Today is the second day of this week's central bank marathon. Traders will hear from the ECB today at 1:15 pm BST, when the Bank announces its next monetary policy decision, followed by a press conference of ECB President Lagarde at 1:45 pm BST. Decision is expected to be the same as in case of FOMC yesterday - a 25 basis point rate hike. This would bring deposit rate to 3.75%. However, the question is what comes next? Will ECB signal no change in its path and hint at another rate hike in September? Or will it follow into Fed's footsteps and stress that decision will depend on incoming data? If decisions are to be data-dependent, it may be hard for ECB to justify another hike.

Markets fully price in 25 bp rate hike today

Markets have fully priced in today's 25 bp rate hike and are currently seeing an around-50% chance of another move in September. Deposit rate is currently seen peaking below 4%, which means that today's rate hike could be the final one. Such expectations are driven by the fact that recent economic data from Europe has deteriorated and credit conditions in the Eurozone have tightened.

Market is almost certain of a 25 bp ECB rate hike today and sees around 50% chance of another move in September. Source: Bloomberg

Weak economic activity

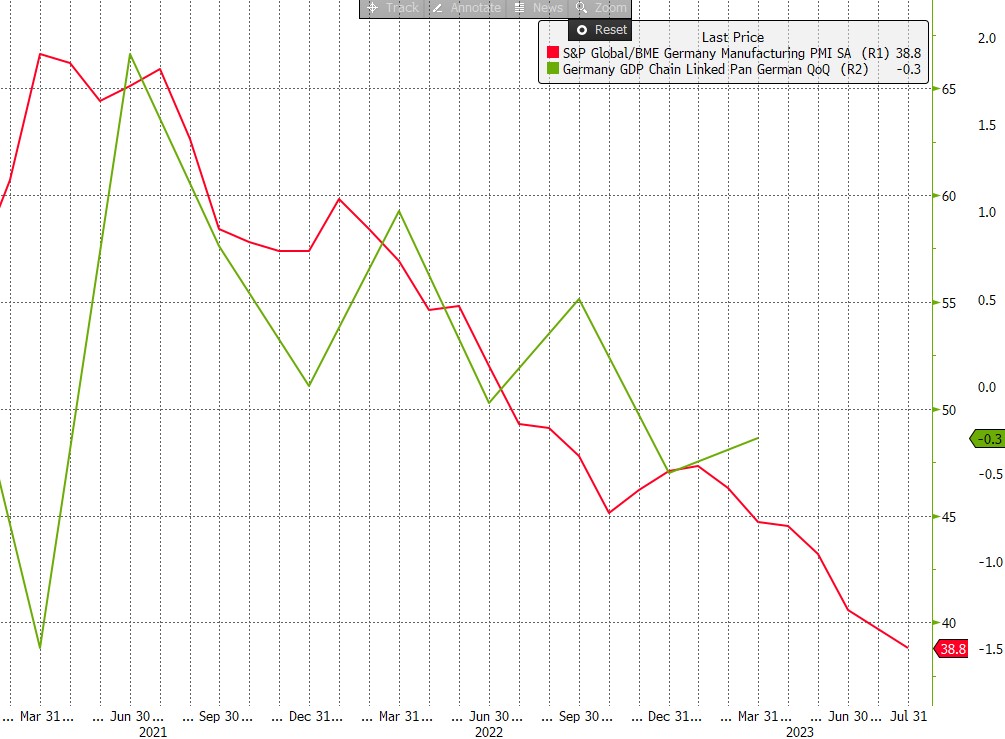

Taking a look at recent data from Europe, we can see that the situation on the Old Continent is not as good as in the United States. Q1 GDP data as well sentiment within the German industry suggest that recession may be just around the corner. While majority of PMIs from the Old Continent remain below 50 points expansion-contraction threshold, indices from Germany suggest that situation in the country is worse than in other parts of the continent. The next GDP report from Germany would likely show Europe's biggest economy entering a technical recession.

