- European equities approach all-time highs

- US indices trade near record levels

- Investors poured a record $1.5 billion into crypto funds last week

- Several Big Tech companies will publish quarterly results after market close

European indices finished today's session higher, with Frankfurt’s DAX up 1.0% to a 7-week high of 15,774 pts and the pan-European Stoxx ended at a new all-time high as investors welcomed strong corporate results across Europe and North America. Swiss bank UBS recorded a 9% increase of net profit in the third quarter, as continued trading helped the world's largest wealth manager to its best quarterly profit since 2015. Reckitt Benckiser Group Plc, producer of the well-known Strepsils throat pills, lifted its full-year outlook amid strong sales of cold and flu remedies and higher prices. Europe’s largest retailer Carrefour will launch a new rapid grocery delivery service in Paris in cooperation with Uber.

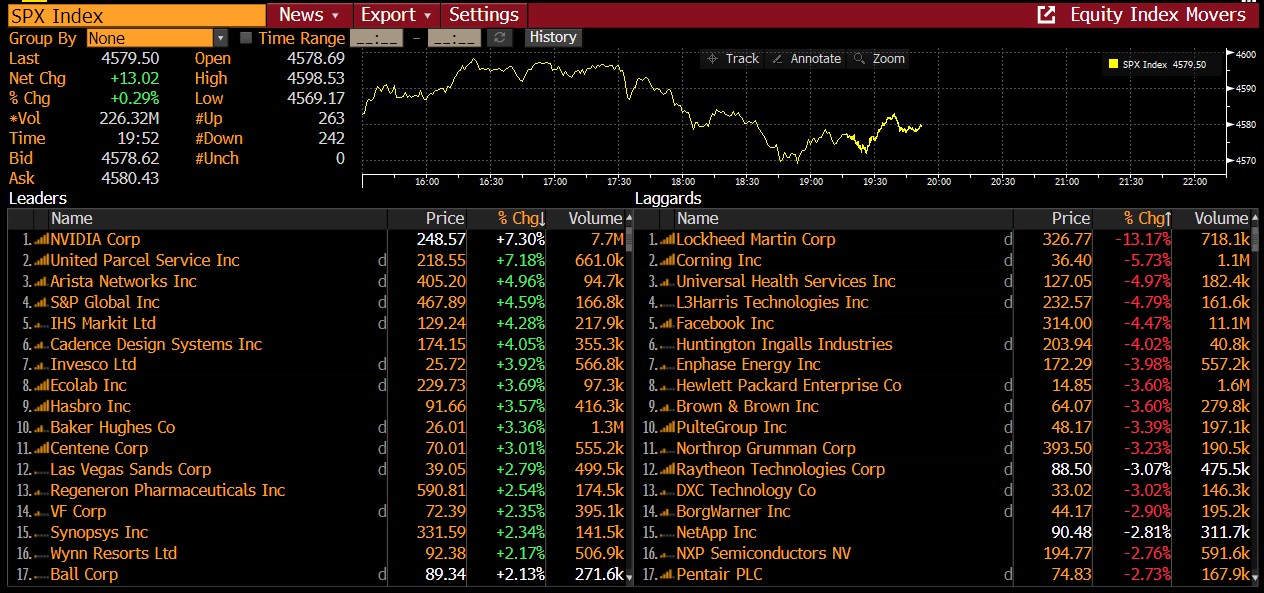

US indices launched today’s session sharply higher, with both the Dow Jones and the S&P 500 hit a fresh record high, as major corporations continued to turn in solid quarterly results. However moods deteriorated later in the session, as intraday reversal in shares of Facebook and Tesla weighed on major averages. Earnings from 3M, UPS and General Electric beat market expectations and Eli Lilly raised its full-year guidance. On the other hand, the results of Lockheed Martin Corp. turned out to be much worse than the analysts' predictions. The company also said it expects a further decline in revenues, which will prevent it from reaching the 2021 target, and that the current trend will continue into 2022. The company's shares fell more than 13% today. Meanwhile, Microsoft, Twitter and Alphabet will release their quarterly earnings after the closing bell.

The current "winners" and "losers" from the US500 index. Source: Bloomberg

The current "winners" and "losers" from the US500 index. Source: Bloomberg

WTI crude rose 1.20% and is trading above $84.50 a barrel, while Brent added 0.35% and is trading around $85.50. Concerns about demand from China weighed down on an otherwise bullish market sentiment, after government intervention cooled a surge in energy and coal prices. Still, prospects for a colder-than-usual November month, coupled with OPEC+ countries’ strategy to keep supplies tight, have been pushing the market closer to a squeeze. Later in the day, investors will gauge on API crude oil stocks change to assess the strength of US demand.

Elsewhere, gold fell over 1.2% and price broke below $1800 level while silver lost 2.7% and is trading around $24.00 as the dollar index rebounded from recent lows and bond yields remain elevated at 1.62%

Bitcoin price pulled back slightly after a failed attempt to break above resistance at $63,000 and is currently trading around $ 62,200 level. Ethereum price rose slightly and is trading around $ 4,200. Cryptocurrency products and funds recorded inflows totaling $ 1.5 billion last week, which is a new record high amid a rally in cryptocurrencies and the launch of the first Bitcoin ETF in the US according to a recent CoinShares report.

Silver price fell more than 2.5% on Tuesday, however sellers failed to break below major support at $23.85 which coincides with the upward trendline, lower limit of the 1:1 structure, 50 SMA (green line) and 200 SMA (red line). If buyers will manage to regain control, then another upward impulse towards local resistance at $24.90 may be launched. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.