harma giant Eli Lilly (LLY.US), best known for its diabetes drug Mounjaro, delivered excellent results for Q4 2025. The stock is up more than 7% pre-market ahead of the Wall Street open and is likely to move back toward record highs today.

- Adjusted EPS: $7.54 vs. $6.73 expected

- Revenue: $19.29bn vs. $18.01bn expected (+43% y/y)

- Mounjaro revenue: $7.41bn vs. $6.75bn expected

- Zepbound revenue: $4.26bn vs. $3.8bn expected

What did the results show? Lilly is “pulling away” from Novo

The company not only beat Wall Street expectations on both revenue and profit, but also issued 2026 guidance that reads like a signal: “demand is still right around the corner — and we’re still riding the wave.” Lilly is positioning itself at the center of one of the biggest shifts in pharma in decades: the boom in GLP-1 drugs for obesity and diabetes.

- This market is starting to look like a new consumer category, not just another line item in a revenue table. In the U.S., revenue increased to $12.9bn, which the company attributed to a 50% increase in volume, largely driven by Mounjaro and Zepbound.

- Two products are carrying that narrative: Mounjaro (diabetes) and Zepbound (obesity). Global Mounjaro revenue rose 110% y/y, and in the U.S. it increased 57% y/y (to $4.1bn). Meanwhile, U.S. Zepbound sales totaled $4.2bn, with total sales up 122% y/y.

The company’s assumptions are clear:

-

2026 revenue: $80–83bn (the market expected ~ $77.6bn)

-

2026 adjusted EPS: $33.50–35.00 (the market ~ $33.2)

In the background is an issue investors aren’t ignoring: U.S. drug pricing is increasingly becoming a “political problem.” And when something becomes a political problem, sooner or later someone tries to regulate it, cut it, or at least limit it. Lilly’s message, however, is straightforward: even if pricing pressure rises, demand and market scale may act as a shock absorber.

- A few days earlier, Lilly CEO Dave Ricks pointed to something the market may not be fully pricing in yet: the potential expansion of Medicare coverage for obesity treatment. If this materializes, the pool of patients who can legally and financially access therapy would expand meaningfully.

- In practice, that means the market could become less constrained by patients’ wallets and more by healthcare system capacity. For Lilly, that could raise the U.S. sales ceiling.

- The contrast with Novo Nordisk is notable: around the same time, Novo delivered more cautious guidance and warned of declining sales and profits in 2026.

- The reasons cited were U.S. pricing pressure and the expiration of exclusivity in selected regions. At this stage of the cycle, Lilly looks like the company with the stronger near-term trajectory and better control over revenue dynamics.

There’s also the broader political thread around agreements with Donald Trump’s administration. According to reports, Lilly and Novo agreed to lower drug prices for Medicare and Medicaid beneficiaries in 2026, and to sell directly to consumers at a discount via a direct-to-consumer platform (TrumpRx, not yet launched). In return, both companies are expected to receive a three-year tariff exemption. Meanwhile, Novo is signaling a strong launch of an oral version of Wegovy in the U.S. Lilly, on the other hand, is counting on approval of its own oral weight-loss drug (orforglipron) later this year.

Key questions for investors now

-

How fast do U.S. prices fall — and can volume offset the impact?

-

Will Medicare meaningfully expand access to obesity therapy?

-

How will the market respond to the rollout of oral GLP-1 versions?

-

Can Lilly maintain dominance despite regulatory pressure?

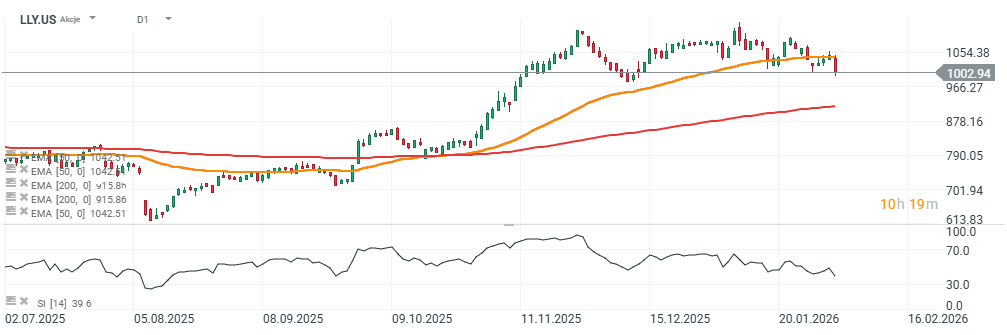

Eli Lilly stock (D1 interval)

Shares pulled back yesterday below the EMA50 (orange line), but if the rebound continues after the U.S. market opens, the price will likely climb back above $1,050 per share.

Source: xStation5

Daily summary: The beginning of the end of disinflation?

Block Inc. lays off 40% of its workforce and rises 16% - Is this a new paradigm?

US Open: Rising oil and PPI pressure Wall Street 📉 Technology and financial stocks drop

UK Spring Statement Preview

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.