The ECB returns from its summer recess to a rate decision meeting. Given the euro area’s solid economic situation and inflation stabilizing near its target, the likelihood of further rate cuts appears low. The ECB's communication is expected to be similar to its July press conference, although several issues could lead to either euro strength or weakness.

ECB Nears Inflation Target

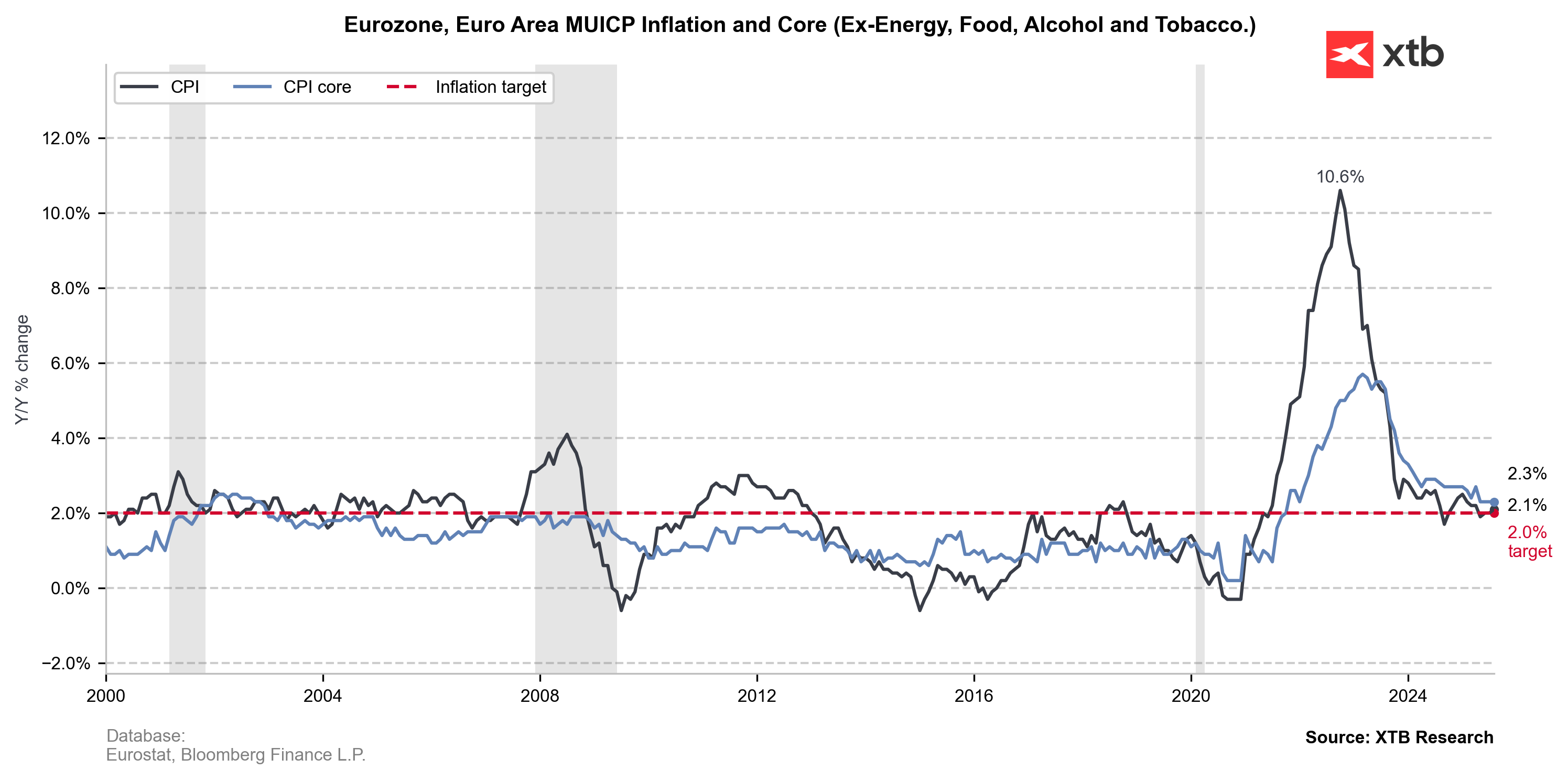

Eurozone inflation has stopped falling, a trend observed across key member states. This prolonged stabilization puts the ECB in a comfortable position, alleviating the need for further rate cuts. The deposit rate of 2.0% provides an additional cushion, allowing for a potential cut if significant economic problems arise.

