- Strong PMIs from Europe

- Germany's reverses plans for Easter lockdown

- US crude oil stocks unexpectedly jump

European indices erased early losses and finished today's session mostly higher amid upbeat preliminary PMIs figures. Manufacturing activity in both the Euro Area and Germany reached record highs while the latest reading from France’s pointed to the strongest expansion in the manufacturing sector since January 2018. Also, services activity unexpectedly returned to growth in Germany and fell less than expected in both the Eurozone and France. On the coronavirus front, German government retracted a 5-day hard lockdown over Easter. The Netherlands joined Germany, France and many other countries on the continent and extended the COVID-19 related restrictions by 3 more weeks. DAX 30 fell 0.35%, CAC40 finished slightly above the flatline and FTSE100 rose 0.20%

US indices are trading mixed, both Dow Jones and the S&P 500 rebounded from yesterday sharp losses, while the Nasdaq fell 1%. Bond yields stabilized around 1.64%, below 14-month highs from the previous week. On the data front, durable goods orders broke the streak of 9 months of growth and fell unexpectedly, while flash Markit PMIs showed that both the manufacturing and services sectors of the economy improved marginally in March. Also, Fed Chair Powell and Treasury Secretary Yellen continued their testimony to the Congress on the CARES Act. Powell said he expects the economy to experience superior growth in 2021 amid a recovery from the pandemic. “There’s going to be a very, very strong year in the most likely case,” Powell said. “There are of course risks to the upside and downside, but it should be a very strong year from a growth standpoint...Longer run we do have to raise revenue to support permanent spending that we want to do.” Powell also expects near-term upward pressure on prices.

WTI crude fell more than 5.6% and is trading slightly above $61.00 a barrel, while Brent is trading 5.80% lower around $64.30 a barrel. Some supply concerns emerged after container ship ran aground and blocked the Suez Canal and several attempts to refloat it have failed. However, sentiment remains bearish amid rising US crude inventories and growing concerns about Europe economic recovery. Latest EIA report showed US crude oil inventories increased by 1.912 million barrels which is the fifth consecutive week of increases. Elsewhere gold rose 0.45% to $ 1,735.00 / oz, while silver is trading 0.14 % higher, above $ 25.00 / oz. However, appreciation of precious metal prices is still limited by a stronger dollar.

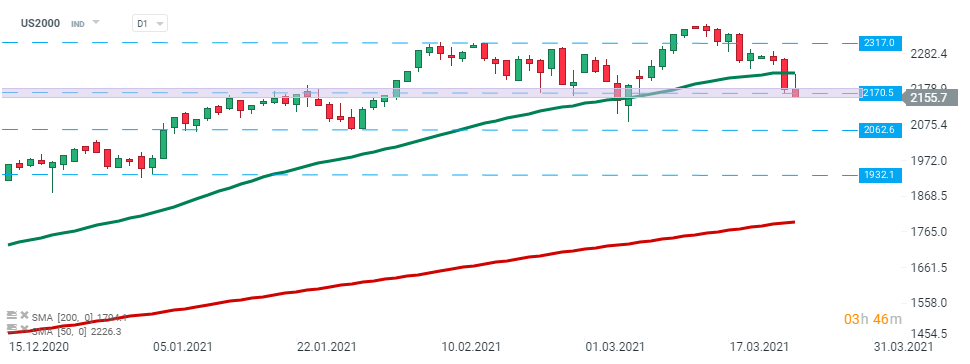

US2000 – yesterday index broke below the 50 SMA (green line) and downward move is being continued today. Currently index is testing major support at 2170 pts. If the current sentiment prevails then downward move may be extended to the 2062.6 pts level. However if buyers will manage to halt declines, then another upward impulse towards local resistance at 2317 pts may be launched. Source: xStation5

US2000 – yesterday index broke below the 50 SMA (green line) and downward move is being continued today. Currently index is testing major support at 2170 pts. If the current sentiment prevails then downward move may be extended to the 2062.6 pts level. However if buyers will manage to halt declines, then another upward impulse towards local resistance at 2317 pts may be launched. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.