

Daily Summary: Oil at new local highs; Iran and Trump dampen market sentiment 💡

BREAKING: Stronger-than-expected decline in US gas inventories

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.