During the first session of the new trading week, we saw a deceleration of stock market gains, most of the major stock market indices from Europe ended the day higher, but the gains were limited, with the FTSE100 gaining 0.66%, the DAX adding 0.08% and the CAC40 losing 0.1%.

U.S. indices, which finished last week phenomenally, fared worse. Today, all major stock indexes from overseas are trading under the bar, and the weakest performer is the Nasdaq, where the discount reaches 0.8%.

Monday brought a strengthening of the U.S. currency, with the dollar gaining most strongly against the British pound, where GBPUSD is trading more than 1% lower . The euro and yen are losing 0.75% against the USD, while the franc is trading 0.55% lower, and AUD and CAD are off 0.25%

U.S. bond yields continue to rise, with today's move on the 10-year reaching +0.8%.

As White House official said, Biden will call on oil and gas companies to invest record profits in lowering costs for American families.

Russia has withdrawn from the operation of the so-called Safe Export Corridor for grains, including Ukrainian wheat and corn, which are posting massive rallies in response. UN-moderated negotiations on the operation of the above agreement were still underway this weekend. Cutting off Ukraine's ability to export grains once again creates the threat of a food crisis in Africa and the Middle East.

The crypto market is sharply divided today. Small projects such as Dogecoin and Binancecoin are gaining more than 5%. Bitcoin, on the other hand, is losing nearly 1% and struggling to hold the $20,000 level.

The precious metals market remains in a downtrend today. Gold is down more than 0.5%, while Palladium is losing nearly 2.2%. Silver is doing much better, trading near Friday's closing levels. The strengthening of the dollar, as well as rise in U.S. bond yields, are translating into a pullback in the precious metals market.

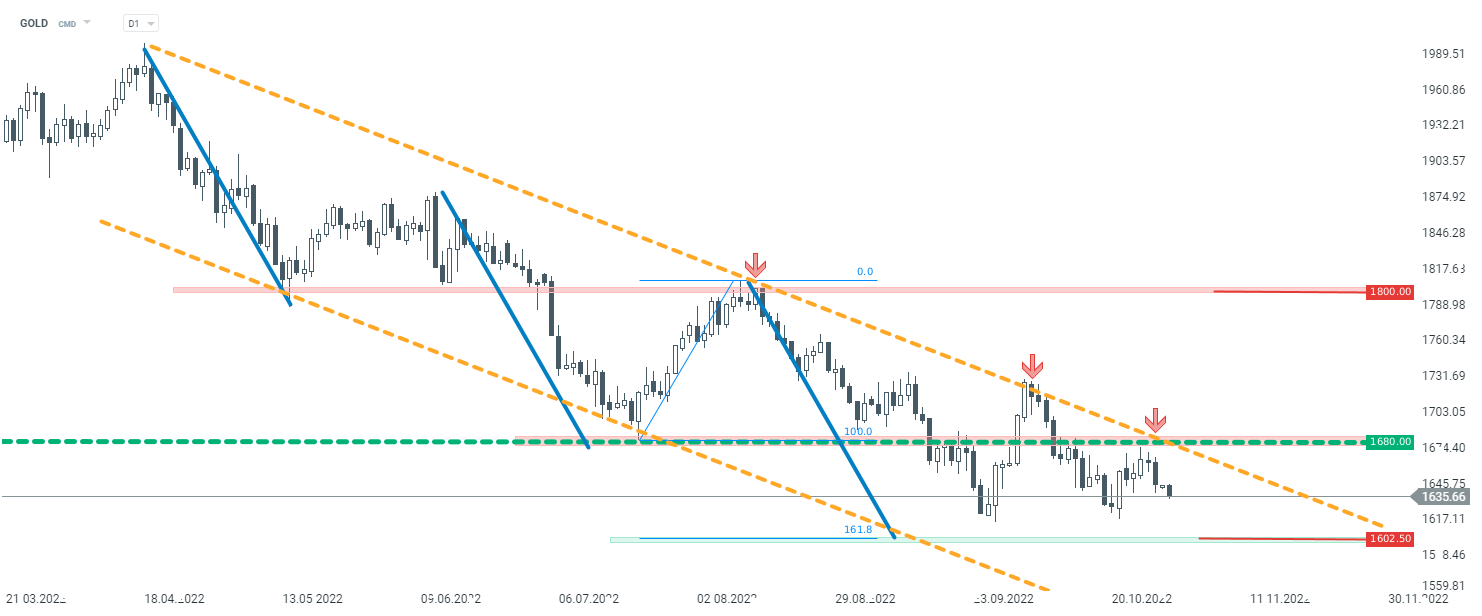

Gold quotes remain in a downtrend. Looking technically at the D1 interval, the price remains below the key resistance zone at $1680. According to classic technical analysis assumptions, a move toward support at $1602.5, where the parity with the last two downward impulses falls, is not excluded.

Gold D1 interval. Source: xStation5

Why are equities ‘holding up’ in this crisis?

Morning Wrap: Russian Oil with a 30-Day Purchase Permit

Cattle futures fall amid JBS plant strike, rising corn and Middle East 📌

An elevated oil price is here to stay as supply concerns grow, equities fall

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.