Summary:

- European stock markets start Wednesday’s trading flat

- British FTSE 100 (UK100) leads the gains in Europe due to GBP weakness

- Daimler should have higher profit margins thanks to cost cuts and increased efficiency, departing CEO Zetsche says

The start of trading on Wednesday across European equity markets has not brought any moves of note. Major indices are not trading far away from their close levels seen yesterday except the British UK100 being 0.5% up on the back of the GBP weakness. Let us recall that the GBP saw a short-lived pop on Tuesday in anticipation of a May’s speech. However, it gave back its gains thereafter as it turned out that no breakthrough was offered by British PM. Taking into account that she will again be unable to convince a sufficient number of MPs to back her renewed Brexit deal, there is a higher likelihood of her resignation in the weeks to come. If this is the case, the key will be who will replace here. Boris Johnson is among candidates and given his approach to the Brexit process (he openly backs Brexit at any cost) one may suppose that the British currency may suffer, hence the UK100 could be offered a short-lived boost. In the longer-run, a possible disorderly Brexit would see UK economic growth losing momentum, therefore it could be negative for both the economy and financial markets.

Start investing today or test a free demo

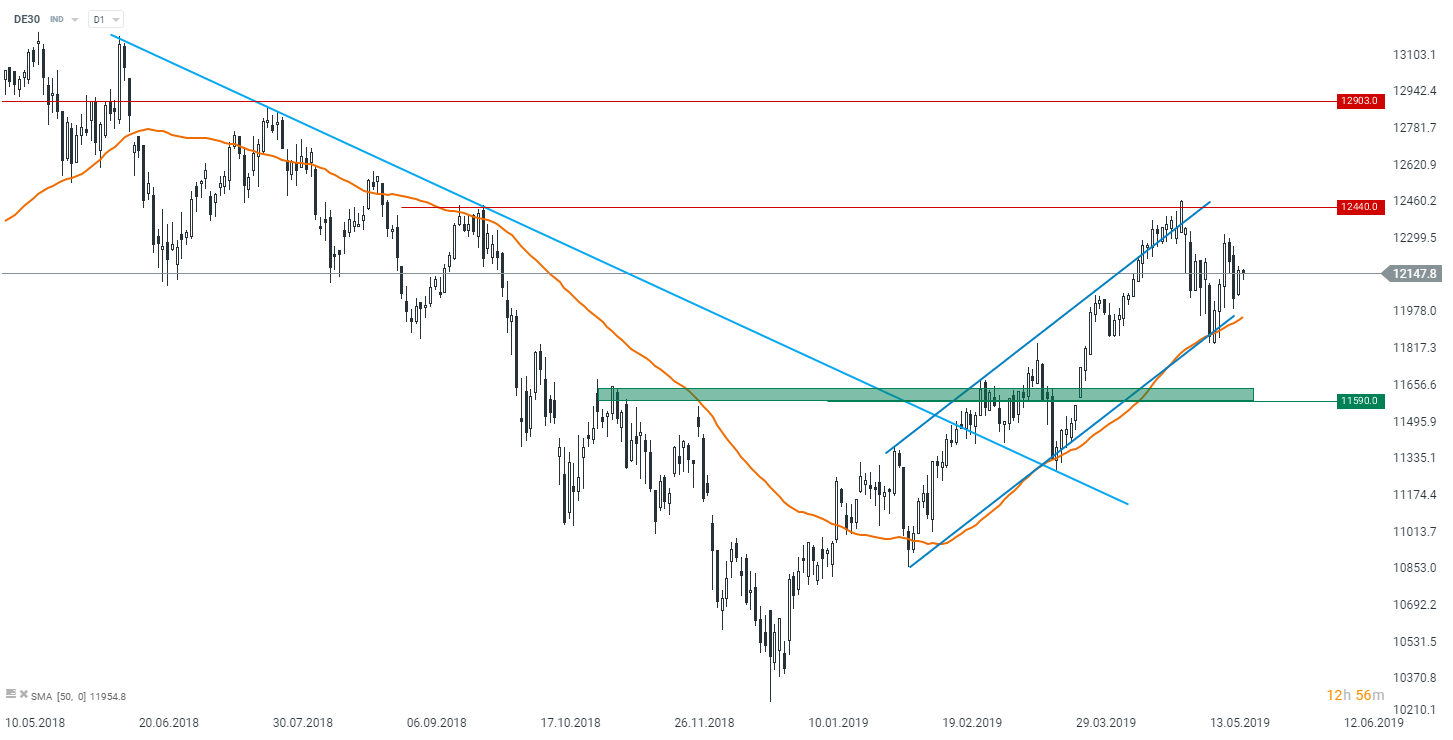

Create account Try a demo Download mobile app Download mobile app A technical view of the German index has not changed too much. The price keeps trading within the bullish channel with the strong support in the form of the lower boundary of this pattern supported by the 50DMA. Keep in mind that a breakdown of this structure could mean more troubles for bulls as it would mean a decline at least toward 11 590 points. Source: xStation5

A technical view of the German index has not changed too much. The price keeps trading within the bullish channel with the strong support in the form of the lower boundary of this pattern supported by the 50DMA. Keep in mind that a breakdown of this structure could mean more troubles for bulls as it would mean a decline at least toward 11 590 points. Source: xStation5

Looking for interesting reports from companies being listed in the German DE30 one may focus on Daimler (DAI.DE). Namely, the company’s departing CEO Dieter Zetsche promised that cost cuts in conjunction with increased efficiency would restore higher profit margins. He said explicitly that “we cannot and will not be satisfied with the current level of profitability”. Zetsche added that Mercedes-Benz would return to a 8-10% margin corridor by 2021. Wednesday is the last day for Zetsche in his 13-year term in office.

The German index is trading barely changed after moderate losses seen in China. Source: Bloomberg

The German index is trading barely changed after moderate losses seen in China. Source: Bloomberg

In turn, the BMW CEO (Harald Krueger) may also soon be dismissed, according to people familiar with the discussions. Namely, the CEO’s second-term outlook is to be discussed in the coming weeks with some supervisory board members questioning whether Krueger is the right choice to lead the company, as Bloomberg reports. His current term in office ends this month, hence an announcement on his future should be known in June/July.

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.