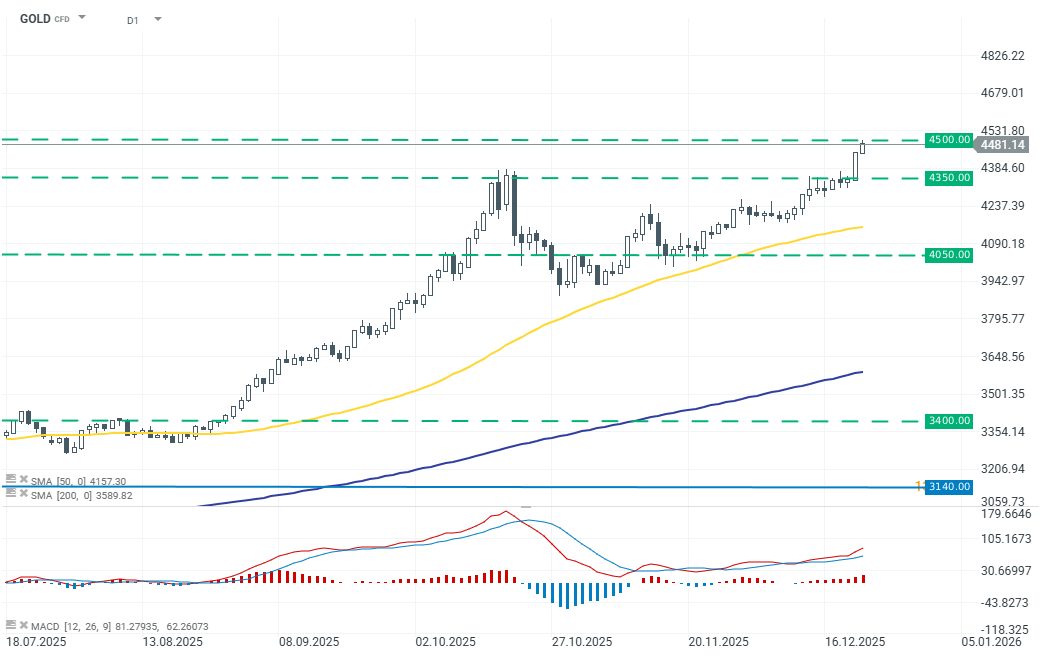

Gold continues its wave of dynamic gains, adding 0.82% today. The price of gold briefly approached another major milestone at 4,500 USD per ounce (4,495 USD). The rally is supported by a clear increase in demand for safe-haven assets and ongoing geopolitical turbulence during Donald Trump’s presidency. The immediate catalyst remains rising geopolitical uncertainty, including tensions between the US and Venezuela, which are curbing risk appetite.

Investors are also increasingly positioning for a more dovish Fed stance in 2026, supported by recent US inflation readings that came in below expectations.

From a technical perspective, gold futures have broken through a key resistance level around 4,350 USD, aligning with the prevailing upward channel. Holding above this level will be crucial to sustaining the current rally. At the same time, the prospect of further monetary easing lowers the opportunity cost of holding gold relative to yield-bearing assets. Combined with continued purchases by central banks — particularly in emerging markets — and growing interest from retail investors, this keeps structural demand for gold elevated.

Daily summary: Markets capitulate under the influence of the Persian Gulf

US Open: Wall Street in Blood

Spring Statement fails to calm UK bond market,

DE40 dips 3% and falls to 2026 lows 🚨📉

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.