Many commentators suggest the ECB may reconsider rate cuts later this year if a trade agreement with the United States leads to further disinflation and a strong euro exacerbates these processes. However, it's too early to consider this scenario, although a mention of such speculation by Lagarde at the press conference could weaken the currency.

Eurozone inflation has gently rebounded from 2%, but ECB projections indicate the target will be met in the medium term. Source: XTB Research, Bloomberg Finance LP

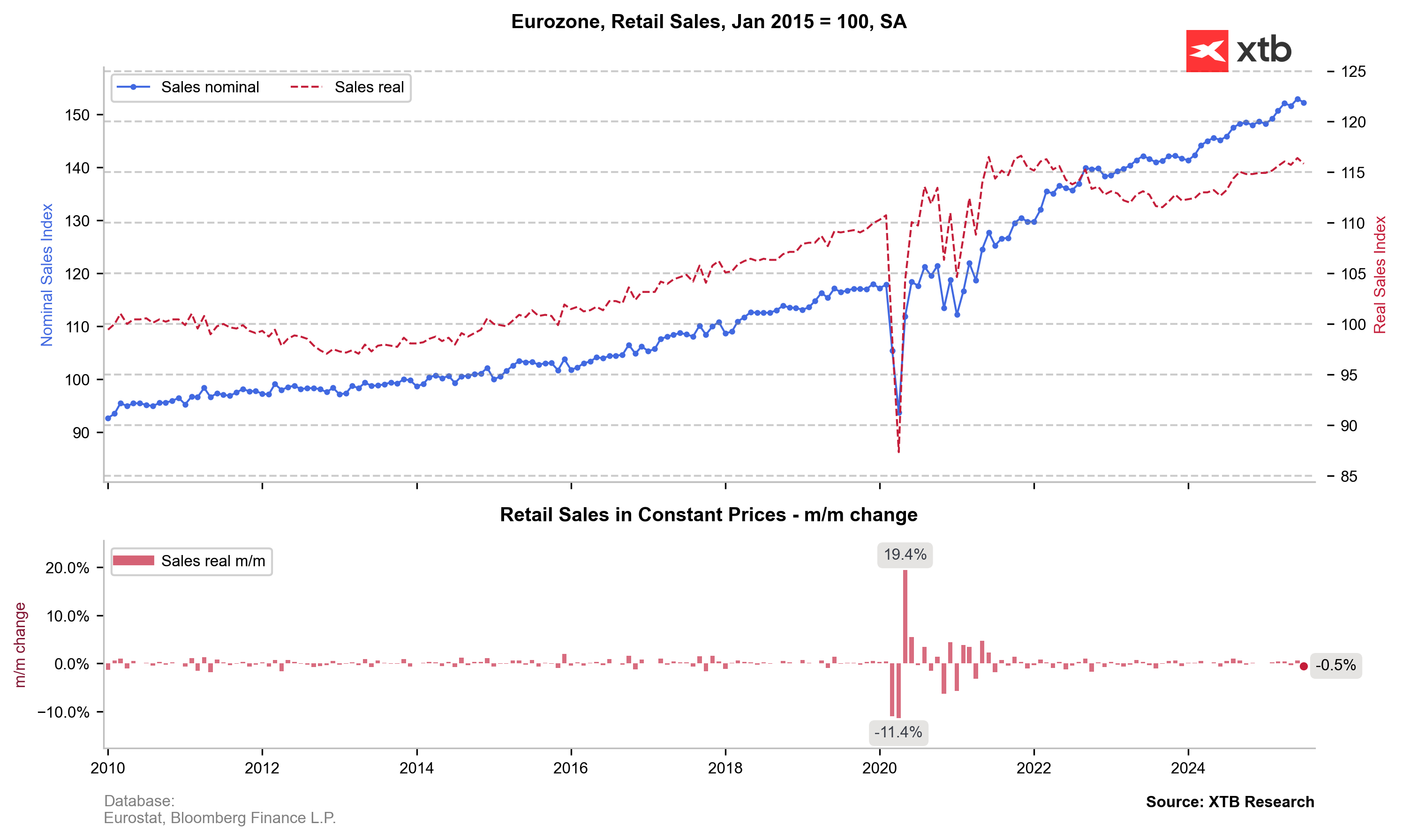

On the other hand, we have recently seen a slight weakness in retail sales, although in real terms, we have returned to the high levels of 2021. Source: XTB Research, Bloomberg Finance LP

