Investors returned to the cryptocurrency market contributing to double-digit gains for some projects and giving hope for a renewed 'retest' of Bitcoin's resistance near $17,000:

- Potentially bankrupt Genesis Capital, which operates in the cryptocurrency lending market, reassured the market yesterday, contrary to Bloomberg reports, indicating that it has no plans to declare bankruptcy at this time. The company likely still holds 175 million FTX exchange tolenes, which have fallen in value from nearly $80 to nearly $1.5 today. According to recent reports, Genesis Capital made loans to the bankrupt Alameda Research fund. The loans were to be 'collateralized' with FTX tokens, whose value is currently scouring the bottom;

- Consulting firm Alvarez & Marsal, which advises FTX identified "significantly higher cash balances" than were initially known. The current FTX balance of $1.24 billion still represents a significant shortfall compared to the billions FTX owes its creditors. As of Saturday 19 November, FTX owed its largest 50 unsecured creditors $3.1 billion.

Bitcoin and Ethereum are trading higher today. Litecoin and Binanceoin, however, are the best performers, both gaining more than 10%.

Long-term investors still losing their conviction?

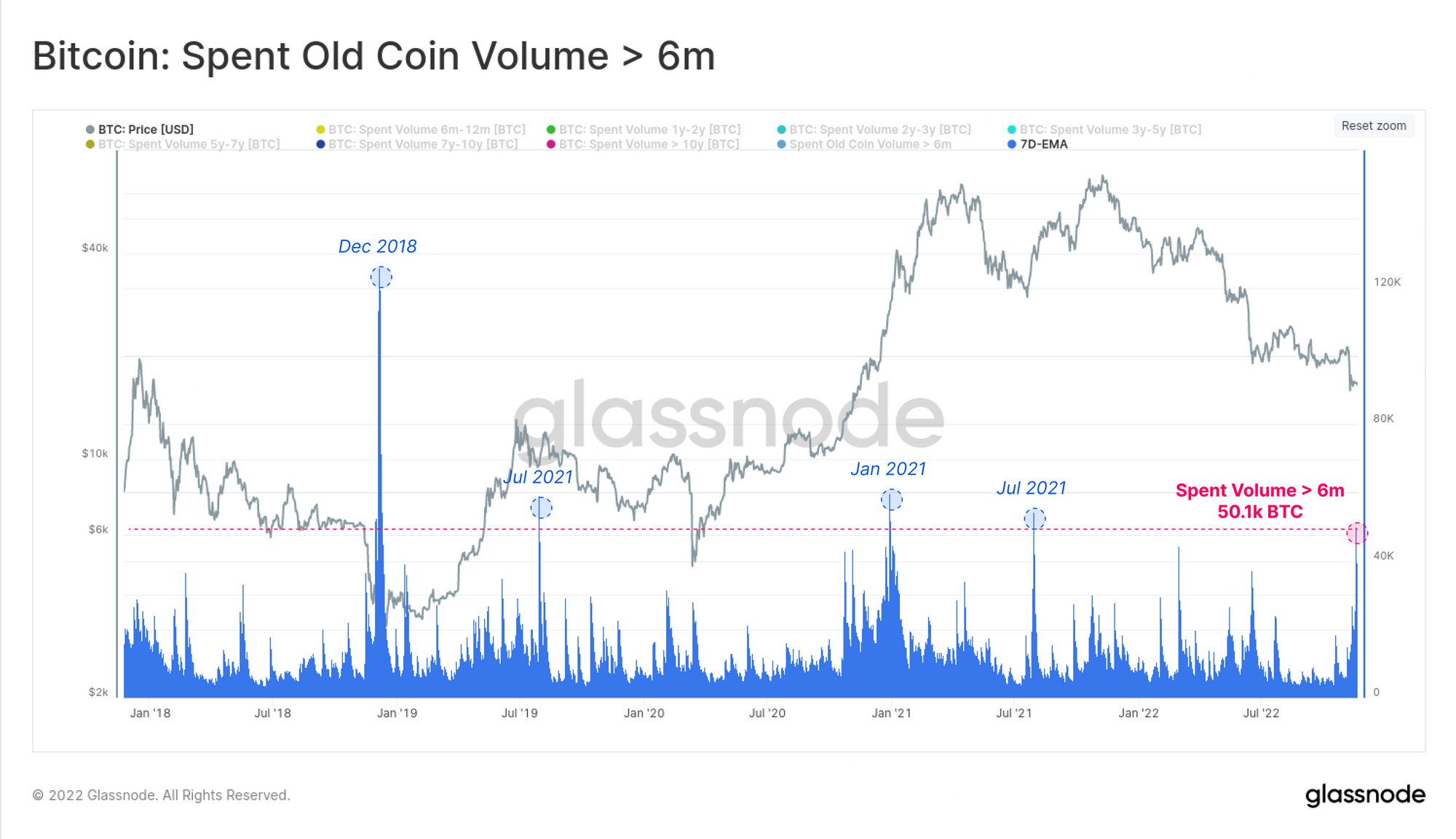

The value of Bitcoin traded older than six months recently reached the highest value in the last 5 years. Nearly 130,000 BTC were issued on November 17, and the weekly average is still above 50,000 BTC per day. The on-chain data indicates significant stress on long-term investors which still poses a risk of capitulation since these investors hold the largest share of all available BTC on the market. Source: Glassnode

