• Bitcoin futures open interest reaches new ATH

• Ethereum transaction fees continue to rise

The cryptocurrency market has seen another good week with Bitcoin and Ethereum hit new yearly highs. Open interest in the BTC futures market has risen to a new record levels, as has the adoption of P2P in sub-Saharan Africa. The Bitcoin hash rate and Ethereum transaction fees also continued to increase. Bitcoin's market dominance decreased to 58.7%. The capitalization of all digital assets in circulation increased to almost 372 billion, while an average daily trading volume is registered at $98 billion.

Open interest in Bitcoin futures hits new ATH

The overall open interest in the bitcoin futures market is at an all-time high ($5.8 billion), with the institutional-focused platform CME accounting for close to $1 billion. Meanwhile premium rates on BTC futures are growing rapidly and we’re starting to see the same levels as in February this year. According to the report from Grayscale Investments, current BTC market structure is similar to “that of early 2016 before it began its historic bull run.” and the demand may continue due to inflation concerns. Grayscale analysts' noticed increase in long term holders as compared to short term speculation even during historic lows. Meanwhile Bitcoin hash rate jumped to record levels thanks to low electricity costs and a soaring BTC price.

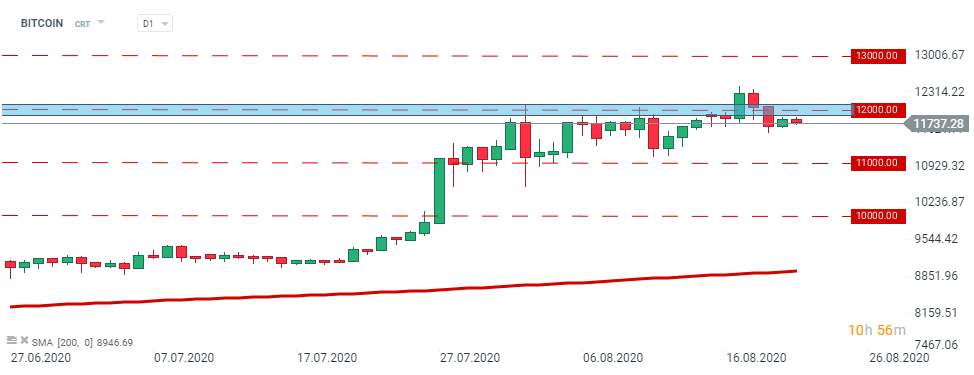

Bitcoin price failed to stay above the major resistance at $ 12 000. Should downbeat moods prevail, support at $11 000may come into play. However, should bulls regain control, resistance at $ 13 000 could be at risk in mid-term. Source:xStation5

Bitcoin price failed to stay above the major resistance at $ 12 000. Should downbeat moods prevail, support at $11 000may come into play. However, should bulls regain control, resistance at $ 13 000 could be at risk in mid-term. Source:xStation5Ethereum price pulled back from its yearly highs following news that Medalla test network came to a halt on August 14 when a bug took most of the testnet’s validators offline. Investors worried that this event might cause delay in launch of Ethereum 2.0. However, Raul Jordan, an editor at Prysmatic Labs (which builds technical infrastructure for the Ethereum blockchain) believes the incident "does not inherently affect the launch date” of Ethereum 2.0 and that the phase 0 launch can proceed as planned. The Medalla testnet is back up and running as of earlier today, though it’s not quite stable yet from all accounts. Meanwhile ETH fees increase even further last week, with August 13th setting a new all-time high fee level, at $8.1 million in daily transaction fees on Ethereum.

Ethereum price managed to reach a fresh new yearly highs this week. However, buyers were unable to hold onto gains and coin pulled back to the $400 handle that is the key support for now. Break below the aforementioned support would be a signal for deeper downward move. In such a scenario, the first key support can be found at $360.44. However if buyers manage to halt declines, another upward movement towards recent highs at $440.58 could be on the cards. Source:xStation5

Ethereum price managed to reach a fresh new yearly highs this week. However, buyers were unable to hold onto gains and coin pulled back to the $400 handle that is the key support for now. Break below the aforementioned support would be a signal for deeper downward move. In such a scenario, the first key support can be found at $360.44. However if buyers manage to halt declines, another upward movement towards recent highs at $440.58 could be on the cards. Source:xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.