Last week, despite dovish signals from the Federal Reserve, which initiated technical quantitative easing (QE) and cut interest rates, proved disappointing for both the Nasdaq 100 and Bitcoin. The largest U.S. technology equity index fell by more than 2% over the past five sessions, while Bitcoin declined from above USD 94.5k following the Fed decision to around USD 87k over the weekend. On Monday morning, the price of the largest cryptocurrency is hovering near USD 89.5k.

- Spot Bitcoin trading volumes have been declining. At the same time, activity in derivatives markets is weakening including futures and, in particular, options (open interest). Altcoins remain unable to recover from the October 10 crash, while trading volumes in smaller projects point to ongoing bearish market conditions. Bitcoin is still trading roughly 30% below its October peak near USD 126k and continues to struggle to regain upward momentum.

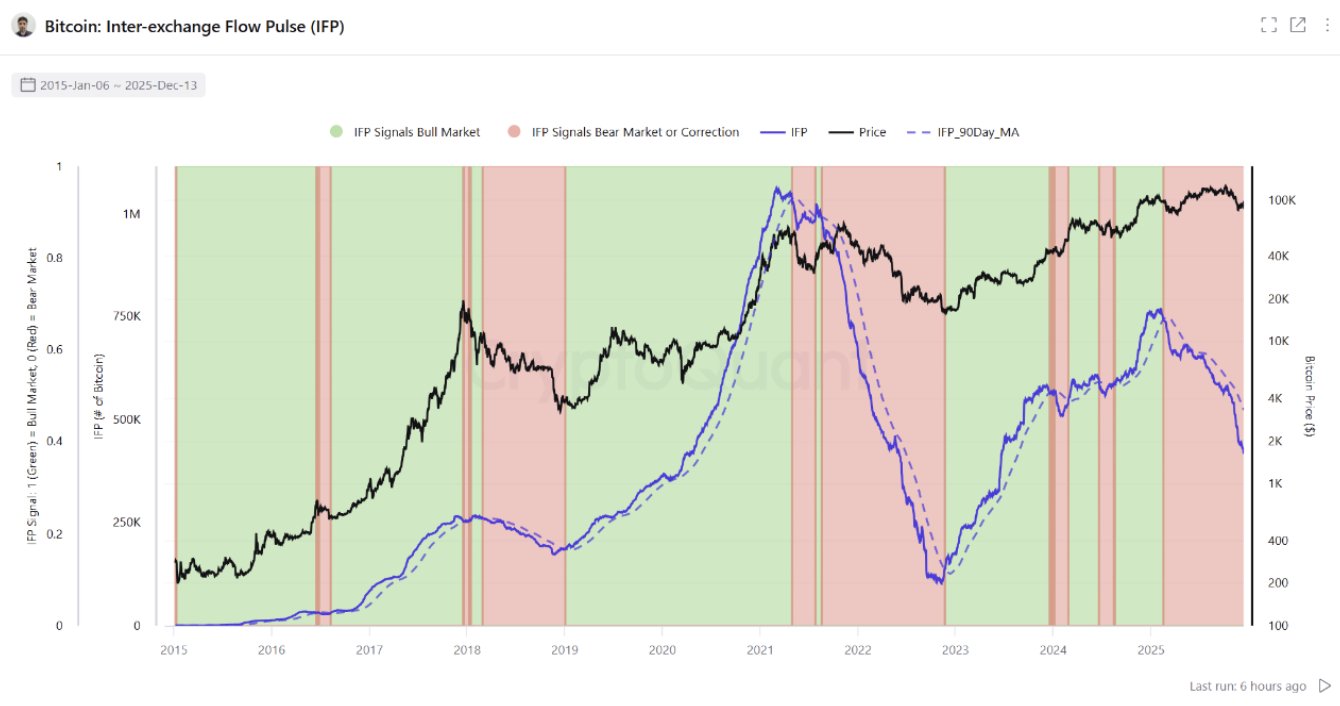

- On-chain data suggest elevated downside risk. A stronger price move is likely to follow several weeks of historically low volatility, reflecting a prolonged consolidation around the USD 90k level. The IFP (Inter-Exchange Flow Pulse) indicator, which measures on-chain Bitcoin activity between exchanges, has been consistently declining — a pattern that also preceded bear markets in 2018 and 2022. At the same time, Bitcoin inflows to Binance are at their lowest levels since 2018, suggesting a broad reluctance among investors to sell BTC at current price levels.

