-

Upbeat economic data supports stock markets

-

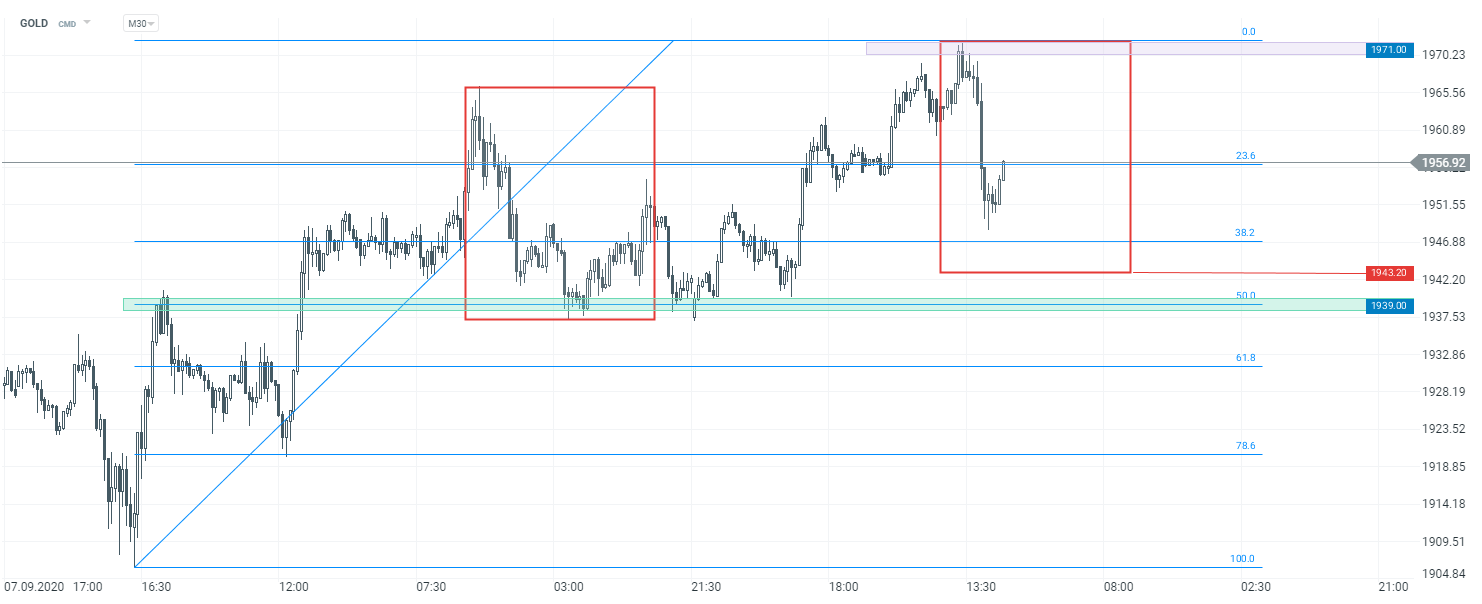

Gold with some bigger swings

-

Markets awaiting tomorrow’s Fed policy announcement

Global stock markets continue to push higher due to solid economic reports which were published today. Major blue-chip indices from the Old Continent finished the day slightly higher. DAX added 0.18% while CAC 40 rose 0.32%. British FTSE 100 outperformed the rest and gained 1.32%. U.S. equities started the day in a positive territory as well with tech stocks leading early gains. Nasdaq is adding as much as 1.50% at press time.

Oil prices tend to gain along with risk assets today. Brent prices returned above $40 per barrel while WTI is trading above the $38 mark. One could spot some bigger swings on precious metals markets. As gold prices approached the $1,971 mark, market bears managed to gain control and gold fell over $20.

Today’s calendar was pretty hectic. Crucial data from China managed to maintain upbeat moods as both Chinese industrial production and retail sales came in above market expectations. German ZEW indices did well too as the Economic Sentiment index rose in September to 77.4 pts (vs exp. 69.8 pts). Another surprise (in a positive sense) was NY Empire State Manufacturing Index as it climbed to 17.0 pts and nearly matched July’s post-Covid peak. However, the U.S. industrial production for the month of August came in below expectations (0.4% MoM vs exp. 1.0% MoM)

Tomorrow will be a big day for global financial markets due to some key events. First of all, investors will get to know the U.S. retail sales data for the month of August. Canada and UK will release their CPI reports while oil traders will focus on EIA’s crude oil data. Finally, the Fed will announce its interest rate decision and Powell’s conference will be in the spotlight as the monetary policy announcement may be regarded as the most important event of the day.

Gold started the day with upbeat moods, but in the afternoon one could have spotted a small correction. Should market bears remain in control, investors may focus on two supports levels. The first one can be found at $1,943 while the second one coincides with the $1,939 mark. Source: xStation5

Gold started the day with upbeat moods, but in the afternoon one could have spotted a small correction. Should market bears remain in control, investors may focus on two supports levels. The first one can be found at $1,943 while the second one coincides with the $1,939 mark. Source: xStation5

Wall Street extends gains; US100 rebounds over 1% 📈

Market wrap: Novo Nordisk jumps more than 7% 🚀

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

NATGAS slides 6% on shifting weather forecasts

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.