-

Sell-off on global financial markets

-

Silver craters over 9%

-

U.S. dollar as “the winner” of the day

Global financial markets started the week amid continued coronavirus fears due to potential U.K. lockdown measures, which might have fuelled today’s rout. Banks were among top laggards as a report concerning suspicious transactions was released. The report suggests that some major banks might have been involved in money-laundering or other illegal activities. European stocks fell the most in over three months - DAX finished the day 4.37% lower while CAC 40 plunged 3.74%.

U.S. indices started the day in a pessimistic moods as well with tech stocks being the most resilient (Nasdaq is down around 1% at press time while S&P 500 is trading almost 2.50% lower). As today’s sell-off is widespread and affects various asset classes, precious metals plunge too. Gold prices tested $1,900 mark today and they seesaw around this crucial barrier now. The biggest declines might be spotted on silver markets as silver spot price craters over 9%. The U.S. dollar re-emerged as a haven currency with EURUSD gradually approaching the 1.1725 level. It is worth mentioning that despite higher volatility (VIX is up 11%), the U.S. bond market is barely moving. Ten-year Treasury yields remain in a range from 60 bps to 75 bps, which indicates that there is no evident fear in fixed income.

Tomorrow the RBNZ will release its rate statement while the Riksbank will announce its interest decision. At 3 pm BST the U.S will publish existing home sales data, which might give some insight into the country’s economic recovery. Apart from that, one might be particularly interested in several FOMC members speeches - Kaplan and Williams will speak at 11 pm BST today while Fed’s Chairman is supposed to start his speech at 3:30 pm BST tomorrow.

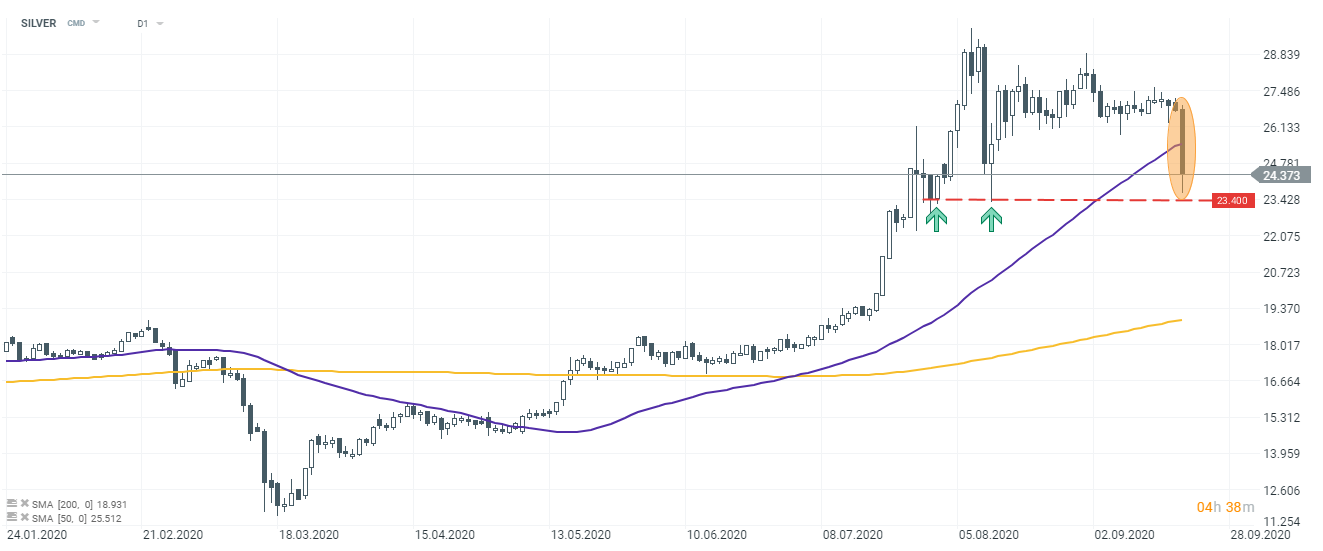

Silver plunges almost 10% today. One might view the $23.4 mark as the nearest support. Bulls did manage to regain control in this area twice following recent price surge. Source: xStation5

Silver plunges almost 10% today. One might view the $23.4 mark as the nearest support. Bulls did manage to regain control in this area twice following recent price surge. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.