Oil:

- Oil prices fell sharply amid the emergence of a new strain of coronavirus, which may reduce oil demand

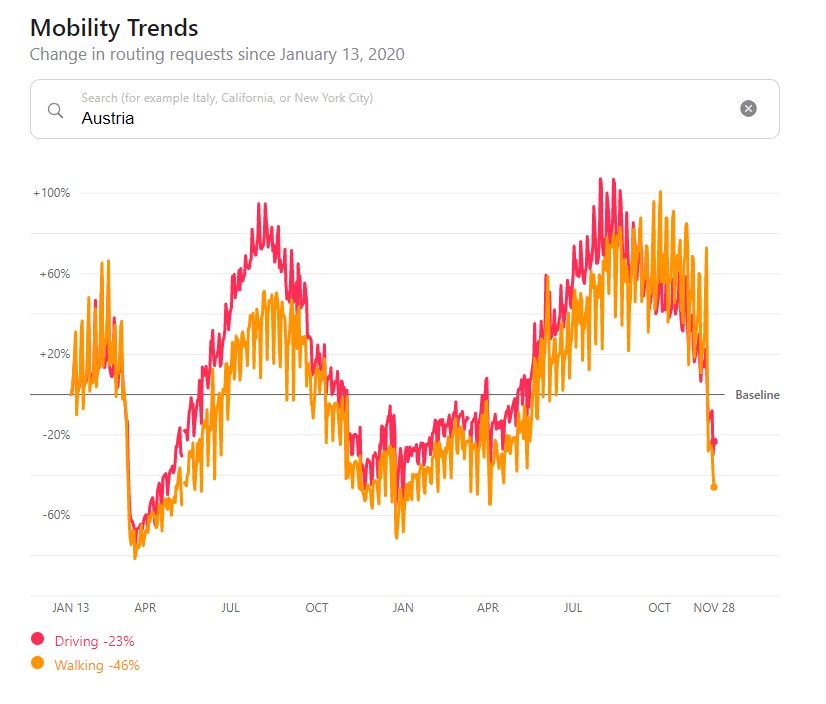

- Additional severe mobility restrictions may be introduced due to the new strain of the coronavirus

- OPEC + is expected to consider keeping production unchanged in the face of demand-related threats

- The largest correction in the current upward trend took place in autumn 2020 (price fell 24%). A correction of this magnitude would push the price towards $ 64.75. The key support zone is located around $62.00, where the last upward impulse started.

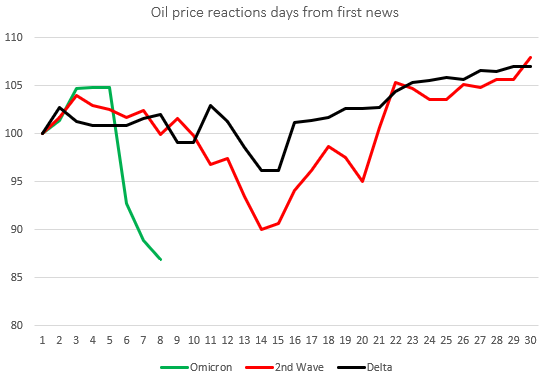

- An analysis of the behavior of crude oil prices during the 2nd wave of the coronavirus and the emergence of the Delta variant shows that on the 15th day since the publication of the first news, the price established local low - on the other hand, the current declines are much more stronger compared to the previous waves

- The first information regarding the significant increase in the number of coronavirus cases in South Africa appeared on November 20 - this would assume that the local low should be established on December 5

- The current movements in the oil market may resemble a "dead cat bounce". After a rebound on Monday, the price returned to decline.

- The downward move on Tuesday, November 30 is the effect of the statement from the Moderna CEO, which indicates the probable ineffectiveness of the current vaccines against the Omicron strain

The rebound after the previous waves took place approximately on the 15th day after the first information appeared. On the other hand, the current declines are much deeper than before. Source: XTB

The rebound after the previous waves took place approximately on the 15th day after the first information appeared. On the other hand, the current declines are much deeper than before. Source: XTB

The decrease in the level of mobility in Austria shows how much mobility around the world can drop if severe restrictions are introduced. Source: Apple

The decrease in the level of mobility in Austria shows how much mobility around the world can drop if severe restrictions are introduced. Source: Apple

Price continues to decline, but reacts positively to the 78.6% retracement. The scope of the largest correction in the current uptrend is $ 64.75. The key support is located around the $ 62.00. Source: xStation5

Price continues to decline, but reacts positively to the 78.6% retracement. The scope of the largest correction in the current uptrend is $ 64.75. The key support is located around the $ 62.00. Source: xStation5

