Summary:

-

Pound rising across the board

-

Conservatives hold circa 15% in election polls

-

Equities mixed with FTSE still around 7300

The pound has begun the new week on the front foot after the latest election polls showed the Conservatives extending their lead over Labour, boosting the currency back near the $1.30 handle to trade at its highest level since the start of the month. News on Friday that the Brexit party would not contest further seats has come as a positive for the Tories and with just over 3 weeks to go until the election they continue to hold a strong lead of around 15% in most opinion polls.

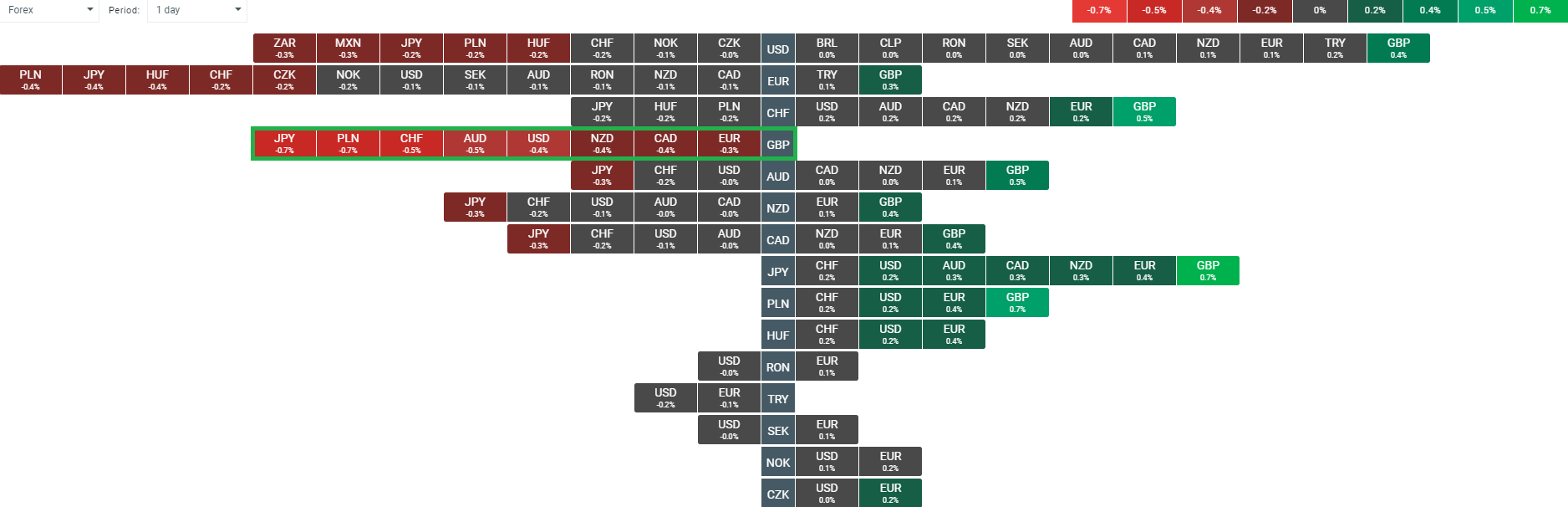

GBP is rising against all its peers today, with the biggest increase of 0.7% seen against the Japanese Yen. Source: xStation

Despite some forecasts that the two leading parties would lose ground at the forthcoming election, the recent trend in polling data since it was called has shown both the Conservatives and Labour party gain support at the expense of the Lib Dems and Brexit party. A series of TV debates between Boris Johnson and Jeremy Corbyn will start tomorrow evening and the latter could do with some good performances if he is to close the gap and prevent a Conservative majority.

Stocks mixed to start the week

On the whole it’s been a fairly mixed start to the new week for stock markets with Asian benchmarks moving higher, Europe little changed and US futures pointing to a record open for Wall Street this afternoon. The moves higher overnight came on the back of some monetary easing from the People’s Bank of China after they cut their 7-day repo rate by 0.05% to 2.5% - the first reduction in this rate in 4 years. It’s a quiet day ahead on the economic data front with little of interest in terms of market moving events.

The FTSE continues to trade in a fairly directionless manner with dips into the region around 7230 being bought and 7450 providing a ceiling. Source: xStation

The FTSE continues to trade in a fairly directionless manner with dips into the region around 7230 being bought and 7450 providing a ceiling. Source: xStation

Daily Summary - Powerful NFP report could delay Fed rate cuts

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

NFP preview

Daily summary: Weak US data drags markets down, precious metals under pressure again!

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.