- Major European indices finished today's session lower, with the DAX falling by 1.22% and the CAC40 declining 0.33%.

-

The PPI reading turned out to be mixed. Headline inflation fell below consensus (8.7% against forecasts of 8.8%). The core inflation turned out to be a surprise as it amounted to 7.3% against expectations of 7.1%.

-

Three major Wall Street indexes are trading slightly higher, the Dow is up 0.4% and the S&P 500 and Nasdaq are gaining 0.5% and 0.8% respectively. The swap market is currently pricing in 28% chances for a 100bp hike on September 21.

-

On the FX market, we can observe a retreat from the US dollar towards the Japanese yen and the British pound. The mood around the yen was influenced mainly by politicians' comments. Hirokazu Matsuno, Japan's chief secretary, announced that the government was ready to make any possible decision in order to stabilize recent excessive yen volatility. Also lower UK CPI and PPI readings also surprised investors.

-

Oil price rebounded more than 2% on Wednesday, as investors continued to assess the outlook for global demand. The International Energy Agency indicated a large-scale gas-to-oil switching in many countries, calculated to average 700,000 barrels per day from October 2022 to March 2023, double the level of a year ago. However, the organization expects that growth in global oil consumption will weaken in the last quarter of 2022 as an economic slowdown intensifies but sees demand picking up strongly in 2023.

-

Meanwhile, Bloomberg said the US government intends to purchase millions of barrels of oil (at a price close to $ 80) to replenish reserves, which have dropped to their lowest level since 1984.

-

NATGAS jumped more than 6% as the potential railroad strike in the US, which could start on Friday, could force generators to burn more gas to produce electricity as about two-thirds of the US coal-fired power plants receive their coal by rail.

-

Mixed moods prevail on the precious metals market. Gold struggles to break above $ 1,700mark, while silver and platinum gain over 2.5%.

-

The mood in the cryptocurrency market is relatively mixed today. Bitcoin is gaining slightly over 0.3%m while Ethereum fell 0.4% ahead of "Merge" which is expected to be completed in less than12 hours.

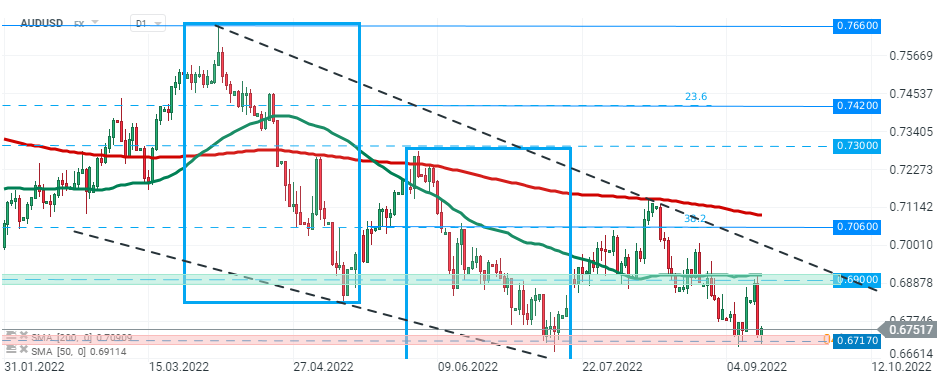

AUDUSD pair fell over 2.0% yesterday, however sellers struggled to break below the major support zone at 0.6717, which managed to fend off bears several times in the past. As long as price remains above this level, another upward impulse towards local resistance at 0.6900 may be launched. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.