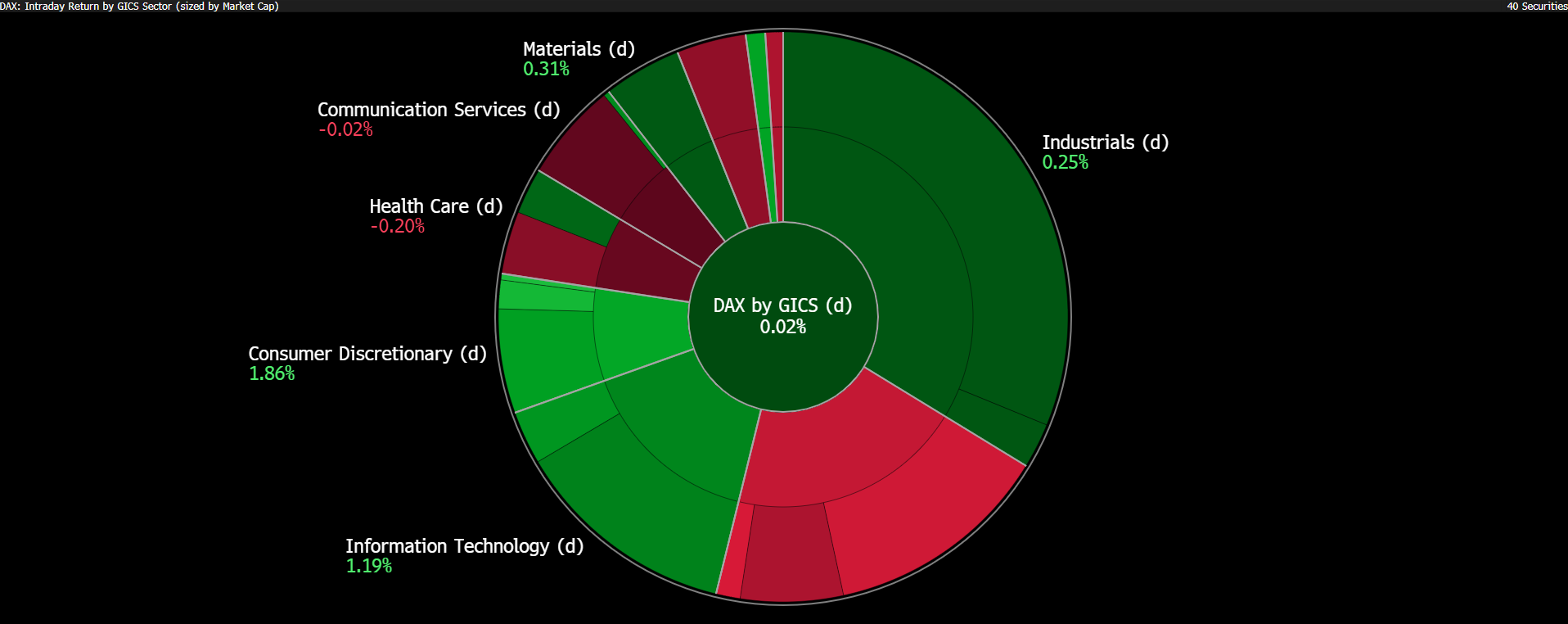

Germany’s DAX is having a softer but very calm session today. The financial sector is under relative pressure, while autos are firm, alongside Rheinmetall (RHM.DE), which is rising after Russia’s overnight strike on Ukraine’s energy infrastructure. Elsewhere in Europe, the CAC 40 and the FTSE 100 are up close to 0.7%, while Poland’s WIG20 is also gaining around 0.7%. Notably, the index barely reacted to reports that Moscow used an Oreshnik intermediate-range ballistic missile (IRBM) just dozens of kilometers from the Polish border. The missile is said to have targeted an underground gas storage site, potentially causing heating and electricity disruptions in western Ukraine.

- The latest wave of Russian strikes suggests Moscow still intends to pursue a battlefield outcome, despite mounting personnel losses. Yesterday, the Kremlin rejected the terms of an agreement negotiated by the so-called “Coalition of the Willing” with Ukraine’s President Zelensky. As a result, Europe’s defense sector has found fresh fuel for gains today.

- In Europe, investor attention is now centered on the U.S. Non-Farm Payrolls report due at 12:30 PM GMT as well as a U.S. court decision on trade tariffs. The Supreme Court ruling could arrive around 16:00. Market consensus suggests that even if the court does not invalidate the revenues collected from existing tariffs, it may tighten the legal framework and make it more difficult for future U.S. administrations to use trade policy in the same way.

