- European equities end lower

- NASDAQ 100 approaches ATH

- BoC decided to end its QE programme

- Cryptocurrencies under pressure

European indices finished today's session lower after a mixed set of quarterly earnings reports. Deutsche Bank stock plunged 7% after the company posted disappointing investment banking revenues. Still, the bank recorded its fifth straight quarterly profit, topping market consensus with a net income of €194 million. Heineken stock fell 0.7% as beer volumes declined over 5.0% in the third quarter, significantly impacted by the pandemic outbreaks in Asia. On the data front, the German GfK Consumer Climate index unexpectedly jumped to a 19-month high heading into November. In the UK, Finance Minister Rishi Sunak unveiled his Autumn budget and said the economy would grow faster than previously expected. Tomorrow investors from Europe will focus on the ECB monetary policy decision. The central bank is expected to maintain a dovish guidance but traders will be looking for an update on tapering and forward guidance on the economy and inflation.

Meanwhile mixed moods can be observed on Wall Street where Dow Jones and S&P500 fell from records while NASDAQ approaches its all-time high as earnings season continues. Coca-Cola, McDonald’s and GM recorded strong quarterly results while Boeing figures disappointed. Also, Microsoft and Alphabet posted a record quarterly revenue, along with Twitter after stating that Apple’s privacy updates had less of an impact on its results. Ford and eBay will release their quarterly results after the closing bell.

The Canadian dollar strengthened significantly after the Bank of Canada kept its target for the overnight rate at 0.25% and unexpectedly decided to end its quantitative easing programme and move into the reinvestment phase, during which it will purchase Government of Canada bonds solely to replace maturing bonds.

WTI crude fell 2.40% and is trading around $82.50 a barrel, while Brent dropped 2.20% and is trading around $83.70 a barrel after today's EIA report showed US crude oil inventories increased to 4.267 million barrels in the week ended October 22nd, above analysts’' projections of a 1.914 million barrels increase. However, the report also showed crude supplies at Cushing declined the most since January, with supply levels already at the lowest since 2018.

Elsewhere, gold price rose slightly and is approaching $1800 level while silver is trading flat around $24.00 amid weaker dollar and lower bond yields. The yield on the benchmark 10-year Treasury note declined to 1.53% as investors weighed a strong earnings season against concerns over slowing economic growth, inflationary pressure and ongoing supply chain issues. GDP growth figures for Q3 will be keenly watched for an update on the US economy.

Cryptocurrencies witnessed a sharp pullback during today's session. Bitcoin fell below $ 59,000 level. Ethereum price broke below psychological $4000 level and other altcoins recorded significant price drops, however later in the session bulls managed to partially erase some losses. There was no major news that could justify such a steep drop and today's moves seem to be cool-off after last week's steep gains that were supported by the launch of Bitcoin futures ETFs in the United States.

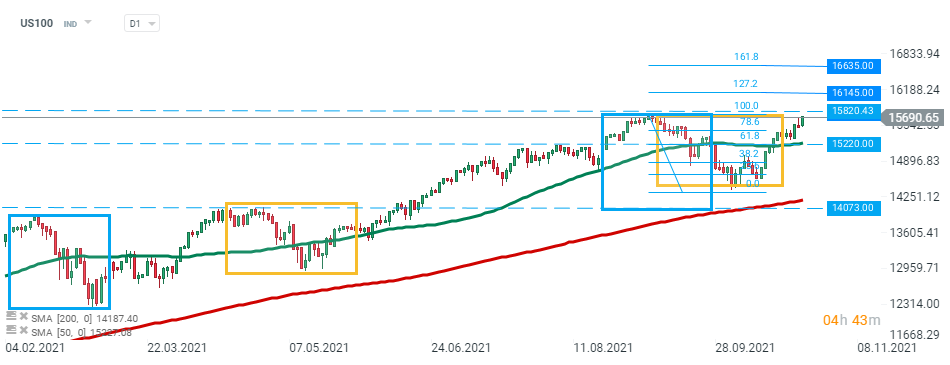

US100 launched today’s session higher and is approaching all-time high at 15,820 pts which coincides with the upper limit of the 1:1 structure. Should break higher occur, then the next target for buyers are marked with 127.2% and 161.8% external Fibonacci retracements. On the other hand, if sellers will manage to halt advances, then another downward impulse towards support at 15220 pts may be launched. Source: xStation5

US100 launched today’s session higher and is approaching all-time high at 15,820 pts which coincides with the upper limit of the 1:1 structure. Should break higher occur, then the next target for buyers are marked with 127.2% and 161.8% external Fibonacci retracements. On the other hand, if sellers will manage to halt advances, then another downward impulse towards support at 15220 pts may be launched. Source: xStation5

Daily Summary: Middle East Sparks Oil Market

Join Live: Oil Soars Past $100

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster

Oil Under Pressure as G7 Decision Remains Pending

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.