- After Friday's slump, gold regains its balance and gains 2.5%

- After Friday's slump, gold regains its balance and gains 2.5%

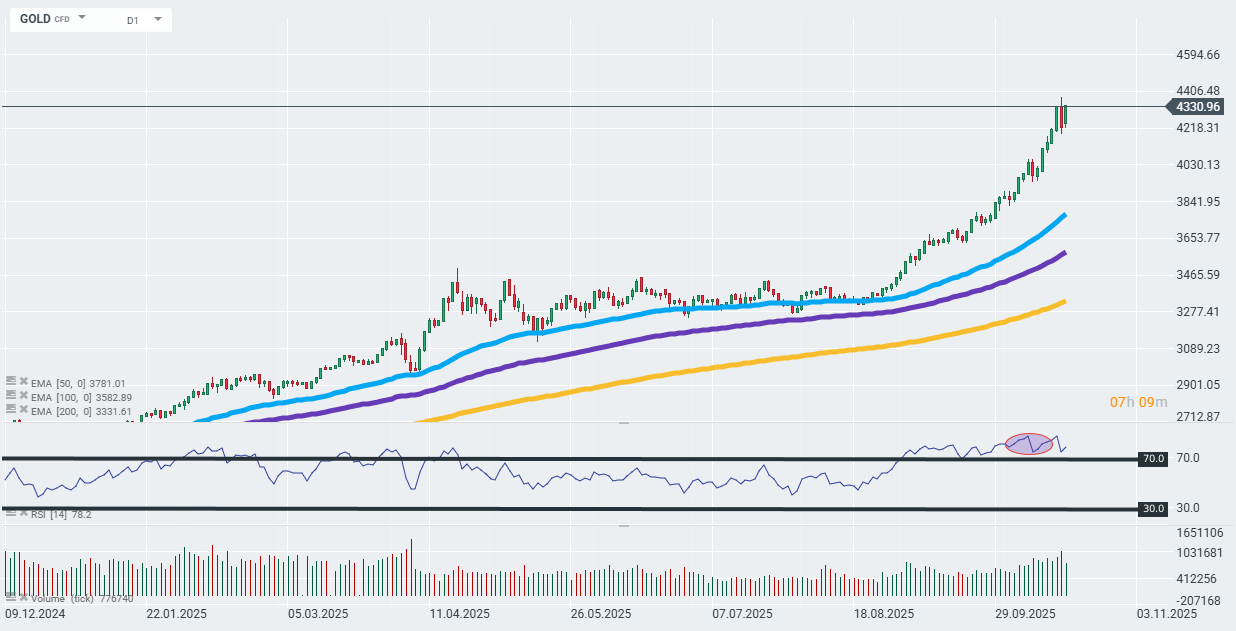

After Friday's slump, which brought gold prices down by almost 2% from record highs of $4,378 per ounce, the market is regaining its balance in Monday trading. The spot price is once again hovering around $4,320, supported by expectations of further interest rate cuts by the Federal Reserve and continued demand for safe-haven assets. Analysts point out that the correction was technical in nature and was the result of profit-taking after several weeks of dynamic growth. President Donald Trump's reassuring statements about a “more reasonable” approach to China temporarily weakened demand for gold, but upcoming trade talks and the ongoing government shutdown in the US are again increasing uncertainty.

The People's Bank of China (PBoC) continues to purchase gold regularly – in September, it made its 11th consecutive accumulation, buying 1.2 tons, and in the entire third quarter, the increase amounted to 5 tons, bringing official reserves to 2,303 tons (7.7% of the value of foreign exchange reserves). This clearly confirms the strategic importance of gold for China's reserve policy.

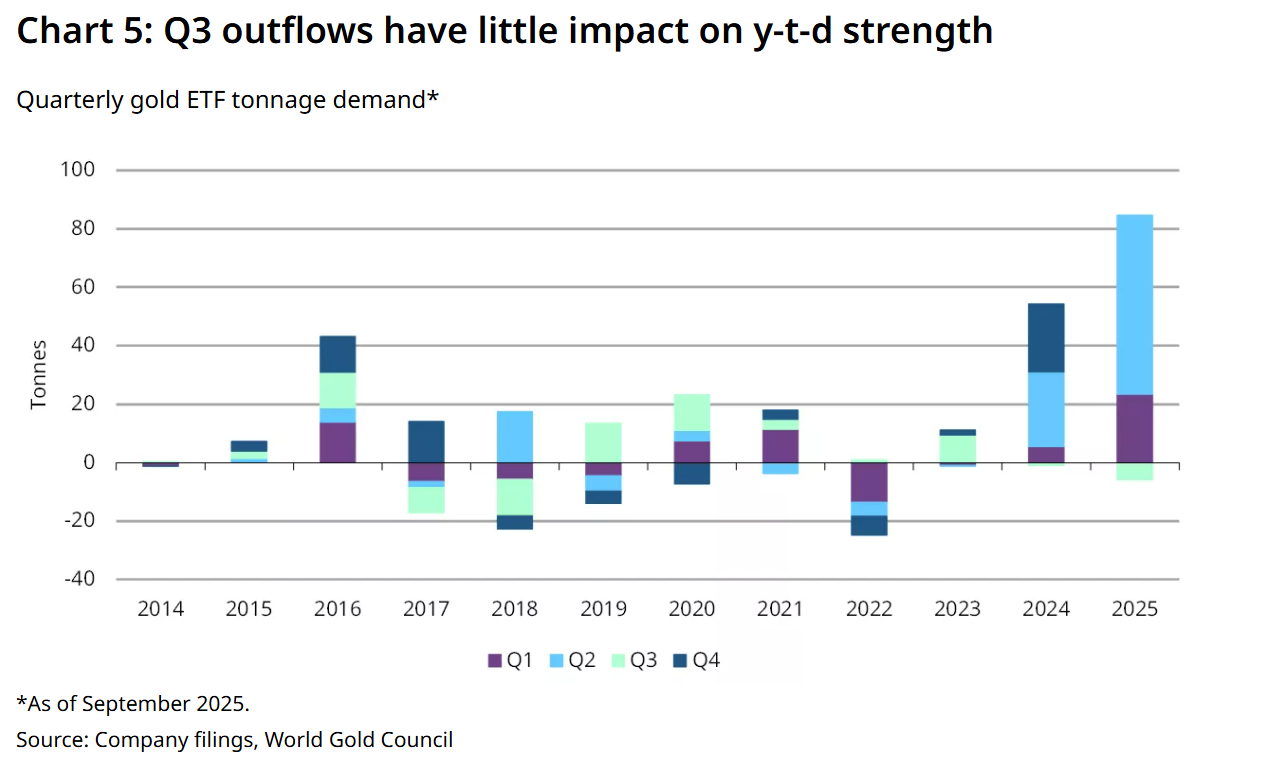

The increased demand is also due to large purchases of ETFs. These funds recorded record inflows in the first two quarters of the year (a total of 79 tons of gold on the Chinese market), although Q3 saw slight net outflows.

Source: World Gold Council, ETF data for the Chinese market.

GOLD is returning to its recent historical highs. The RSI for the 14-day average on the D1 interval remains above 70 points. Source: xStation

Morning wrap (10.02.2026)

Daily summary: Metals and Wall Street on the rise; NATGAS underperforming 💡

Wall Street extends gains; US100 rebounds over 1% 📈

Politics batter the UK bond market once more, as Starmer remains under pressure

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.