European stock indices finished Monday’s session higher as two critical factors lead to upbeat mood - signed Covid relief in the United States and EU-UK trade agreement, which was struck before Christmas. As a result major indices trade near record levels - both in the U.S. and in Europe. The German DAX closed 1.49% higher and managed to climb to fresh all-time highs today! However, DE30 (futures contract) is still to reach record levels. CAC 40 gained 1.20% while FTSE 100 will resume trading tomorrow as London Stock Exchange was still closed today.

Investors might have spotted some bigger moves on FX today as the U.S. dollar gained ground against its peers. EURUSD fell below 1,2200 for a moment while GBPUSD slid towards 1,3430. Gold prices have tested $1,900 mark twice, but failed to break above. Meanwhile, Bitcoin is trading near $27,000 in the evening.

Tomorrow’s economic calendar will be almost empty - just like today. Nevertheless, some might still want to pay attention to two readings: CB Consumer Confidence from the United States for December (revision) and API weekly crude oil stock. Therefore, headlines will likely play significant role.

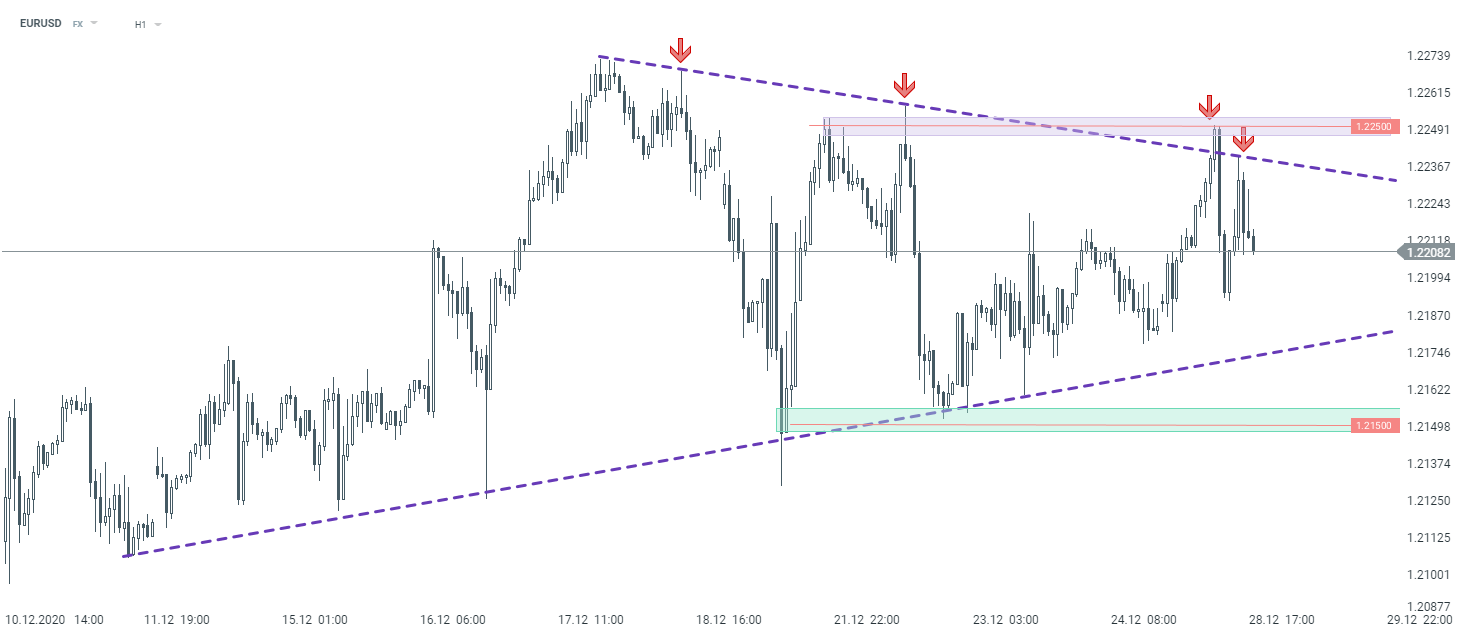

EURUSD started today’s session higher, yet the currency pair bounced off 1,2250 and changed direction. In order for a bigger move to occur, the currency pair would either need to climb above 1,2250 or fall below support level at 1,2150. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

US2000 near record levels 🗽 What does NFIB data show?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.