Natural gas:

- The price of gas is falling due to the prospect of higher-than-usual temperatures in the near term

- However, it should be remembered that last year's attack of winter, both in the USA and in Europe, took place in January and February

- Lower gas prices may also be related to the decline of other energy resources

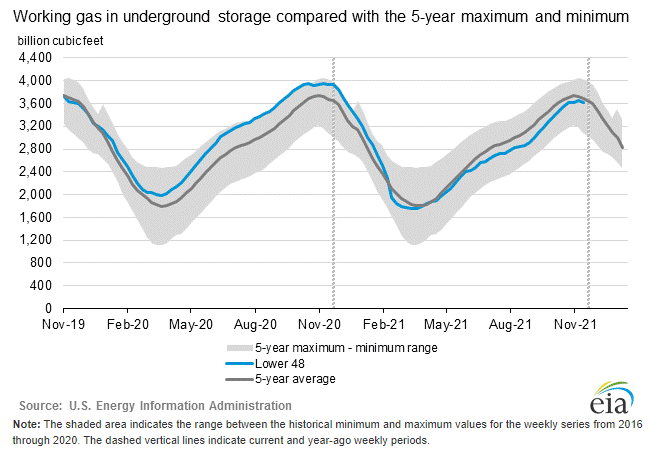

- Gas inventories have started to decline in the US but remain near the 5-year average

- Gas stockpiles in Europe are also declining, although they have rebounded slightly in recent days. The trend of decline of European gas inventories is smaller compared to last year and to the 5-year average

US gas inventories have started to decline, but remain close to the 5-year average. Source: EIA

US gas inventories have started to decline, but remain close to the 5-year average. Source: EIA

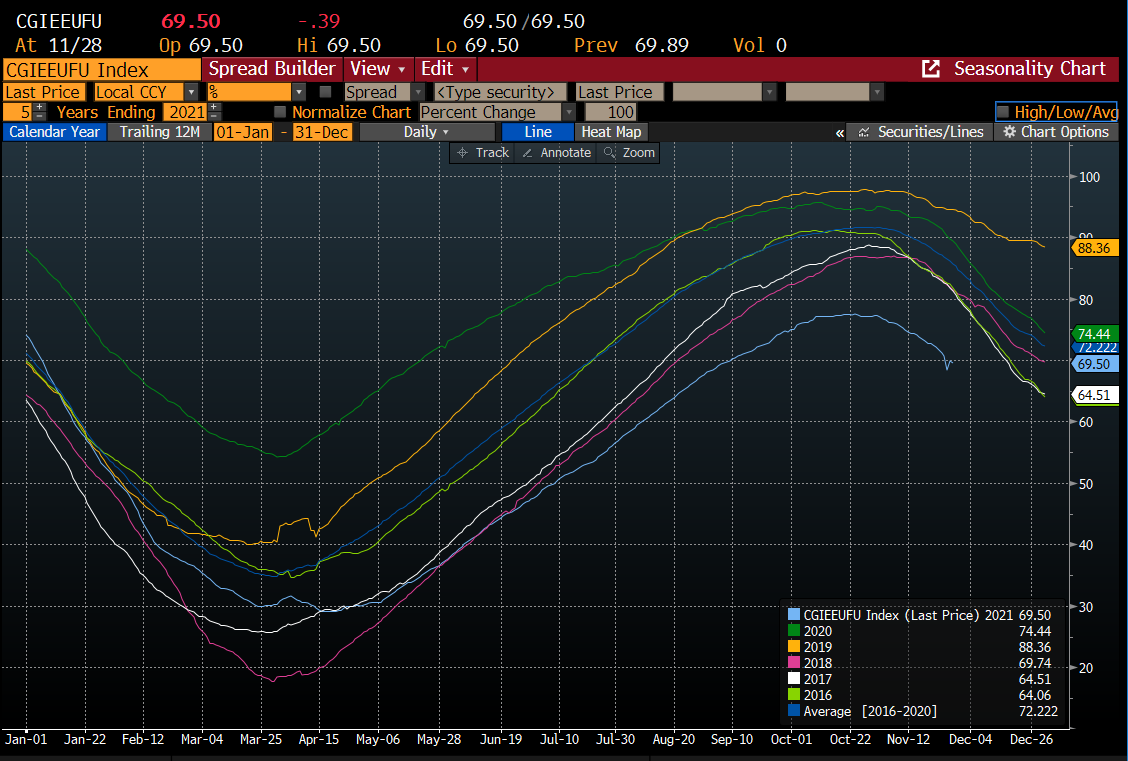

Gas inventories in Europe are falling, but at a slower pace compared to last year. Source: Bloomberg

