Futures on ICE Arabica Coffee (COFFEE) gains almost 3% today as market prices in limited supply. Cold weather and frosts in top growing regions can hit supply this year, as weather change. According to McDougall Global View, not only 2025 but also 2026 crop could be limited due to the early stress flowering and further cold weather patterns. As we can see on the chart, coffee is resisting the falling price channel, rising above both - EMA50 and EMA200, where momentum may favour buyers.

Source: xStation5

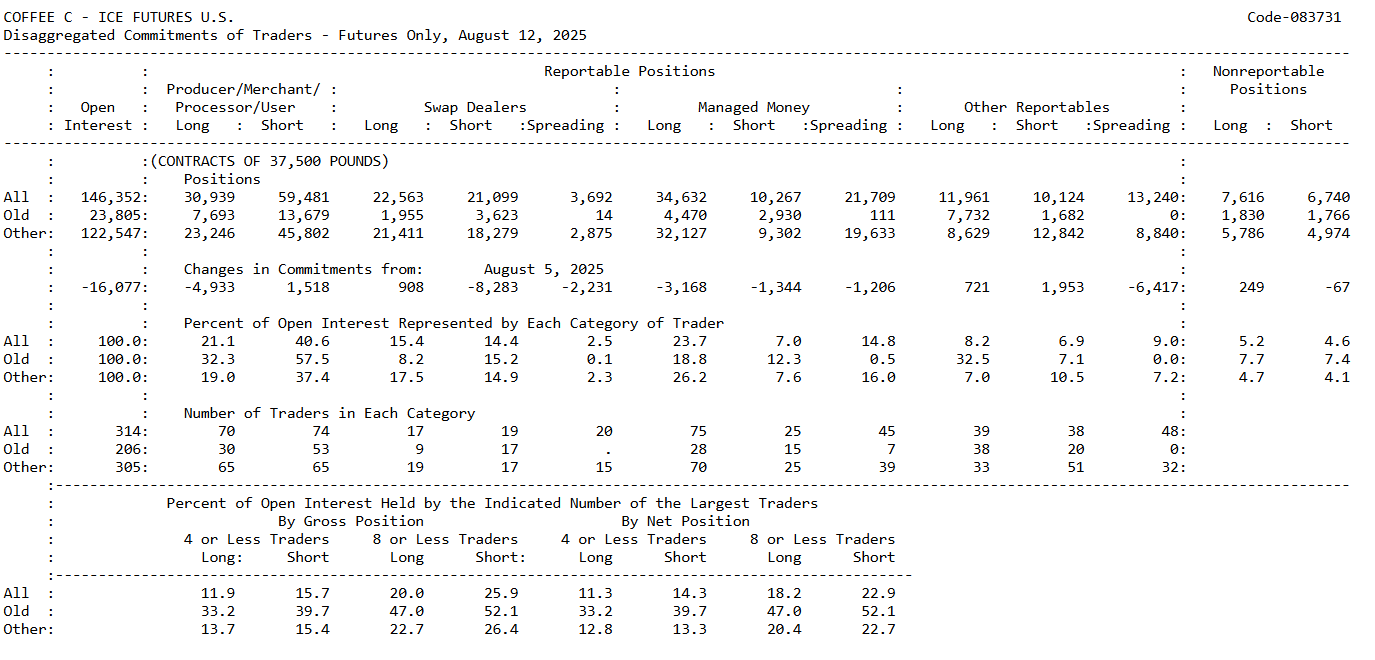

Coffee CoT Report Analysis

Open interest fell by around 16,000 contracts – this shows that some players have stepped away from the market, indicating a clear outflow of capital over the past week.

Producers/Merchants (hedgers):

-

Strongly net short, with roughly 59.5k shorts versus 30.9k longs.

-

This is a classic signal: farmers and exporters are hedging production because they fear lower prices ahead.

Swap dealers (often banks, structural hedging):

-

Significant reduction in positions, especially shorts (-8.3k).

-

This suggests they are offloading risk back into the market and are less willing to hold exposure themselves.

Managed money (speculative funds):

-

Still clearly long (34.6k longs versus 10.3k shorts), but they cut back on long exposure (-3.2k).

-

At the same time, they also reduced shorts, meaning overall participation is shrinking – less aggression on either side of the market.

Other reportables (e.g., CTAs, smaller funds):

-

A mixed picture: an increase in longs (+721) and shorts (+1.95k), but a sharp drop in spreading activity (-6.4k).

-

This indicates less arbitrage and fewer neutral strategies, translating into reduced technical liquidity in the market.

Market structure (share of OI)

-

Producers hold about 41% of open interest on the short side and only 21% on the long side – fundamentally, the market is heavily hedged against downside.

-

Managed money accounts for 24% of longs versus just 7% of shorts – speculators remain net bullish, but less so than a week earlier.

-

The largest players (top 4–8 traders) control up to 26% of total shorts – a high concentration that makes the market sensitive to their moves.

-

The most notable shift is that producers added shorts (+1.5k), while funds cut longs (-3.2k). Open interest fell overall, signaling position closures – likely profit-taking or risk reduction. The overall tone:a little less enthusiasm from funds, more hedging pressure from producers.

Trading implications

-

Fundamentals: producers are betting on lower prices, leaving a clear supply overhang in the market.

-

Speculators: still long, but with reduced conviction – bulls are less confident and may retreat under supply pressure.

-

Large trader concentration: heavy short exposure by the biggest players raises the risk of sharper declines if funds continue trimming longs.

-

Short term: the market looks weaker, with room for downside corrections.

-

Long term: unless fundamentals improve (Brazilian weather, crop yields, logistics costs), persistent hedging pressure will cap the market’s upside potential.

Source: CoT, CFTC

Economic calendar: Central banks vs global risks to inflation (05.03.2026)

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.