PMIs from Germany hint at further drop in economic activity. Source: Bloomberg

PMIs from Germany hint at further drop in economic activity. Source: Bloomberg

Tightening of credit conditions

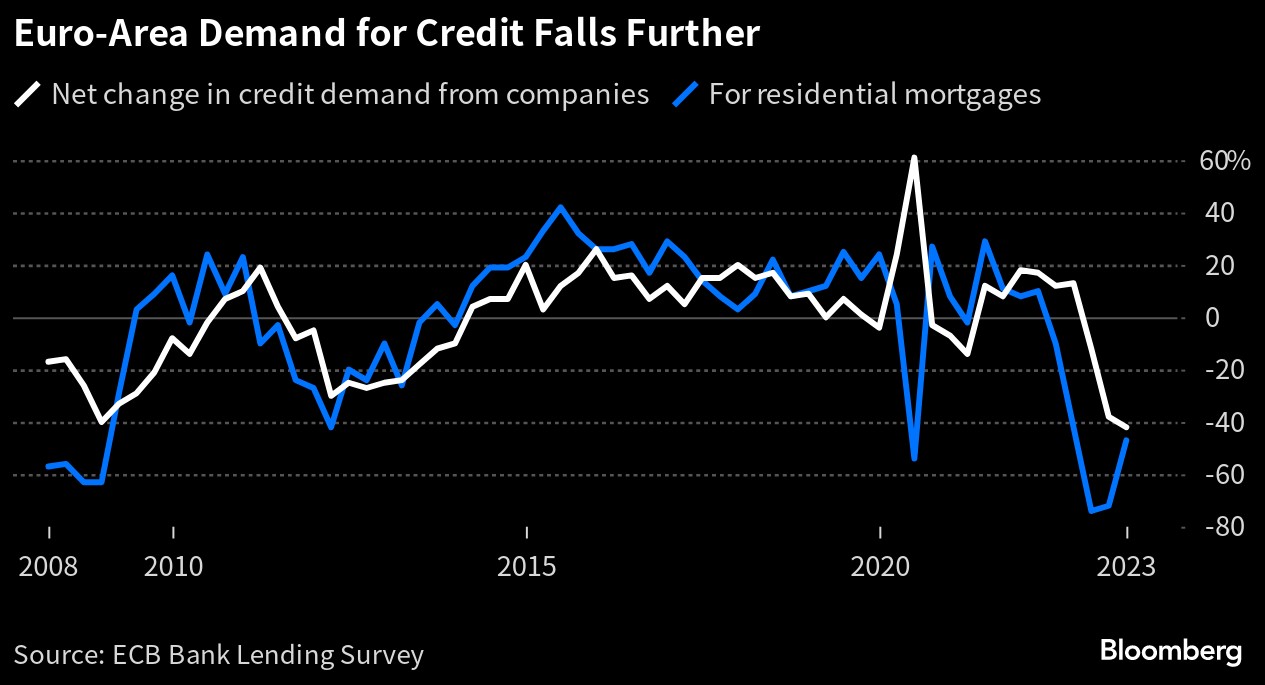

The latest report from the European Central Bank on the state of the credit market in the Eurozone shows a significant decline in demand for commercial loans. As seen in the chart below, the situation is slightly better for consumer loans, but there is still a substantial year-on-year decline. The rate hikes in the Eurozone have quickly impacted credit conditions, although it should be remembered that there was also an impact related to Credit Suisse, which was taken over by UBS in the face of potential collapse.

Tighter credit conditions in Europe led to a drop in credit demand. Does the ECB need to tighten them further? Source: Bloomberg

