Oil

-

WTI breaks above key resistance, paving the way for a test of $72.50 mark

-

Bank of America expects oil price to reach $100 per barrel over the next 6 months (under the assumption of severe winter)

-

Oil also gains as another hurricane hits US Gulf coast, this time in Texas

-

Weather outlook start to impact natural gas prices and may also begin to influence oil prices

-

Oil bulls do not seem to be concerned about lower demand forecasts from OPEC. This creates a basis for halting OPEC+ output increases, what should have a positive impact on prices over the medium term

-

Strengthening of the US dollar remains one of the key risks for oil price gains

OIL.WTI broke above the downward trendline, paving the way for a test of the resistance near $72.50 mark. Source: xStation5

OIL.WTI broke above the downward trendline, paving the way for a test of the resistance near $72.50 mark. Source: xStation5

Natural Gas

-

Natural gas prices in the United States jumped above 5 USD per MMBTU

-

Natural gas prices increased in October during the past 4 years

-

Concerns mount ahead of the start of US heating season. On the other hand, this September is the hottest one since 1950, leading to a jump in demand for electricity for air conditioning

-

Around half of the US natural gas production in the Gulf of Mexico remains suspended

-

Concerns over Democrats actions against US fracking. Should ban of fracking go through and high export demand is maintained, natural gas prices may increase further

-

According to American Energy Alliance research, United States may import up to 30% of needed natural gas should Democrats' plans go through. US is net exporter currently

Ban on fracking may have a massive impact on the US economy. Source: AEA

Ban on fracking may have a massive impact on the US economy. Source: AEA

Palladium

-

Palladium drops amid significant slowdown in demand from automotive sector

-

Interestingly, lower demand for palladium is not a result of lower auto demand but rather lack of available chips for production. As a result, unit production is limited and therefore demand for car catalytic converters

-

drops as well

-

Toyota announced that it will cut production by 330 thousand units in October, meaning a 40% reduction compared to initial plan

-

It is also said that a new technology is being developed that will allow to substitute palladium with platinum in car catalytic converters production

Palladium price dropped to around $2,050 per ounce, where the upward trendline can be found. On the other hand, palladium dropped below the $2,300 area marked with the lower limit of the overbalance structure and the lower limit of the downward channel, suggesting that bears' are in advantage. Source: xStation5

Palladium price dropped to around $2,050 per ounce, where the upward trendline can be found. On the other hand, palladium dropped below the $2,300 area marked with the lower limit of the overbalance structure and the lower limit of the downward channel, suggesting that bears' are in advantage. Source: xStation5

Soybean

-

Declines on the soybean market decelerate recently in spite of WASDE report turning out to be not so positive for agricultural goods

-

WASDE report showed much higher end stocks (although still very low in historical terms), higher production and high yields

-

On the other hand, crop quality remains very low, what may put high yield estimates under question

Latest WASDE report was rather negative for prices but actual data on harvest may turn out to be weaker. Source: Bloomberg

Latest WASDE report was rather negative for prices but actual data on harvest may turn out to be weaker. Source: Bloomberg

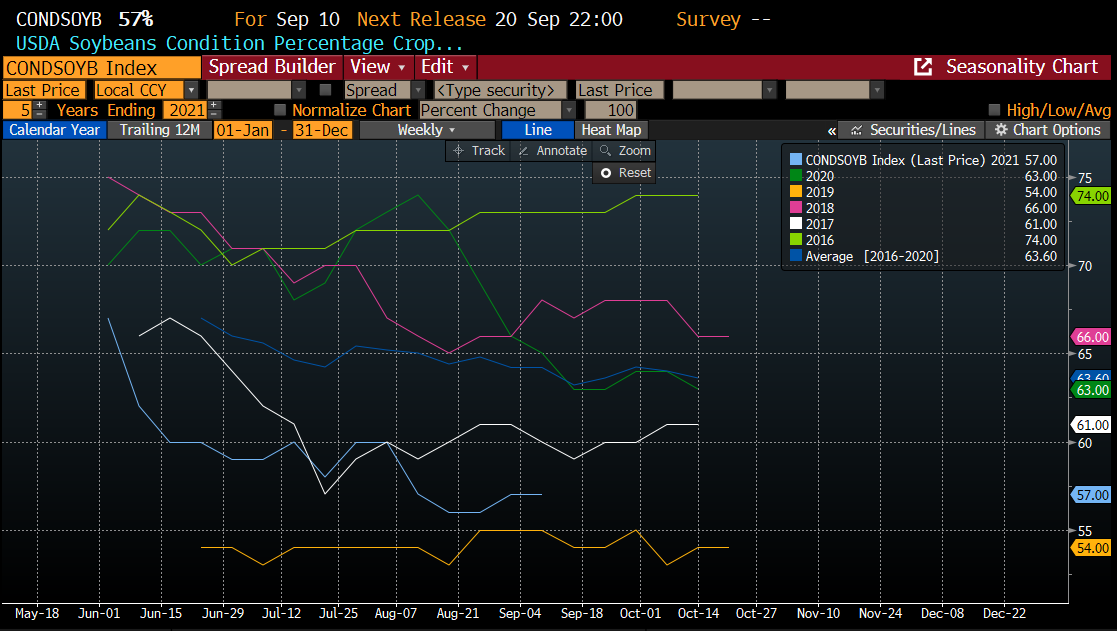

Crop quality in the US is low compared to the previous 5 years. The United States needs rainfall and current September is the hottest one since 1950. October may also turn out to be warm and dry. Source: Bloomberg

Crop quality in the US is low compared to the previous 5 years. The United States needs rainfall and current September is the hottest one since 1950. October may also turn out to be warm and dry. Source: Bloomberg

Rising Middle East Unrest Sparks Volatility

Middle East Tensions Rattle Global Markets

The Week Ahead

OIL and GOLD gain on Middle East tension ⚔️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.