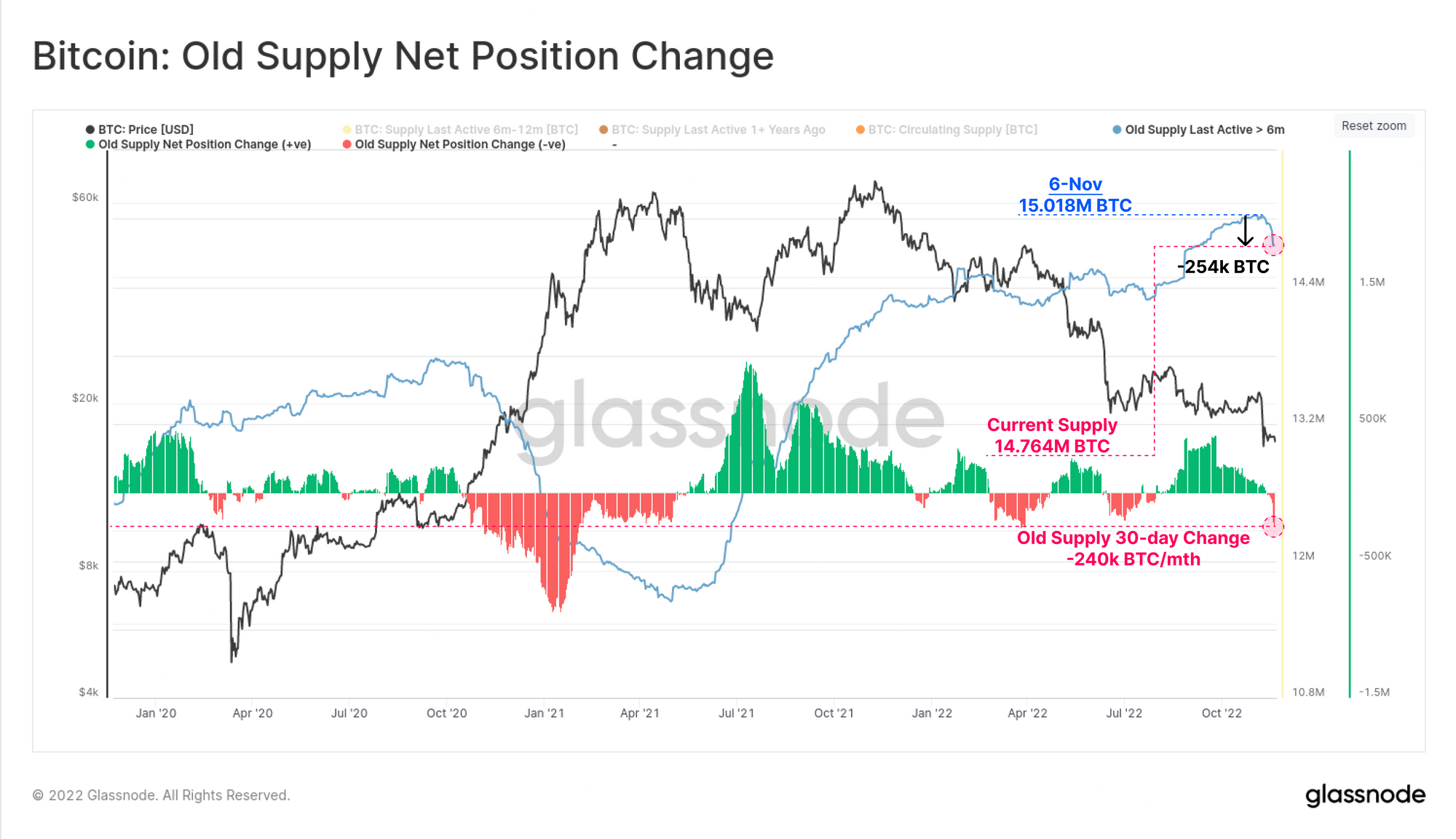

The value of Bitcoin traded older than six months recently reached the highest value in the last 5 years. Nearly 130,000 BTC were issued on November 17, and the weekly average is still above 50,000 BTC per day. The on-chain data indicates significant stress on long-term investors which still poses a risk of capitulation since these investors hold the largest share of all available BTC on the market. Source: Glassnode In the face of the FTX bankruptcy, a total of 254,000 BTCs were sold that were more than 6 months old (nearly 1.3% of the total circulating supply of Bitcoin). The 30-day change shows that this is the steepest drop in the supply of older coins since the January 2021 bull market when long-term investors took advantage of the bull market to distribute Bitcoin at a profit. Source: Glassnode

