- Global stock markets extend declines

- Natural gas and aluminum prices at record levels

- BoC leave interest rates unchanged

Wednesday's session was not the best for the stock market investors. European indices finished the session significantly lower. The German DAX (DE30) hit its lowest levels in a month. US indices are also trading lower, but the sell-off scale is milder compared to the indices from the Old Continent.

Today's macroeconomic calendar was not particularly interesting and it is hard to find one clear reason behind the downturns in the stock markets. The Bank of Canada did not surprise and kept the interest rate and scale of the asset purchase program unchanged, which in turn led to a weakening of the CAD. The US JOLTs report showed that the number of available jobs has risen sharply again and clearly exceeds the number of unemployed - further evidence that employers have a problem finding employees.

Today we can observe strong movements in the commodity markets. Natural gas prices have increased by nearly 10% today, reaching the highest levels since 2014, while aluminum price jumped to a level not seen since 2008! In both cases, we are dealing with massive demand (rebound in the global economy) and clear supply problems. Crude oil prices rise by around 1% in the evening. A stronger dollar continues to put pressure on precious metals.

Tomorrow the highlight of the day will be the decision of the European Central Bank (12:45 pm BST). Investors will also be offered EIA report on oil stocks and US weekly jobless claims data.

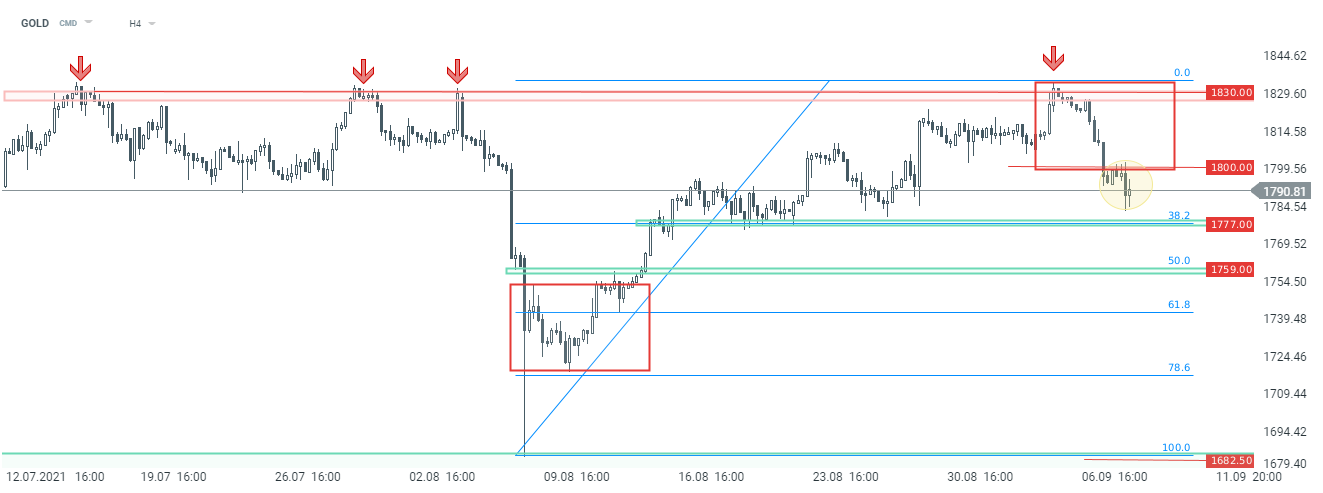

Gold prices fell below $ 1,800 an ounce today, moving away from key $ 1,830 resistance - Friday's attempt to break this barrier was unsuccessful. If current sentiment prevails, the downward move may accelerate towards $1777 area, which is marked with the 38.2% Fibonacci retracement of the latest upward wave. This level served as a support in the second half of August. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

US2000 near record levels 🗽 What does NFIB data show?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.