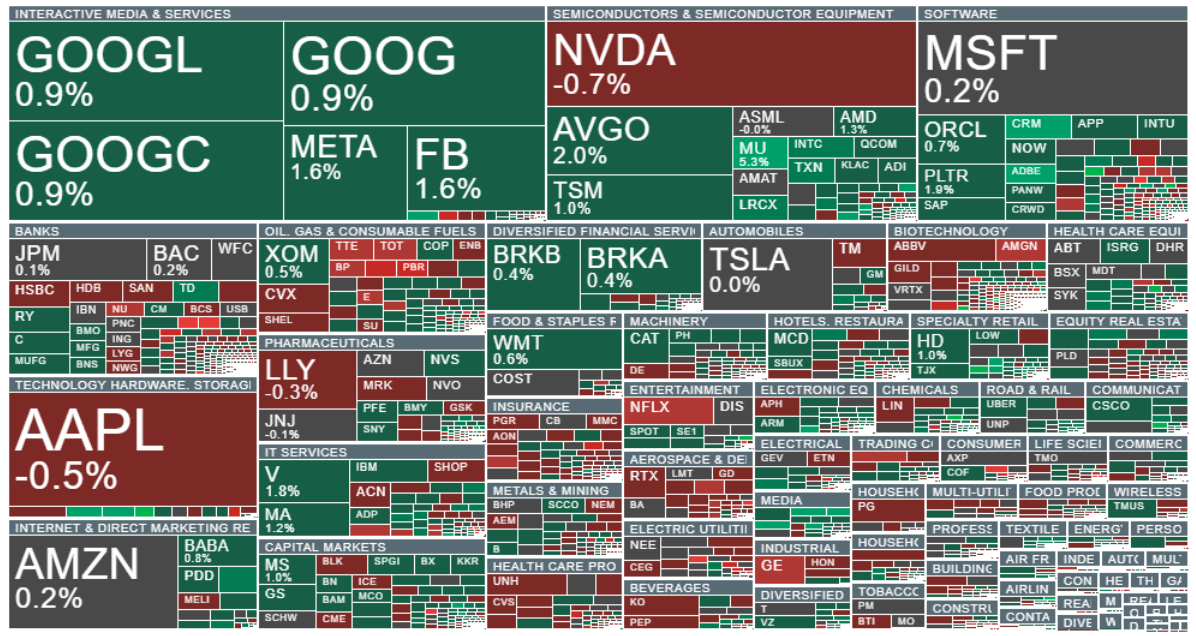

- The final session of the week brings cautious gains on Wall Street, with S&P 500 (US500) futures up 0.2 percent and Nasdaq 100 (US100) futures rising 0.4 percent. Shares of Micron, Adobe (which will report earnings next Wednesday), and Salesforce are advancing, while Netflix and General Electric are under pressure. The US dollar is trading roughly flat. Despite quite positive sentiments on Wall Street, cryptocurrencies slide, with Bitcoin falling 3% to $88k and large cryptocurrencies such as Polkadot falling 8% to 10%.

- The PCE report was supportive for markets, with inflation expectations coming in line with forecasts, while personal consumption and income largely matched economists’ projections. Preliminary University of Michigan data for December also delivered a positive signal for Wall Street, showing an improvement in consumer sentiment and a decline in inflation expectations in both the one-year and five-year horizons. This combination strengthens expectations for a realistic rate cut in December and a lower-risk dovish policy outlook heading into 2026, which could support risk assets while putting downward pressure on yields and the dollar.

US macro data published today

US PCE Price Index YoY: 2.8% (Forecast 2.8%, Previous 2.7%)

- US PCE Price Index MoM: 0.3% (Forecast 0.3%, Previous 0.3%)

US Core PCE Price Index YoY: 2.8% (Forecast 2.8%, Previous 2.9%)

- US Core PCE Price Index MoM: 0.2% (Forecast 0.2%, Previous 0.2%)

US Real Personal Consumption MoM: 0.0% (Forecast 0.1%, Previous 0.4%)

- US Consumer Spending MoM: 0.3% (Forecast 0.3%, Previous 0.6%)

- US Personal Income MoM: 0.4% (Forecast 0.3%, Previous 0.4%)

University Michigan Sentiment Prelim (December): 53.3 (Forecast 52, Previous 51.0)

- University Michigan Expectations Prelim: 55 (Forecast 52.7, Previous 51.0)

- University Michigan Condition Prelim: 50.7 (Forecast 52.1, Previous 51.1)

University Michigan 5 Yr Inflation Prelim: 3.2% (Forecast 3.4%, Previous 3.4%)

- University Michigan 1 Yr Inflation Prelim: 4.1% (Forecast 4.5%, Previous 4.5%)

- Shares of CoreWeave (CRWV.US), one of the most heavily sold-off tech names earlier this year, have surged more than 20 percent over the past five sessions, confirming that concerns about overstretched AI infrastructure investment have eased significantly. Analysts at Roth Capital Partners initiated coverage on the GPU-leasing company with a buy rating and a 110 USD price target, implying roughly 25 percent upside from current levels.

-

In the commodities market, gains are led by natural gas futures (NATGAS), which are up more than 5 percent, and cocoa, which is climbing nearly 4 percent. Oil is posting a modest increase of just under 0.7 percent.

-

The newly announced Pentagon strategy calls for Europe to take over the majority of NATO defense spending by 2027 and aims to reduce the risk of a conflict over Taiwan. The U.S. defense sector is edging lower; shares of RTX, the largest American defense company, are among those pulling back. Next week, drone manufacturer AeroVironment will report its earnings.

-

The meeting between China’s Vice Premier He Lifeng and US Treasury Secretary Scott Bessent likely went smoothly, as Chinese officials issued a positive statement afterward, highlighting plans to broaden cooperation with the United States.

(daily summary in progress)

Source: xStation5

Daily summary: Markets capitulate under the influence of the Persian Gulf

US Open: Wall Street in Blood

Spring Statement fails to calm UK bond market,

DE40 dips 3% and falls to 2026 lows 🚨📉

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.