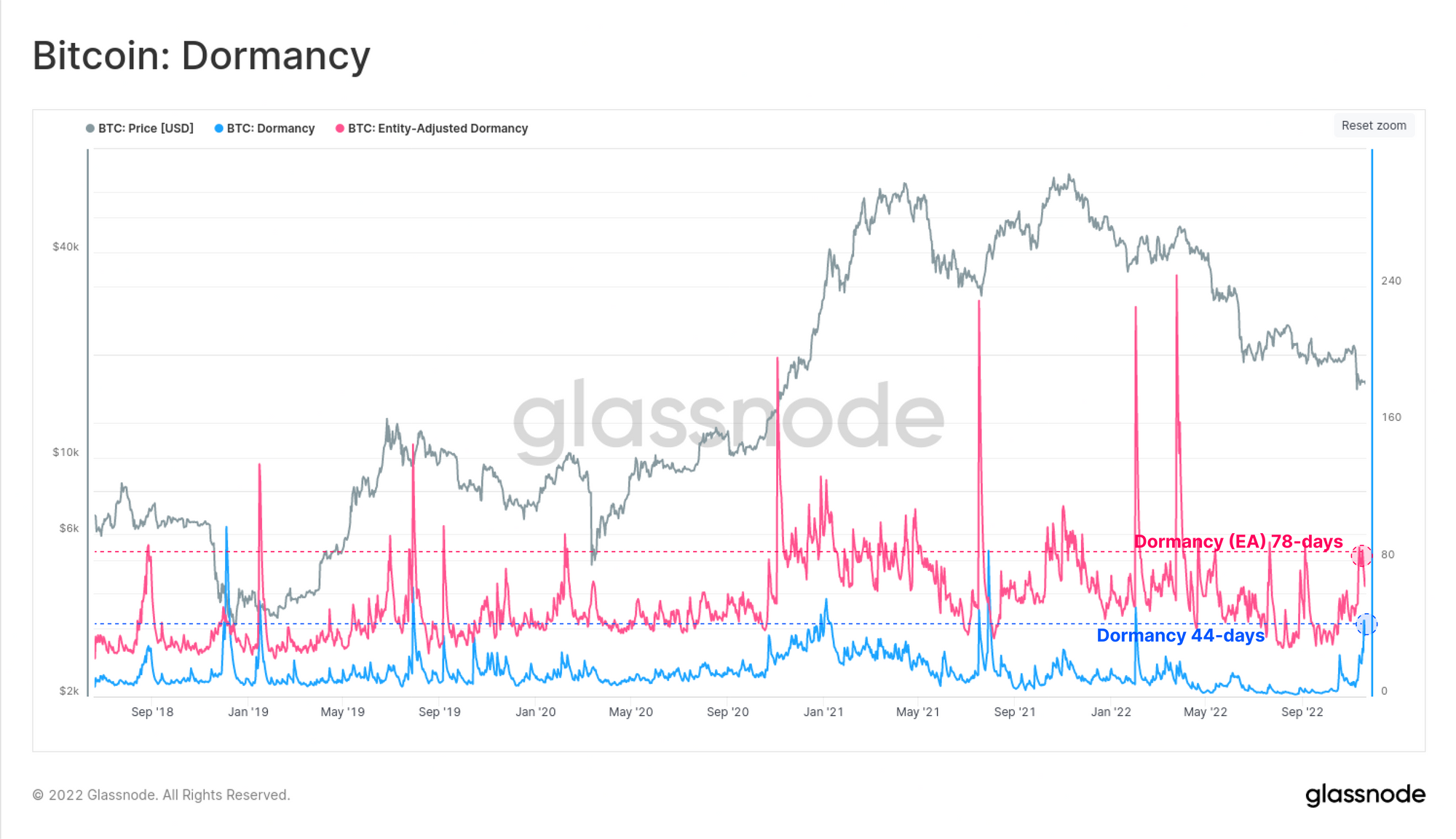

In the face of the FTX bankruptcy, a total of 254,000 BTCs were sold that were more than 6 months old (nearly 1.3% of the total circulating supply of Bitcoin). The 30-day change shows that this is the steepest drop in the supply of older coins since the January 2021 bull market when long-term investors took advantage of the bull market to distribute Bitcoin at a profit. Source: Glassnode The Dormancy chart indicates the average 'age' of Bitcoin sold. The indicator shows that the average age of liquidated Bitcoin has increased and is now 44 days and signals a higher supply of long-term investors (blue chart). At the same time, the supply of 'dormant' Bitcoin, adjusted for internal reshuffling of on-chain wallets (red chart), has also increased and now stands at 78 days. The data confirms the supply-side reaction of investors with the statistically highest level of conviction to the collapse of the FTX exchange. Source: Glassnode

The Dormancy chart indicates the average 'age' of Bitcoin sold. The indicator shows that the average age of liquidated Bitcoin has increased and is now 44 days and signals a higher supply of long-term investors (blue chart). At the same time, the supply of 'dormant' Bitcoin, adjusted for internal reshuffling of on-chain wallets (red chart), has also increased and now stands at 78 days. The data confirms the supply-side reaction of investors with the statistically highest level of conviction to the collapse of the FTX exchange. Source: Glassnode BinanceCoin chart, D1 interval. The Binance cryptocurrency exchange token has erased much of the losses