- US core PCE inflation surges at fastest pace in 30 years

- Amazon shares drag Wall Street lower

- FED Bullard believes that tapering should start this fall

The US core PCE inflation, excluding food and energy, fell to 0.4% m / m in June, from a 0.5% increase in the previous month and below market expectations of 0.6%. However, the annual rate the Fed uses as its headline indicator for inflation rose to 3.5% in June from 3.4% in the previous month. Today's reading fell below analysts' estimates at 3.7%, but this is a level not seen for 30 years. Fed members reiterate that price pressure is a temporary phenomenon due to fiscal stimulus, supply constraints and rising commodity prices. The Fed is probably happy with the data as they may confirm the thesis that the price increase may be temporary and justify keeping the current policy unchanged.

Nevertheless, the US dollar held firm today. The EURUSD pair fell significantly below 1.1900, which is related to Bullard's statement, who not only expects the QE program to be tapped in the fall, but also sees the prospects of interest rate increases next year. Bullard indicates that the labor market will behave much better than expected, which should give a chance for a change in monetary policy. Given such harsh words, market movements were limited.

We saw mixed sentiment on Wall Street. Investors were not very optimistic about Amazon's quarterly report, which showed a smaller increase in sales than in the previous quarter, which suggests declining consumer interest. Robinhood shares have come under pressure today as well, which shows that investors are unsure about the company's future.

Coffee has lost more than 8% since yesterday's close, falling below 180 cents a pound. The first reports of subsequent frosts indicate their limited impact on coffee crops. Lower temperatures are also expected to persist during the weekend, but only in some areas of Minas Gerais, which is mainly responsible for the production of Arabica.

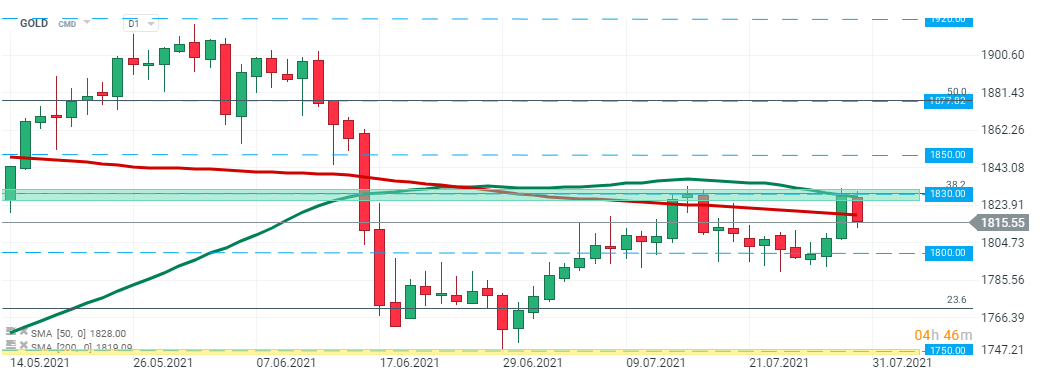

Gold prices rose sharply during yesterday's session however buyers failed to break above major resistance at $1830 and price pulled back. This level is marked with 50 SMA (green line) and 38.2 Fibonacci retracement of the downward wave from August 2020. If current sentiment prevails then support at $1800 may be at risk. Source: xStation5

Gold prices rose sharply during yesterday's session however buyers failed to break above major resistance at $1830 and price pulled back. This level is marked with 50 SMA (green line) and 38.2 Fibonacci retracement of the downward wave from August 2020. If current sentiment prevails then support at $1800 may be at risk. Source: xStation5

Daily summary: Wall Street tries to stop the sell-off 📌Gold down 1.8%, Bitcoin loses 4.5%

Wheat drops amid higher than expected WASDE report

US Earnings Season Summary 🗽What the Latest FactSet Data Shows

3 markets to watch next week (14.11.2025)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.