DE40 (H1 interval)

Source: xStation5

Source: Bloomberg Finance L.P

Source: Bloomberg Finance L.P

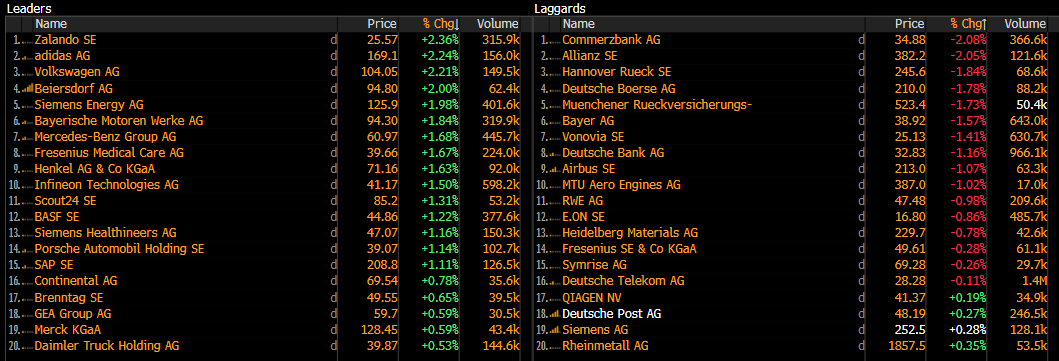

Hannover Re downgraded by Morgan Stanley

Morgan Stanley downgraded Hannover Re to Equal Weight and set a target price of €270, implying roughly 10% upside from current levels. Despite the target suggesting upside, the stock is sharply lower today, and sentiment across Germany’s financial sector remains broadly cautious.

Source: xStation5

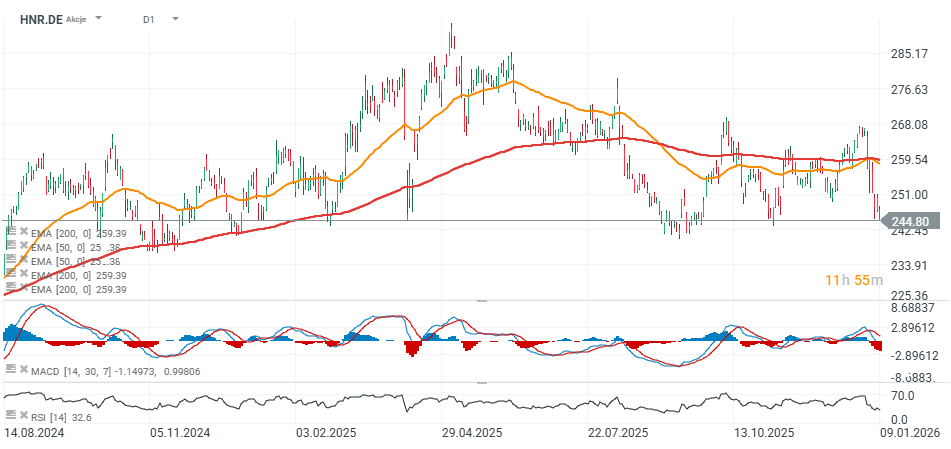

Rheinmetall: momentum returns, but a potential bearish pattern forms

Rheinmetall has started a fresh leg higher, but the chart is also beginning to outline a potentially bearish head-and-shoulders formation, which could become relevant if the current move loses momentum.

Source: xStation5

Porsche rises despite a Barclays downgrade

Porsche AG shares are advancing even after Barclays downgraded the stock to Underweight from Equalweight and cut its target price to €40 from €42.50. Barclays argues that valuation is the key issue. Porsche is currently trading at a P/E above 20x on 2026 forecasts, while BMW and Mercedes-Benz, which also aim for around 10% margins over the medium term, trade at meaningfully lower valuations.

- The bank also highlights volume risk. In its view, the model refresh cycle will only start to meaningfully support sales in 2–4 years, creating a “product gap” at a sensitive point in the cycle. Barclays points out that key new ICE/PHEV SUV launches are not expected until 2027/28 (mid-range segment), while another premium ICE SUV may not arrive until 2028/29. That is a long time in a cooling demand environment.

- Barclays believes the market’s 2027 volume expectations may be too optimistic, especially given the planned phase-out of the ICE Macan in 2027 (similar to the 718 series ending in 2026).

- The bank also questions whether Porsche can realistically reach its new medium-term margin target of 10–15%, suggesting that achieving this level before 2028 may be unlikely. Barclays lists multiple headwinds that could weigh on margins and earnings, including lower sales volumes, persistent U.S. tariffs, the need to further compensate suppliers for cost pressures, weak demand in China, pressure from luxury-related taxation, and softer appetite for BEVs.

In short, Barclays’ message is that Porsche is still priced like a business with stable, high growth and a clear margin path, while the bank sees too many obstacles for that scenario to play out smoothly over the next few years. Despite the downgrade, the stock is rising strongly and approaching a test of the 200-period EMA (EMA200), suggesting growing pressure for a potential trend shift.

Source: xStation5

TeamViewer shares rise despite softer full-year revenue preview

TeamViewer released preliminary full-year revenue figures that came in slightly below the analyst consensus. Despite that, the stock is gaining and is among the stronger performers in the German market today.

-

Preliminary FY2025 revenue: €767 million vs €776.8 million expected

-

Preliminary FY2025 ARR: around €760 million, implying roughly +2% YoY growth on a constant-currency basis (pro forma)

-

FX moves, particularly EUR/USD, weighed on reported ARR

-

Adjusted EBITDA margin guidance (pro forma) for FY2025 remains unchanged at around 44%

Source: xStation5

Daily summary: Moderate risk, moderate declines

Blue Owl Capital: Local issue or a “Lehman moment”?

US OPEN: Moderate declines amid risks and data

Michael Burry and Palantir: A well-known analyst levels serious accusations

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.