caused by the drop in sentiment around the cryptocurrency market and is rising above the two key moving averages SMA50 (black line) and SMA200 (red line) signaling an attempted trend reversal. Following the collapse of FTX, the centralized exchange owned by Chanpeng Zhao accounts for about 64% of cryptocurrency trading and has become the main centralized player in the industry. Source: xStation5

BinanceCoin chart, D1 interval. The Binance cryptocurrency exchange token has erased much of the losses caused by the drop in sentiment around the cryptocurrency market and is rising above the two key moving averages SMA50 (black line) and SMA200 (red line) signaling an attempted trend reversal. Following the collapse of FTX, the centralized exchange owned by Chanpeng Zhao accounts for about 64% of cryptocurrency trading and has become the main centralized player in the industry. Source: xStation5 Bitcoin chart, H4 interval. The main cryptocurrency is trying to unwind the declines, on the chart we see a double hole formation near $15,500. The main resistance still runs around $17,000, which coincides with the 23.6 Fibonacci retracement and from where another downward impulse towards $14,000 could potentially be triggered. Source: xStation5

Bitcoin chart, H4 interval. The main cryptocurrency is trying to unwind the declines, on the chart we see a double hole formation near $15,500. The main resistance still runs around $17,000, which coincides with the 23.6 Fibonacci retracement and from where another downward impulse towards $14,000 could potentially be triggered. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.