-

Fed delivered a 75 basis point rate hike, putting Fed funds rate in the 3.75-4.00% range. Decision was in-line with market expectations

-

USD dropped while indices and gold gained in response to Fed decision as Fed noted that there is a lag between policy actions and their impact, and investors took those remarks as dovish

-

However, Powell was in no way dovish during the press conference, stressing that it is very premature to even think about slowing rate hikes and that ultimate level of rates may be higher than previously expected. USD regained strength and US indices moved to session lows during the presser

-

Gold also completed U-turn during the press conference and trades back where it did at decision announcement time

-

European stock markets traded lower today with German DAX and UK FTSE 100 dropping 0.6%. Italian FTSE MIB managed to finish flat while Polish WIG20 jumped over 2%

-

Wheat price plunged after Russia said that it will return to Black Sea exports agreement

-

Oil prices rose to a 3-week high on media reports saying that Iran may soon attack Saudi Arabia. Iran, however, dismissed reports and said that no such action is planned

-

ADP report showed a 239k increase in US employment in October (exp. 195k). Increase was entirely driven by leisure and hospitality as well as transportation sectors

-

German trade data for September missed expectations with exports and imports unexpectedly dropping. However, a drop in imports outpaced drop in exports leading to a higher-than-expected trade balance for the month

-

DOE report pointed to a smaller draw in US oil inventories than was signaled by API data yesterday. Reports also showed a spike in US imports of Saudi crude

-

NZD and JPY are the best performing major currencies while GBP and CAD are top laggards

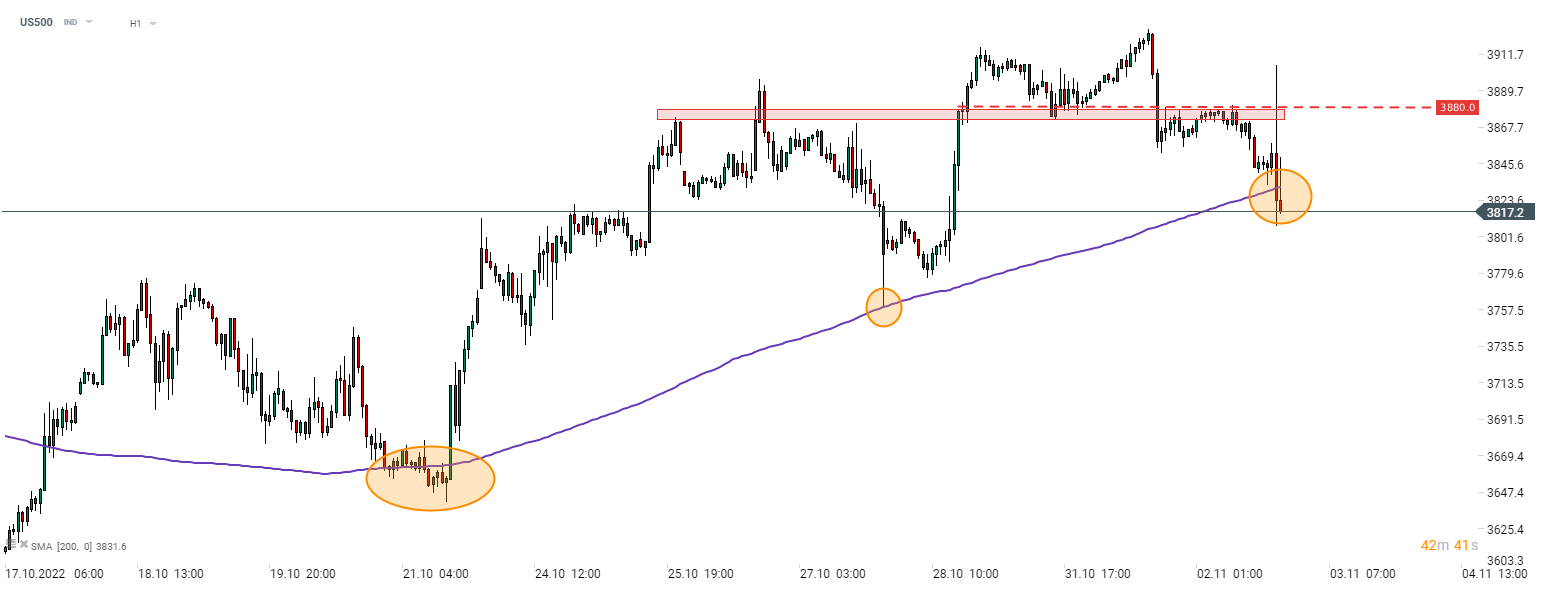

US500 erased post-decision gain during Powell's press conference and is now making a break below 200-hour moving average. Source: xStation5

US500 erased post-decision gain during Powell's press conference and is now making a break below 200-hour moving average. Source: xStation5

DE40 dips 3% and falls to 2026 lows 🚨📉

🚨 EURUSD deepens decline, falls to key support zone

Morning wrap (03.03.2026)

Daily summary: Markets aren’t afraid of the conflict, valuations are normalizing

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.