Bitcoin and Ethereum charts (H1)

Source: xStation5

Source: xStation5

Source: CryptoQuant

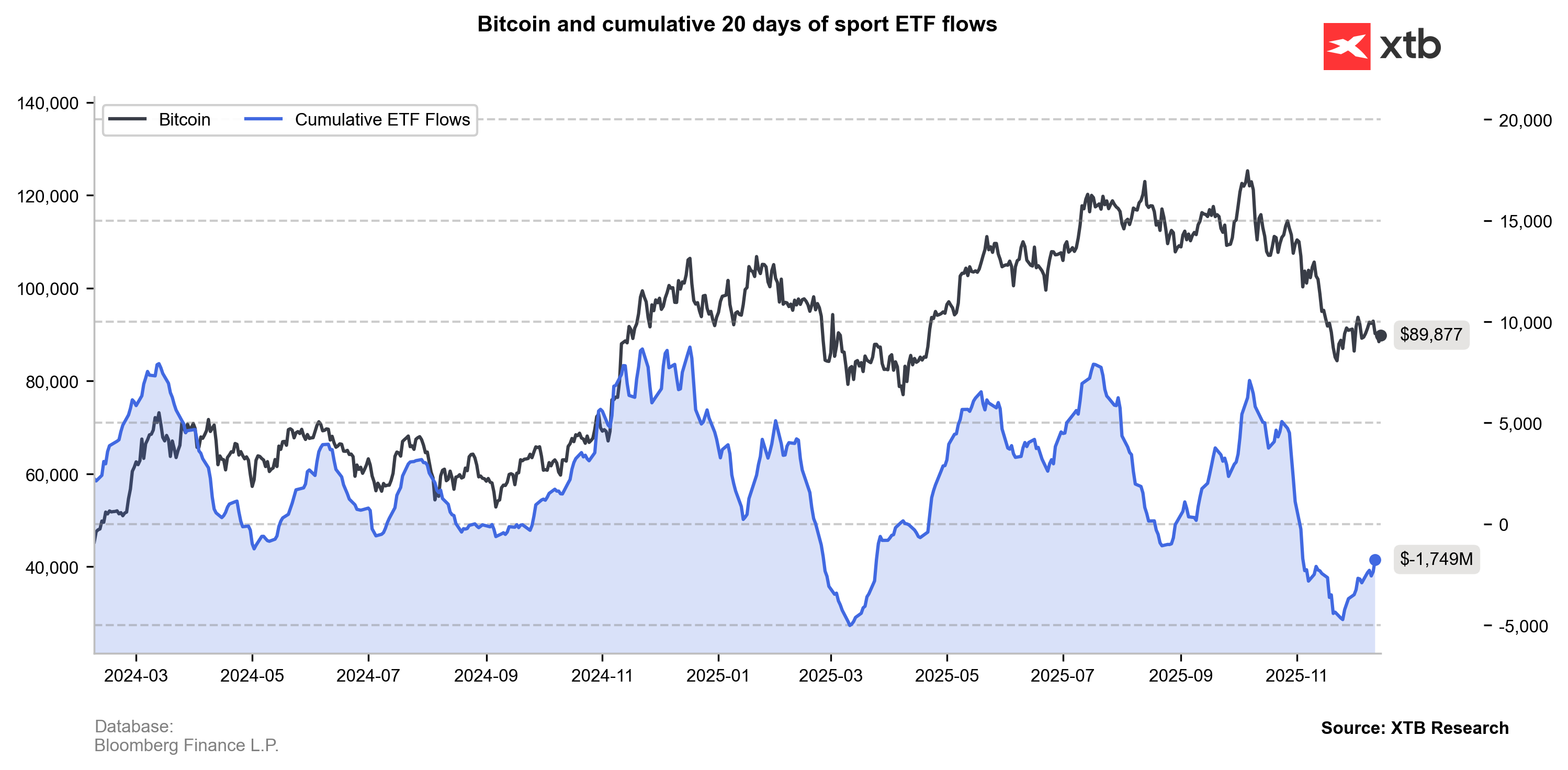

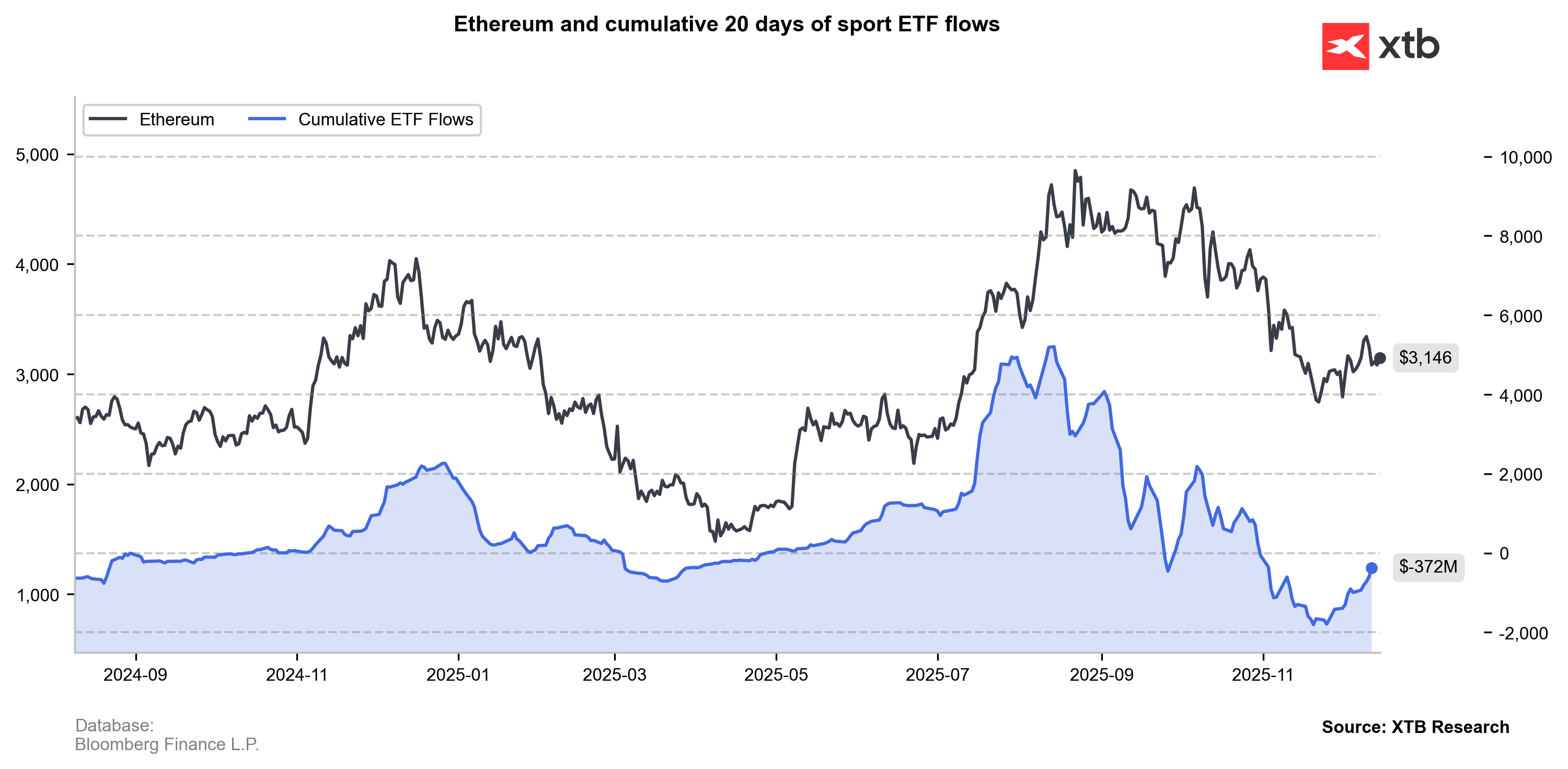

ETF Flows

Without a clear improvement in equity market sentiment and a meaningful rebound in trading activity across crypto markets, downside risks remain elevated despite solid fundamentals for the year ahead. These include an expected strong U.S. earnings season, the prospect of interest rate cuts in 2026, and a potentially broad, dovish shift in Federal Reserve policy. Recently, ETF funds have recorded only modest inflows during price increases, while experiencing sharp outflows during market declines.

Source: XTB Research, Bloomberg Finance L.P

Source: XTB Research, Bloomberg Finance L.P

Despite attempts to revive activity, overall sentiment within ETF funds points to caution and significantly reduced interest in Bitcoin and Ethereum investments. This resembles a state of market “fatigue” and demand exhaustion following years of strong gains. On the positive side, ETF funds focused on Bitcoin, Ethereum, and even Solana (SOL) recorded positive net inflows last week.

Source: XTB Research, Bloomberg Finance L.P

Source: XTB Research, Bloomberg Finance L.P

Daily summary: Markets capitulate under the influence of the Persian Gulf

US Open: Wall Street in Blood

Spring Statement fails to calm UK bond market,

DE40 dips 3% and falls to 2026 lows 🚨📉

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.