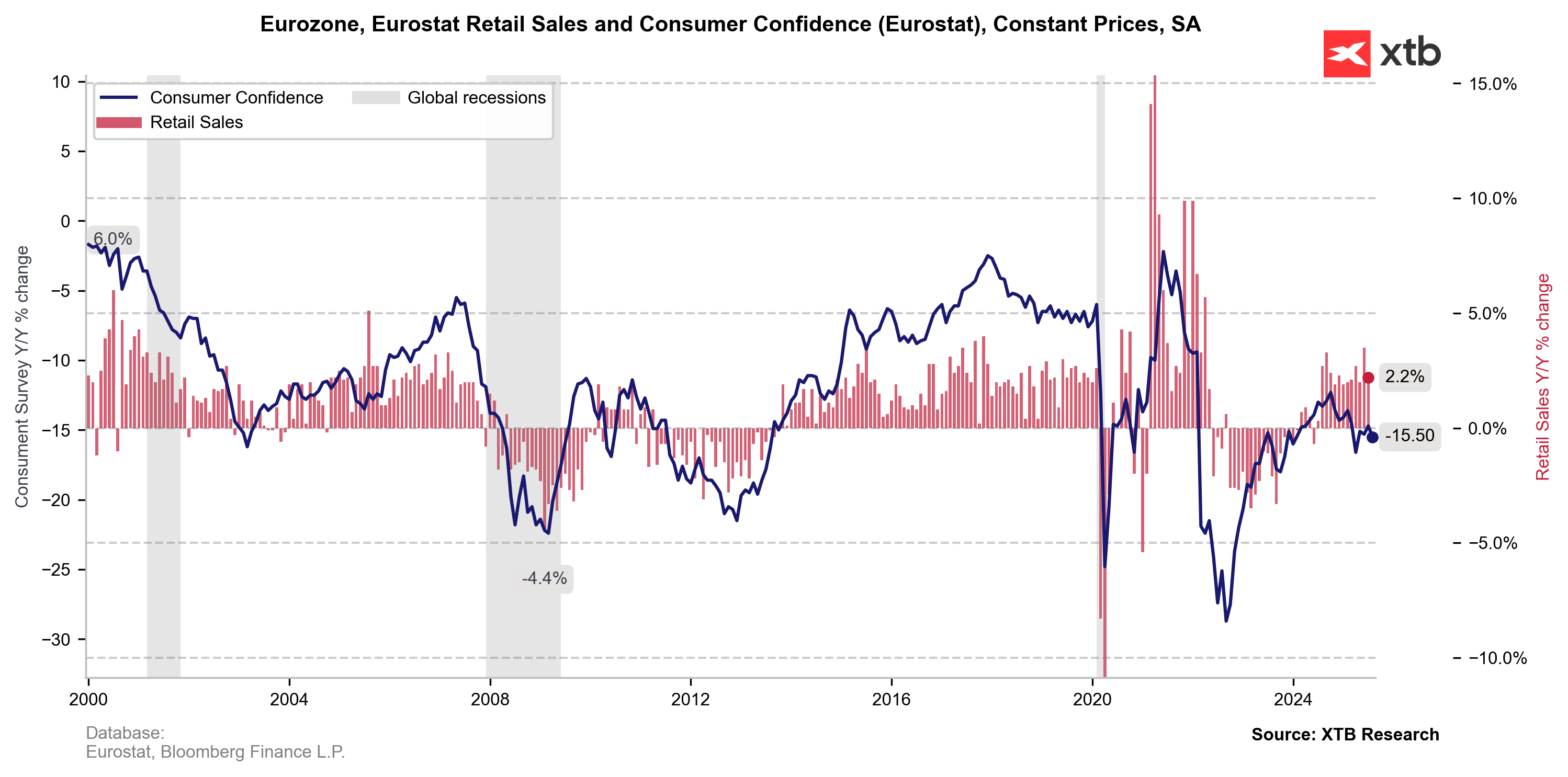

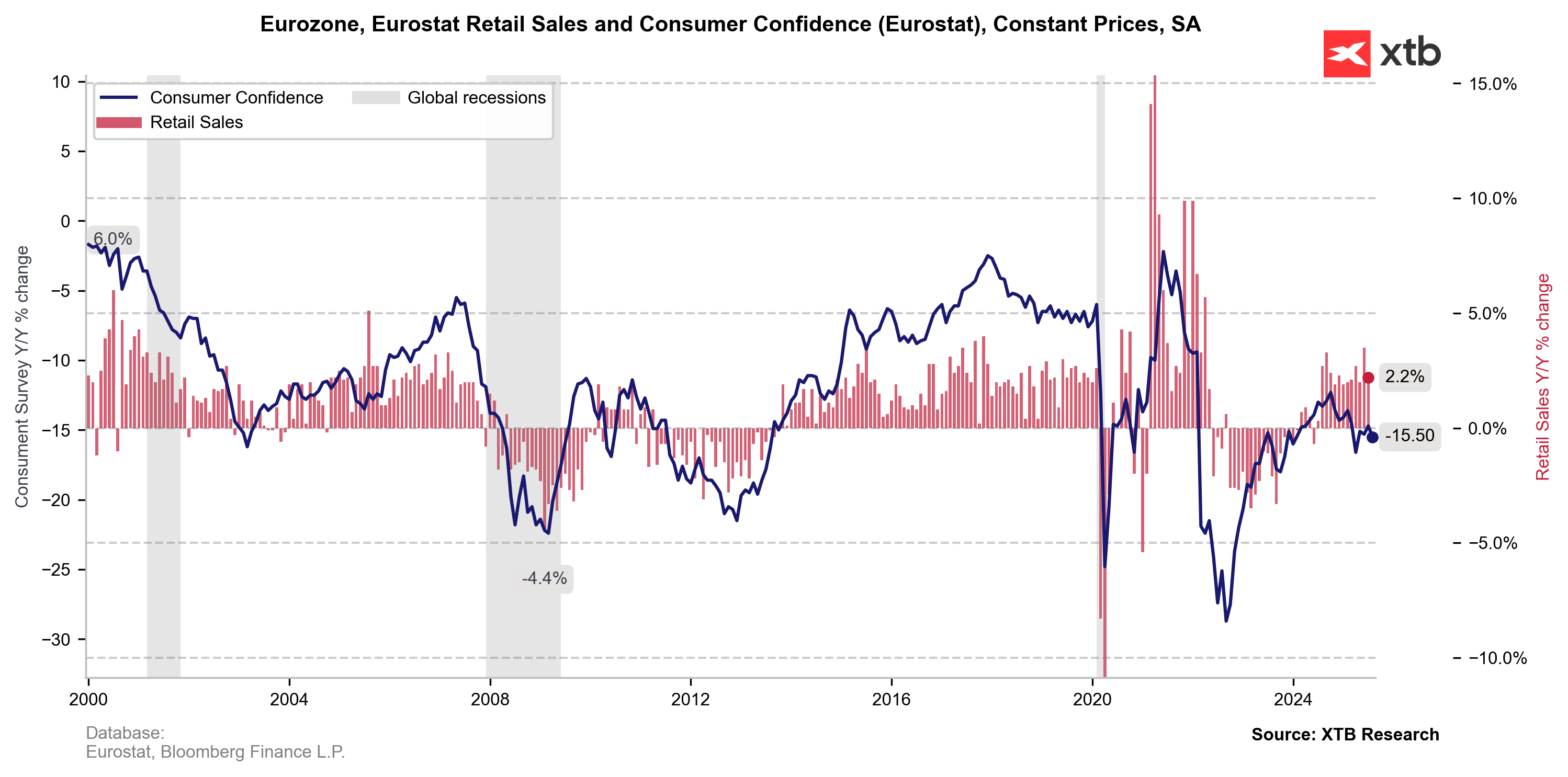

Consumer sentiment has attempted to rebound in recent months but is now trending downwards again. We have not seen a return to the 2016-2020 levels of consumer satisfaction in the eurozone. Retail sales are recovering year-on-year at a similar pace to that period, but it's important to note the low base from last year. Source: XTB Research, Bloomberg Finance LP

