Dick's Sporting Goods reported results above expectations for 1Q24. In particular, investors welcomed the raising of full-year forecasts. The company highlighted strong demand for its goods, which in a still heavily inflationary environment is a positive surprise.

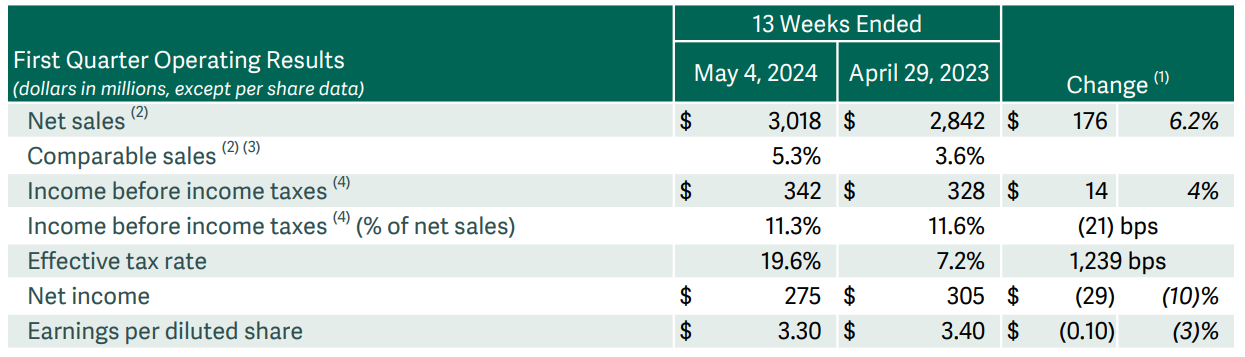

At the revenue level, the company achieved $3.02bn (+6.2% y-o-y). Comparable sales grew by 5.3% y/y (versus the 2.4% expected by consensus).

At the operating income level, the company reported $342m (+4% y/y), which resulted in obtaining the operating margin over 11% for the first since 1Q23.

At the net profit level, the company reported a 10% y-o-y decline to $275m, translating into earnings per share of $3.3. Despite the y/y decline, the company strongly beat market expectations of $2.96.

Results for 1Q24. Source: Dick's Sporting Goods

Results for 1Q24. Source: Dick's Sporting Goods

Although the company's results ultimately came in better than expected, the real fuel for the upside in pre-market trading was the full year outlook. The company raised its 2024 revenue projections to between $13.1bn and $13.2bn. Dick's Sporting Goods' expected EPS is $13.35-13.75 (previous: $12.85-13.25). Furthermore, the company expects comparable sales demand to increase by 2-3%, a 100 bps increase in projections over the previous forecast.

The company has increased its forecasts in anticipation of continued high demand for its products, particularly in the sneakers segment. At the same time, according to management statements, it plans to continually increase its market position, which can be seen in its expanding shop network. Dick's Sporting Goods opened two new shops in 1Q24 and plans to open six more in 2024. On top of this, the company has opened three Golf Galaxy Performance Centers and plans to increase this number by a further seven.

Dick's Sporting Goods' stock was up almost 8% in pre-opening trade in response to the results and elevated forecasts.

Dick's Sporting Goods is up more than 7% in pre-opening market trading. This brought it back to similar levels as after the previous report. In the previous quarter, after a positive surprise, the stock continued to rise by around 7% before it recorded a decline. Source: xStation

Dick's Sporting Goods is up more than 7% in pre-opening market trading. This brought it back to similar levels as after the previous report. In the previous quarter, after a positive surprise, the stock continued to rise by around 7% before it recorded a decline. Source: xStation

Boeing gains amid news about potential huge 737 MAX order from China 📈

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%

Brent tops $90 per barrel

RyanAir shares under pressure amid Middle East conflict 📉

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.