Gas inventories in Europe are falling, but at a slower pace compared to last year. Source: Bloomberg

Soybean:

- Prices are retreating again after failing to break above the downtrend trendline

- The weak Brazilian real can increase the competitiveness of Brazilian soybeans

- Corn price drops are much smaller, which may suggest excessive weakness of soybean prices

- Seasonality indicates a potential rebound in early December, reflecting the positioning of soybean speculators

- Good weather in Brazil and Argentina means that the production prospects in these countries are increasing

SOYBEAN - price continues to decline, which may be related to better production prospects in South America. On the other hand, the demand for American soybeans is still very high. Source: xStation5

SOYBEAN - price continues to decline, which may be related to better production prospects in South America. On the other hand, the demand for American soybeans is still very high. Source: xStation5

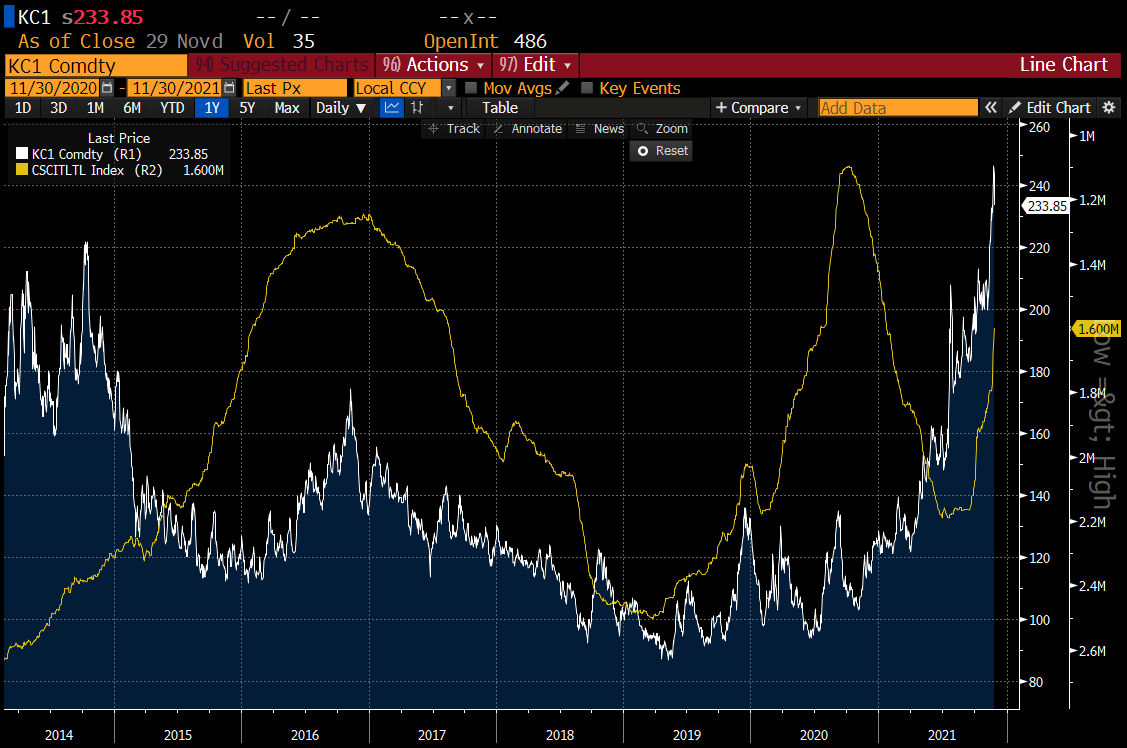

Coffee:

- Nearly 7% correction move during Monday's session

- The positioning of coffee speculators continues to increase

- Price decline may be related to improving weather conditions in Brazil - recent moderate rainfall increases production prospects

- Rabobank indicates a deficit on the market in the 2021/2022 season at the level of 5.2 million bags

- Rabobank points to an oversupply on the market in the 2022/2023 season at the level of 3.3 million bags - production is expected to rebound by 8.2% to 177 million bags compared to the current season

- Rabobank expects an average price of $ 2 per pound in Q1 2022 and a drop to $ 1.66 in Q4 2022

- Coffee inventories continue to decline strongly (stocks of the best quality coffee, certified for ICE deliveries)

Coffee stockpiles continue to decline sharply. Source: Bloomberg

Coffee stockpiles continue to decline sharply. Source: Bloomberg

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.