Economic Outlook Offers No Case for Pre-emptive Cuts

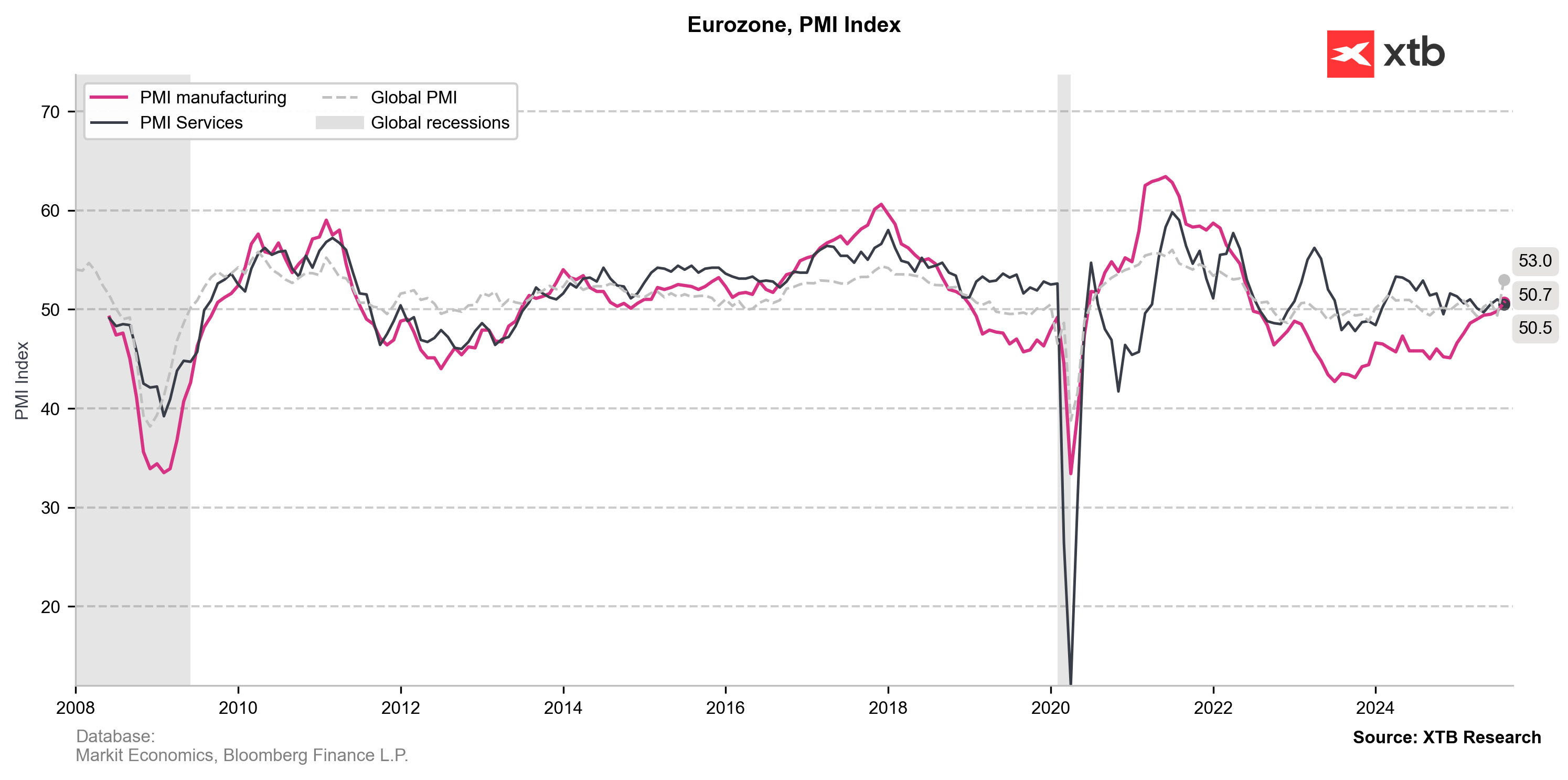

Eurozone business activity is experiencing a gradual and subdued expansion, despite persistent concerns about a decline in external demand due to Donald Trump's tariffs and continental fiscal challenges. According to August PMI data, the situation has improved in both manufacturing and services, although trends are changing in the largest EU economies.

In France, optimism is primarily driven by the highest employment growth in over a year, although companies warn that the new prime minister's proposed additional corporate taxes would primarily lead to layoffs. Conversely, a clear drop in orders has been recorded in Germany, where a combination of lagging domestic demand and high wages is forcing companies into significant restructuring.

Nevertheless, the easing of deep trade uncertainty, the gradual expansion of the business sector due to the transmission of less restrictive monetary policy, and stable inflation projections all legitimize the ECB's current pause.

Business activity in Europe remains on the edge of expansion, far from the dynamism needed for a decisive improvement in sentiment. Nevertheless, we see a clear improvement compared to what we observed a few or several months ago. Source: XTB Research, Macrobond data

Markets Eye Stability and Potential Cuts from December

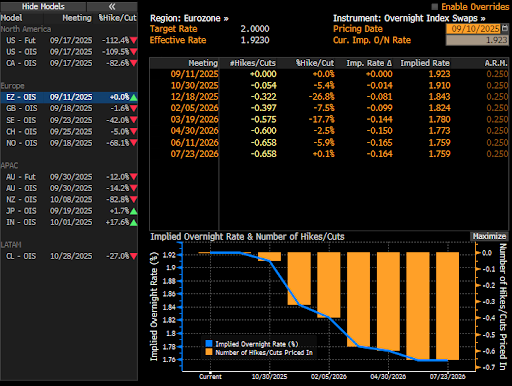

Market expectations point to no changes in interest rates for both Thursday's decision and the October meeting. A slightly higher probability is assigned to September, so any dovish statements could increase expectations for December. However, the market does not anticipate a full cut until mid-next year.

Source: Bloomberg Finance LP

EURUSD Situation

The world's most important currency pair started the week by rising to nearly 1.18, its highest level since late July. Volatility in the pair has clearly decreased as pressure on the dollar has lessened amid the trade war. However, a divergence in monetary policy between the ECB and the Fed is very close. The ECB is comfortable with its interest rates, and while the economy is not in great shape, the risk of recession seems low.

Conversely, in the US, the Fed is preparing for an entire cycle of cuts, and the labor market is sending extremely negative signals. As a result, the chances of reaching 1.20 this year remain realistic, although geopolitics could again play a significant role. If the conflict with Russia in Europe were to escalate, the euro and other regional currencies could lose value. However, if the pair reacts mainly to monetary and economic factors, the recent trend drawn by the upward trend channel may continue.

AI scare trade broadens out as we wait for key inflation update

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.