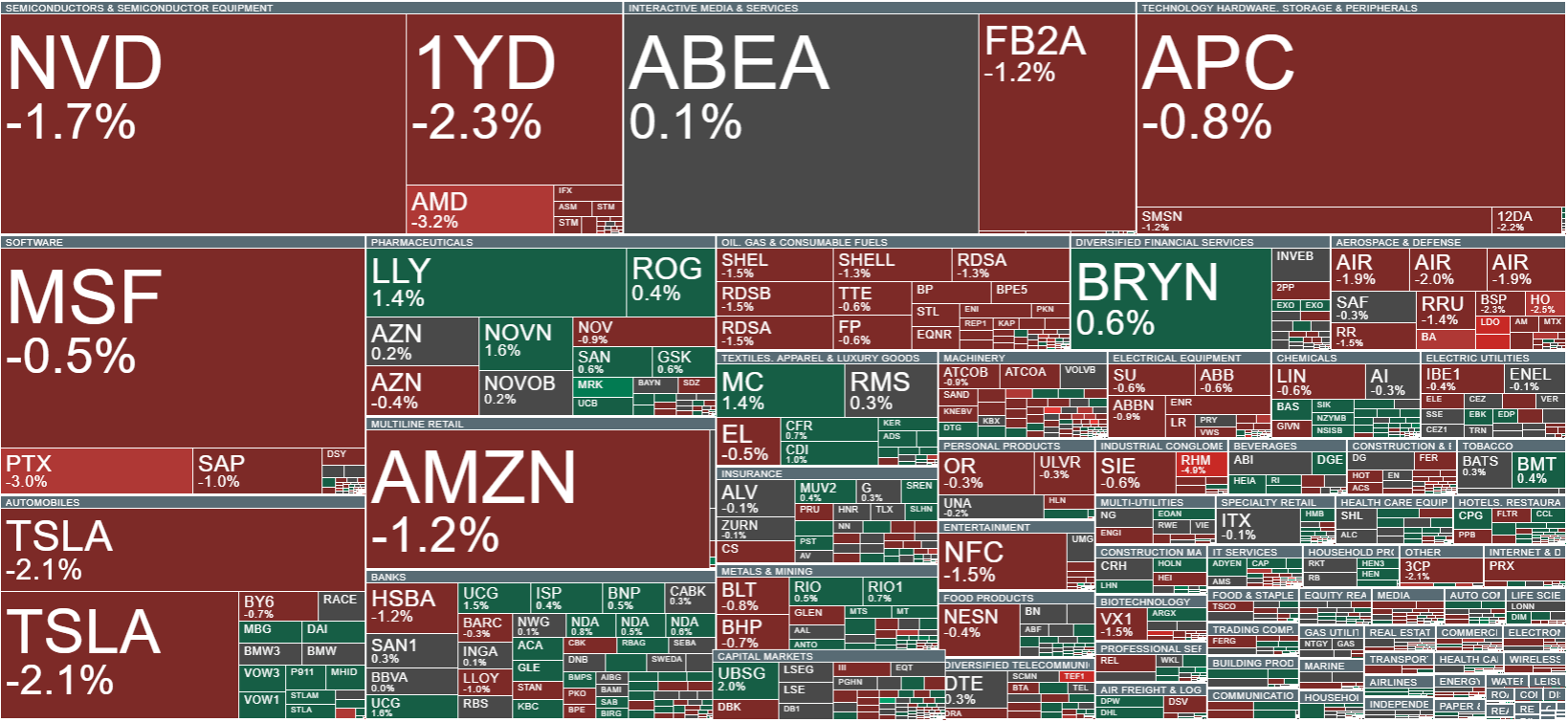

At the start of the week, markets have many reasons to remain cautious. Ahead of us are important economic data releases from the United States, meetings of major central banks in the eurozone, the UK, and Japan, as well as technical events in financial markets related to expiring contracts. As a result, most European indices are losing value. As of 11:25 AM, the German DAX is down about 0.4%, the UK’s FTSE is down 0.3%, and the Spanish IBEX 35 has fallen 0.2%. At this moment, the French CAC40 is slightly in the green.

Today, attention is also drawn to data from Germany. The ZEW Index for December came in at 45.8, significantly above the forecast of 38.5 and the previous November reading. This indicates that investors are much more optimistic about the future of the German economy. The ZEW Index is important because it reflects the sentiment of institutional investors and can signal the likely direction of the stock market and the euro.

Despite positive readings from Germany, the main driver of today’s declines is global factors. Investors are primarily awaiting US data on inflation and the labor market, which could influence expectations for interest rate cuts in 2026. A strong US labor market could push up bond yields and put pressure on stock valuations, including German DAX companies.

Another significant topic is the peace talks regarding Ukraine. According to Donald Trump, an agreement is closer than ever, and the United States could offer Ukraine NATO-style security guarantees. This news triggered profit-taking in the European defense sector.

Currently, volatility is being observed across the broader European market.

