- Pfizer(PFE.US) and BioNTech (BNTX.US) requested regulatory clearance for their vaccine in Europe

- OECD sees brighter economic outlook

- Stocks in the US Hit All-time High

Meanwhile S&P 500 and the Nasdaq hit record highs as hopes that a COVID-19 vaccine will be available soon. Investors’ attention focus on a handful of vaccine candidates as well as the start of global shipments as drugmakers submit paperwork for regulatory approvals. Dollar weakened after Fed Chair Powell pointed, during his testimony in Congress, that more fiscal action is needed and FED will expand both its bond-buying programme and ultra-cheap loans to banks. On the economic data, recent figures showed a rise in construction spending but a decrease in the manufacturing index. Yesterday US reported 157,901 new Covid-19 cases compared to 138,903 the day before. Death toll reached 1,172, compared to Sunday’s two week low of 826. Hospitalizations hit another record, with at least 96,039 people hospitalized for Covid-19.

US crude futures are trading 1.3% lower at $44.71 a barrel, while the international benchmark Brent contract fell 0.9% to $47.48. OPEC+ delayed output talks until tomorrow, as group members were unable to reach an agreement regarding crude production cuts. Investors will also keep an eye on the API report which will be published later in the day, with forecasts of 2.272 million barrels drop .

Elsewhere, gold futures rose more than 2.0% to $1,813.00/oz, after dropping almost 6% in November, its worst month in four years, while silver surged more than 5% to $23.90. EUR/USD is trading 0.95% higher at 1.2048 amid weaker dollar.

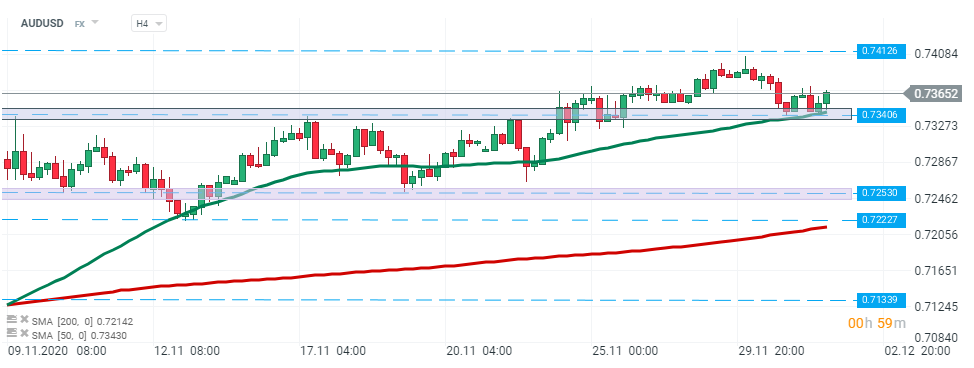

AUDUSD – pair bounced of the upper limit of the consolidation range at 0.7340 which is additionally strengthened by 50 SMA (green line). Should upbeat moods prevail, resistance at 0.7412 may come into play. Source: xStation5

AUDUSD – pair bounced of the upper limit of the consolidation range at 0.7340 which is additionally strengthened by 50 SMA (green line). Should upbeat moods prevail, resistance at 0.7412 may come into play. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

US2000 near record levels 🗽 What does NFIB data show?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.