While economic releases scheduled for today are scarce, the ones that will be published are definitely worth attention. European Commission will release a new set of economic forecasts today at 10:00 am BST. Traders should expect some short-term volatility in case forecasts differ significantly from the previous ones. Apart from that, FOMC minutes will be released in the evening (7:00 pm BST). Some Fed members hinted that taper discussions have begun during the latest FOMC meeting on 15-16 June and minutes may confirm this. If this is so, market reaction will depend on whether taper was only mentioned or was it discussed more in depth.

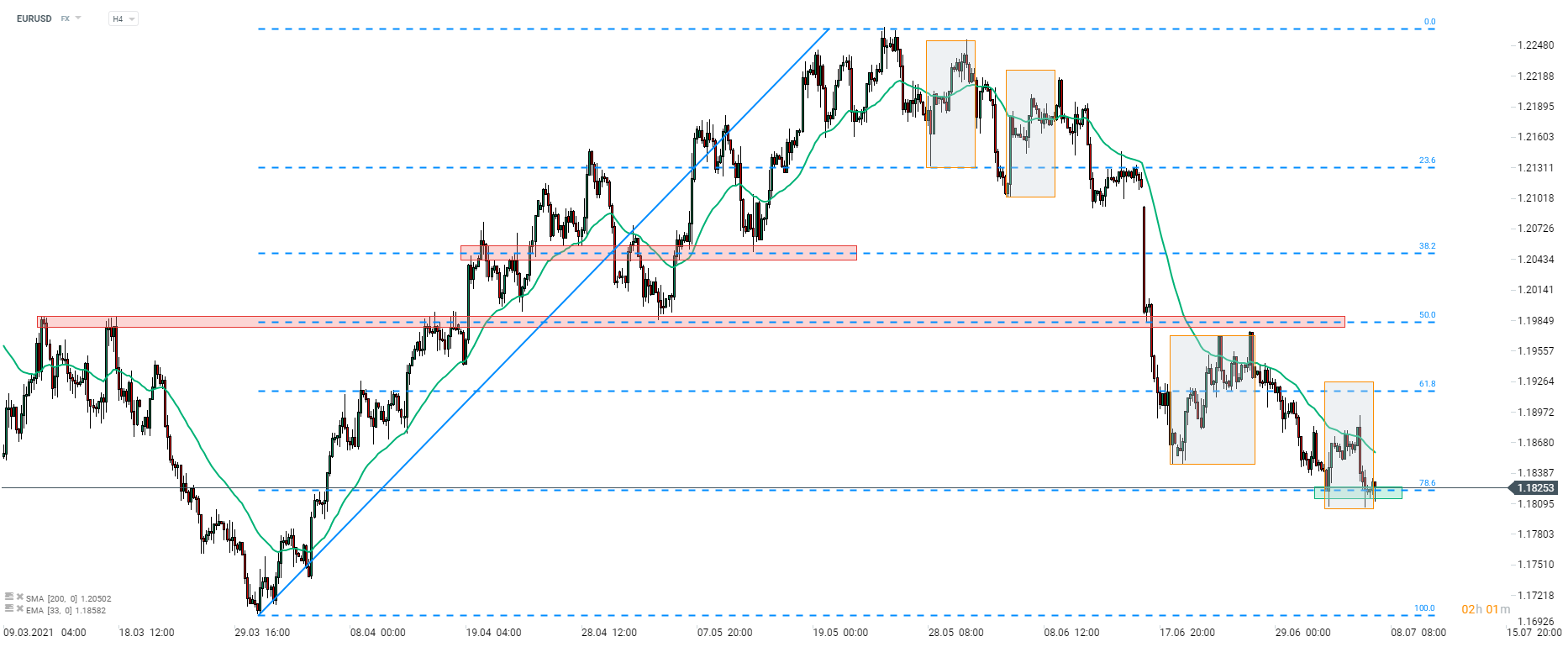

EURUSD halted what seemed to be an upward correction this week and pulled back towards the 1.1820 support area. This zone is marked with previous local high as well as 78.6% retracement of the upward move started at the end of March 2021. Pair can become more active following release of EC forecasts and FOMC minutes. Should we see a rebound, the major resistance to watch can be found in the 1.1920 area and is marked with 61.8% retracement and the upper limit of local market geometry.

Source: xStation5

Source: xStation5

NFP preview

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.