Source: xStation

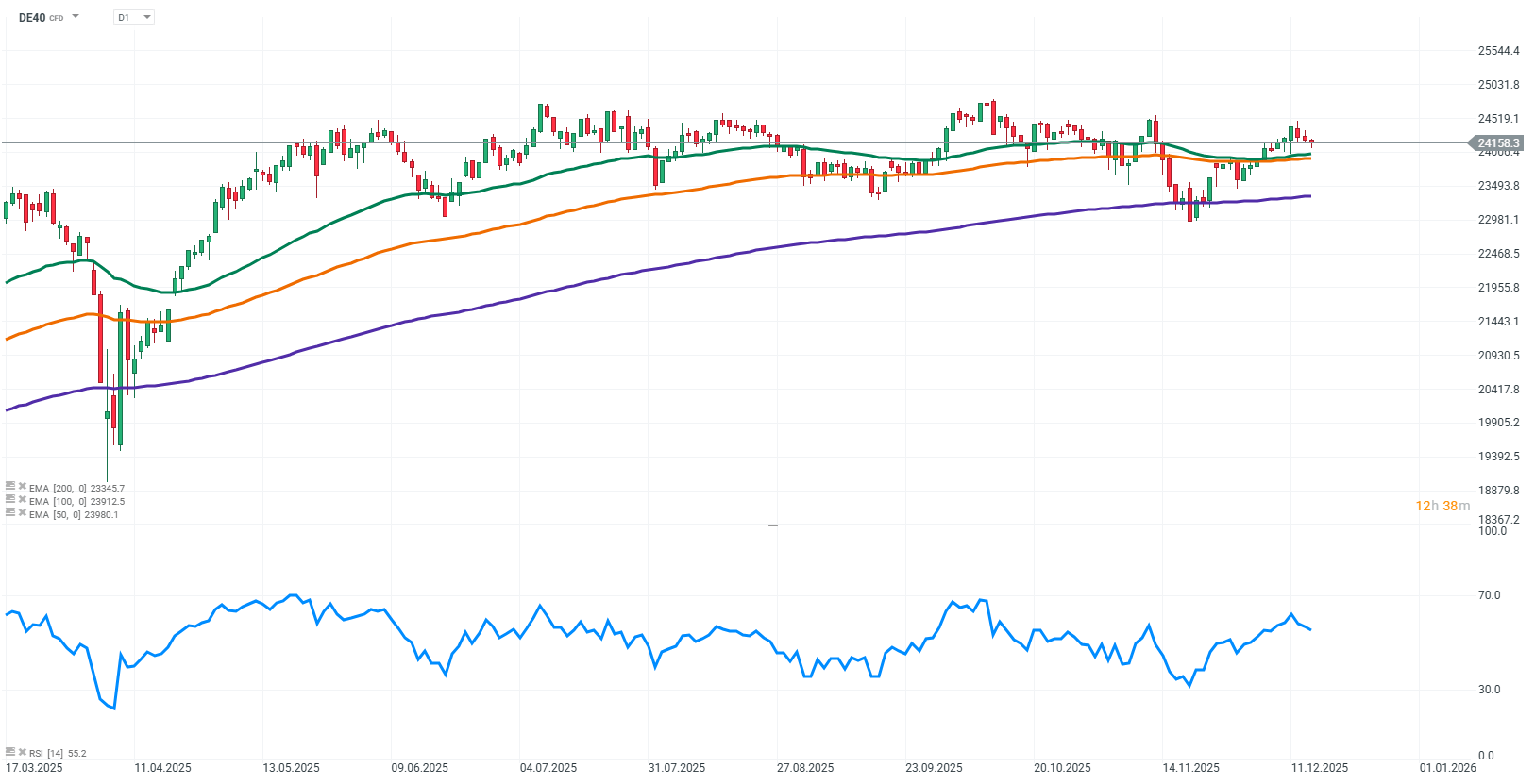

Today, DE40 index futures are under clear selling pressure. The correction is influenced, among other things, by rumors of a possible end to hostilities in Ukraine, which is causing investor caution. Additionally, the market is awaiting key macroeconomic data from the United States and central bank decisions, creating uncertainty and limiting larger price moves. Despite the short-term pressure, broadly speaking, the index remains in a consolidation phase, oscillating around the 50-, 100-, and 200-day moving averages, indicating a relative balance between supply and demand. In the coming sessions, investors will closely monitor macroeconomic signals that may determine the direction of the next price movements.

Source: xStation

Company news:

European defense stocks are under significant downward pressure today. The biggest losses are seen in Rheinmetall (RHM.DE), RENK (R3NK.DE), and Hensoldt (HAG.DE), with declines also affecting companies such as Dassault Aviation (AM.FR), Thales (HO.FR), Kongsberg (KOA.NO), Leonardo (LDO.IT), and Saab (SAABB.SE). The sector’s weakness is a result of reports on progress in peace talks regarding the Ukraine conflict. US President Donald Trump stated that an agreement is closer than ever before, and Washington is considering providing Ukraine with substantial security guarantees, similar to NATO mechanisms. For markets, these signals suggest the possibility of reduced demand for military equipment in Europe, which has grown in recent years due to the ongoing war.

BASF (BAS.DE) shares are rising today following positive news regarding its key Ludwigshafen site and the company’s development strategy. BASF signed a new works agreement guaranteeing no forced layoffs until the end of 2028, provided profitability targets are met. At the same time, the company plans to invest €1.5–2 billion annually in infrastructure modernization, capacity expansion, and the transformation toward more sustainable chemistry. Additionally, BASF has entered a distribution agreement with OQEMA, which, starting January 2026, will be responsible for selling the company’s products in Central and Eastern Europe.

DE40 dips 3% and falls to 2026 lows 🚨📉

Middle East conflict ramps up a gear as energy price spike rips through markets

Chart of the day 🚨OIL surges 5% putting pressure on Wall Street

🚨 EURUSD deepens decline, falls to key support zone

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.