Cocoa futures on ICE (COCOA) are down almost 3.5% today amid markets focusing on 2025/2026 season, expecting strong supply improvement. The start of the crop season in the Ivory Coast scheduled at October 1 (world’s largest cocoa producer), brought the prospect of fresh supply to the market. In the effect, cocoa prices are down more than 50% from the ATH.

Now markets await grinding data from key cocoa markets, scheduled next week. In the data will be lower than expected, which is a probable scenario, we may expect the head and shoulders technical pattern confirmation, and increase sell-side pressure on cocoa futures amid speculators and market participant focus shifting from tight supply to low demand environment, and a significant improvement of cocoa production, next year.

Source: xStation5

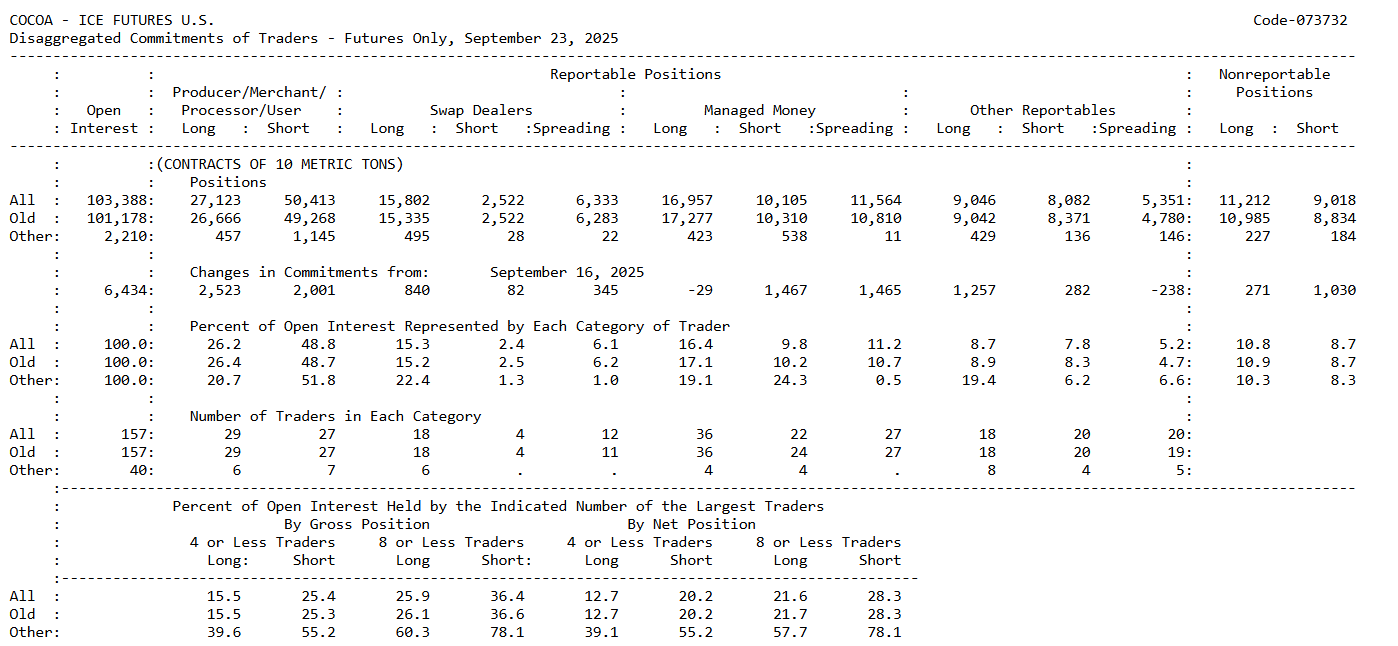

Cocoa Market Outlook (CoT – September 23, 2025)

Commercials (Producers/Merchants/Processors/Users)

-

Positioned strongly on the short side: about 50.4k short contracts vs. 27.1k long.

-

This is a classic hedging stance – producers and processors are protecting themselves against the risk of further price increases by selling futures.

-

The rise in commercial short positions suggests the supply side of the market expects high prices and is actively hedging.

Managed Money (Speculative Funds)

-

Clearly on the long side: 16.9k long vs. 10.1k short.

-

This indicates speculative capital is still betting on higher cocoa prices, despite heavy commercial shorting.

-

Over the past week, speculative funds added around +1.5k new short contracts, hinting at growing caution.

Takeaways from the Positioning

-

A classic clash of roles is visible: producers remain defensive (short), while funds maintain the upper hand on the long side.

-

Such a setup often means the market stays under supply pressure, but speculative money still supports the upside.

-

With commercials increasing shorts and funds cautiously adding to shorts as well, the market may enter a consolidation phase, with some risk of profit-taking after recent gains.

Commercials are heavily hedging against high prices, while managed money continues to bet on further upside – though with slightly more caution than before. This points to a potentially more pressure on managed money (large speculators) positioning, if the grinding data would signal slowing processing demand on chocolate and other cocoa-related products.

Source:CFTC

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.