- Good sentiment on the stock market in Europe

- Low volatility on the forex market

- JPY lost the most to USD, while CAD strengthened

- Gold and oil near Friday's closes

- Declines on most cryptocurrencies

- Cardano continues to rise

Monday's session did not bring much excitement to the financial market. On the one hand, Mondays are statistically characterized by lower volatility, and on the other hand - today in the US there was no trading due to the holiday, which also translated into smaller movements.

Although the mood on the Asian stock market was mixed, the vast majority of Europe's main indices managed to end today's session higher. The Austrian ATX gained as much as 1.68%, the London FTSE100 added 0.91% and the German DAX closed 0.32% higher. In turn, indices from Russia, the Netherlands and Poland lagged behind.

Changes in the forex market were moderate today. Looking at the major currencies, the most noteworthy were the Canadian dollar, which managed to gain around 0.3% to the USD, and the Japanese yen, which lost 0.4%. The other currencies are trading rather in the region of the benchmark against the US dollar.

Gold quotations have not fluctuated much today, with investors awaiting the Fed's decision on interest rate hikes (Wednesday, 26 January, 19:00 GMT). However, as reported by Commerzbank, investors are likely to be more cautious about possible bullion purchases ahead of the first interest rate hike, as evidenced by falling long positions on COMEX. There is still uncertainty in the black gold market about a potential conflict between Russia and Ukraine, but concerns about global oil supply are easing somewhat following increased production in Libya and China's agreement to release its strategic stockpiles in January/February 2022.

The start of the week brings declines for most cryptocurrencies, and one of the few projects that saw larger gains today was Cardano. The cryptocurrency gained up to 10% today on the back of the launch of the Pavia project, focused on the metaverse in the Cardano network. As for the oldest of the cryptocurrencies, this one is currently falling below $42,000. Ethereum is also not doing well and at one point during the day it broke below the psychological $3,000 barrier. The total crypto market capitalization at the moment is $2.01 trillion.

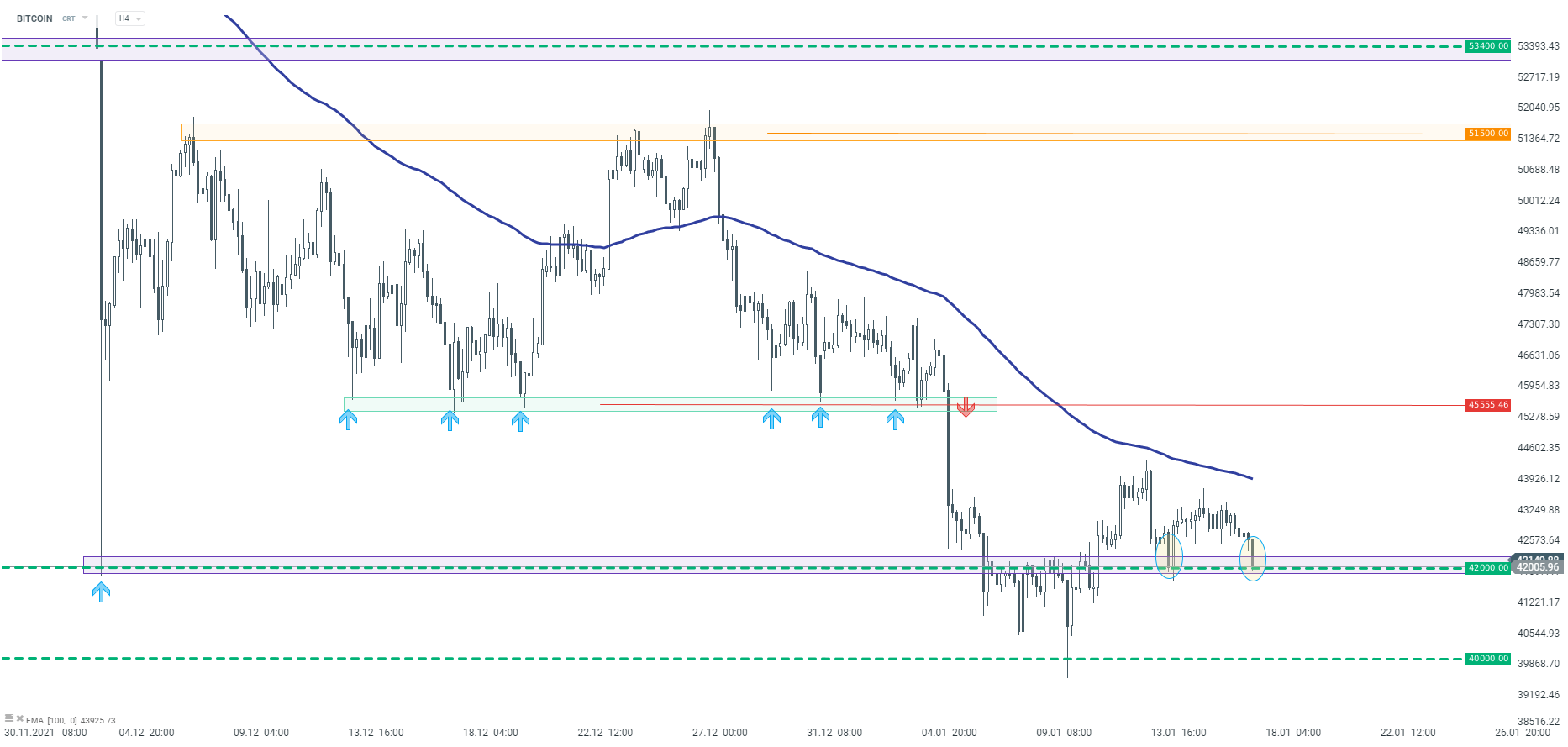

Bitcoin is not doing well today. Looking at the H4 interval, we see a renewed attack on the key horizontal zone at $42,000. This level was a support on January 14, however, despite the rebound, the price did not manage to go above the average of the last 100 periods - blue line on the chart. If the previously mentioned support at $42,000 is broken, the declines may become stronger. Source: xStation 5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.