US actions in Venezuela following the seizure of power from Nicolás Maduro are now focused on rebuilding the country’s devastated oil sector. Energy Secretary Chris Wright is expected to meet this week with major US oil companies. The administration hopes that Chevron, ConocoPhillips and others will help restore production after years of neglect and corruption. Oil companies, however, are approaching the situation cautiously and are seeking guarantees of political stability, rule of law and long-term US backing before committing to multibillion-dollar investments, which experts estimate at around USD 10 billion per year over the next decade.

President Donald Trump said that elections will not be held in the near term, arguing that the country must first be “nursed back to health.” He also suggested that the US may subsidize the reconstruction of the oil sector and claimed that operations could be restarted in under 18 months, with companies potentially reimbursed by the US government or by future production revenues. Trump framed the strategy as a way to lower oil and fuel prices for American consumers while strengthening US energy and geopolitical leverage.

For the oil market, it is unlikely that developments in Venezuela will have a significant short-term impact. Refineries in the US Gulf Coast — designed to process heavy Venezuelan crude — could handle imports if supplies gradually return. However, the outlook is very long-term. Any additional Venezuelan supply would likely exert only moderate downward pressure on prices over the coming years. The scale and pace of recovery will depend on financing, political stability, and whether companies ultimately decide to commit to large-scale investment — a decision that will likely require US guarantees.

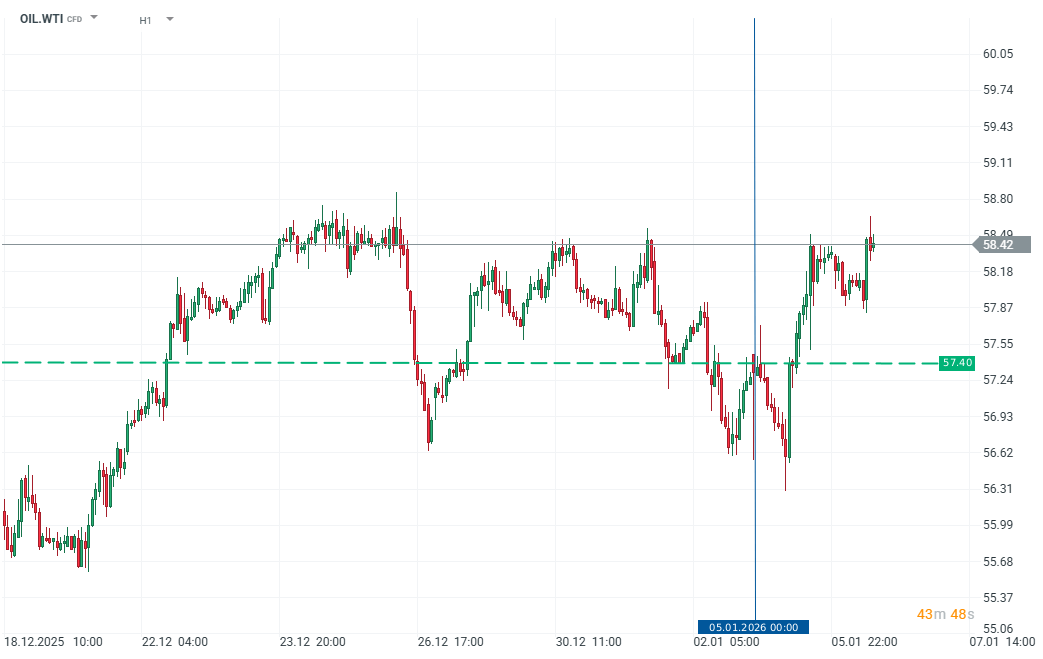

Oil prices not only recovered their initial post-weekend losses, but have now risen above Friday’s closing levels.

Daily Summary: Oil at new local highs; Iran and Trump dampen market sentiment 💡

BREAKING: Stronger-than-expected decline in US gas inventories

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.