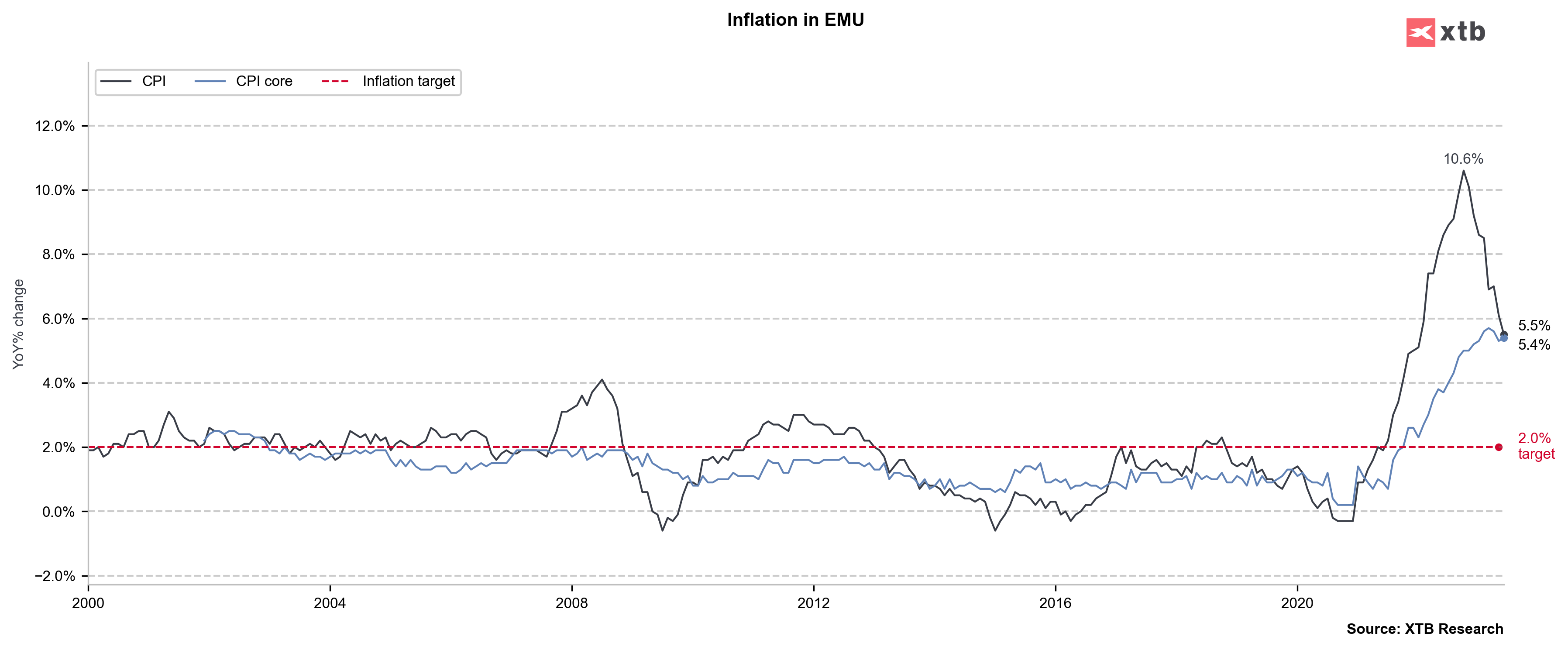

Inflation remains extremely high

Inflation in the euro area dropped to 5.5% in June but core inflation proved to be more sticky with a 5.4% YoY reading. Flash inflation data for July is expected to show a small drop but as it will not be released until Monday, it won't have an impact on today's decision. Given that inflation remains at such high levels, it looks reasonable to continue with rate highs but economy and credit markets are 'screaming' that rates are restrictive enough already.

CPI inflation in euro area remains elevated. It should be noted that positive base effects, that accounted for around a half of recent drop in inflation, will soon run out. Lack of clear impact of higher rates on inflation can be clearly seen given that core inflation remains close to recent multi-year highs. Source: Bloomberg, XTB

What will ECB do?

It is likely that the European Central Bank will follow a similar approach as the Federal Reserve . The ECB won't explicitly state that a rate hike in September is guaranteed. Even the most hawkish members of the ECB from countries like the Netherlands or Germany have indicated that September's decision will depend on data. Moreover, economic activity data suggests that the ECB should already hold off on further rate hikes, and it doesn't appear that real interest rates will enter positive territory before the September decision. Nonetheless, the market hopes that today's move will be the last one in the current hiking cycle.

DE30 trades just 1.5% below all-time highs!

DE30 is breaking above 16,300 points today, thus negating the previously identified head and shoulders pattern. It is also evident that the rebound in EURUSD is supporting further gains in the DE30, which is now less than 1.5% away from historical highs. Despite the challenges faced by the German industry, the stock market believes in a brighter future, which would require a slightly less hawkish monetary policy. However, if during her speech, Christine Lagarde, clearly indicates that another rate hike should take place in September, it cannot be ruled out that the DE30 might retest the area around the 50-period moving average, where it has recently bounced off. On the other hand, if there is a definitive declaration of an end to rate hikes, a move towards 16,500 points cannot be ruled out. Source: xStation5

NFP preview

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.