-

Stocks in Europe and US extend upward move

-

China asks local governments to prepare for Evergrande collapse

-

Rate decisions from CBRT, BoE and Norges Bank

-

Disappointing flash PMIs for September

-

Bitcoin gains on Twitter news

Stock markets around the world move higher on Thursday. Major benchmarks from Europe finished today's trading around 1% higher and indices from Wall Street are trading over 1% higher at press time. This is surprising given that flash PMIs for September from Europe and the United States disappointed today. Manufacturing and services indices were expected to drop but decline was bigger than expected, with supply bottlenecks and weakening demand being seen as prime reasons.

Today's performance of equity markets may suggest that Evergrande concerns eased. However, this is far from true, especially given news that arrived on the markets today. China urged the company to avoid near-term default on its USD bonds but at the same time asked local governments to prepare for the downfall of the Chinese developer and resulting consequences. In other news it was reported that the company's EV unit has halted payments to its staff and suppliers.

Big moves could have been spotted on the FX market today after the Central Bank of the Republic of Turkey, Bank of England and Norges Bank announced monetary policy decisions. The Norwegian central bank became the first one from a developed country to hike rates in post-Covid era. Norges Bank increased rates by 25 basis points and provided a boost for NOK. On the other hand, CBRT delivered an unexpected rate cut and has pushed lira to fresh record lows. When it comes to the Bank of England, rates were left unchanged but the announcement was viewed as a hawkish one and boosted odds for a rate hike at the beginning of 2022.

Bitcoin gained around $1,000 in the evening following the announcement from Twitter. US social media company said that users using an iOS app will be able to tip others with Bitcoin.

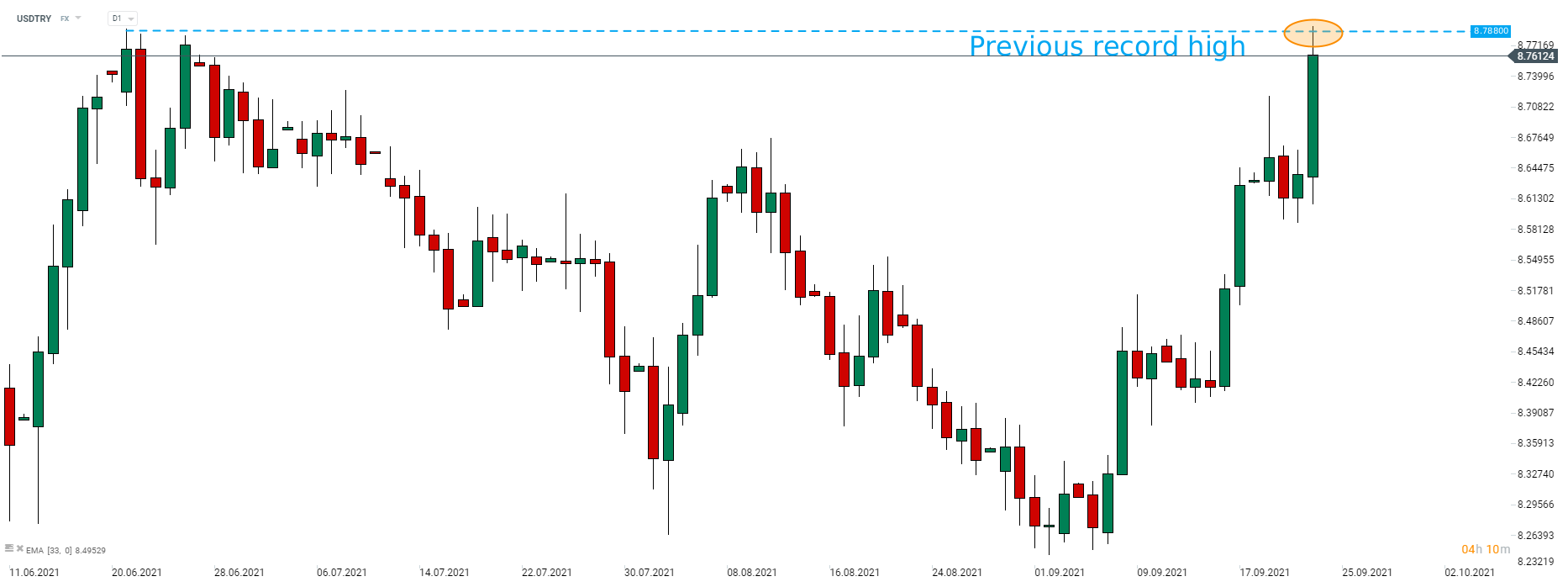

USDTRY trades around 1.5% higher on the day after CBRT delivered an unexpected rate cut. The pair has been trading lower before CBRT announcement and jumped almost over 2% afterwards. While USDTRY pulled back from daily highs, a new record high on the pair was reached. Source: xStation5

USDTRY trades around 1.5% higher on the day after CBRT delivered an unexpected rate cut. The pair has been trading lower before CBRT announcement and jumped almost over 2% afterwards. While USDTRY pulled back from daily highs, a new record high on the pair was reached. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

NFP preview

Daily summary: Weak US data drags markets down, precious metals under pressure again!

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.