-

The UK labor report showed a decrease in the unemployment rate, which fell to 3.8% from the previous 3.9%.

-

The payrolls report revealed a 6.5% increase in wages in April, surpassing expectations for 6.1%.

-

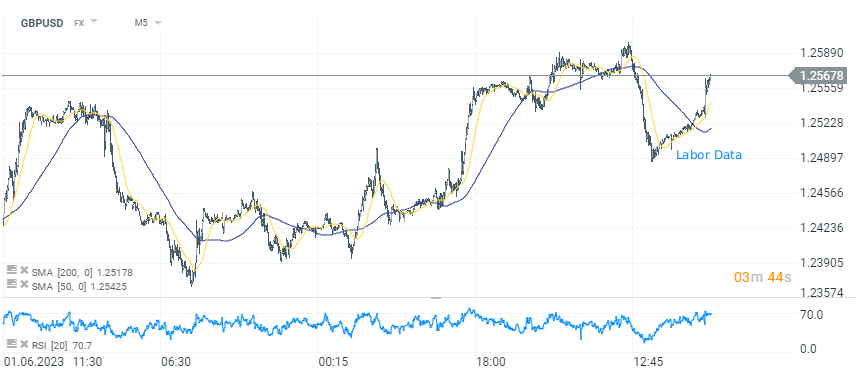

GBPUSD has risen from 1.2530 to a high of 1.2566 after the publication of the labor data.

Labor data

The UK labor report outperformed expectations, demonstrating the resilience of the labor market despite economic pressures. The unemployment rate dropped unexpectedly to 3.8% from 3.9%, propelled by a significant rise in employment, with a growth of 250K in the three months to April. The report also showed a decline in those seeking out-of-work benefits and a 6.5% increase in wages in April, exceeding market forecasts. However, gains may be limited due to ongoing concerns about inflation in the UK.

Economic outlook

The robust labor data suggest that the UK economy is doing better than predicted despite high inflation and rising central bank interest rates. The job report indicates that workers are demanding and receiving pay awards, which, coupled with businesses' higher pricing intentions, risk of a wage-price spiral. As such, the Bank of England may decide to continue raising interest rates to fight inflation.

GBPUSD

Post-publication of the labor data, GBPUSD has seen a modest rise. The pair is currently hovering near the highs, although the jump only roughly halves the losses from the previous day. Given that markets have already priced in about 100 bps worth of future rate hikes, this report doesn't significantly change that. Therefore, the gains for the pound may be more limited if solely reacting to the labor data. Additionally, GBPUSD performance will be highly reactive to the upcoming US CPI inflation report and the tone set by the Federal Reserve. The possibility of a future rate hike in July by the Federal Reserve may support dollar and could put a downward pressure on GBPUSD currency pair.

Post-publication of the labor data, GBPUSD has seen a modest rise. The pair is currently hovering near the highs, although the jump only roughly halves the losses from the previous day. Given that markets have already priced in about 100 bps worth of future rate hikes, this report doesn't significantly change that. Therefore, the gains for the pound may be more limited if solely reacting to the labor data. Additionally, GBPUSD performance will be highly reactive to the upcoming US CPI inflation report and the tone set by the Federal Reserve. The possibility of a future rate hike in July by the Federal Reserve may support dollar and could put a downward pressure on GBPUSD currency pair.

GBPUSD, M5 interval, source xStation 5

NFP preview

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.