Gold prices are experiencing their third consecutive session of declines, marking what could be the longest losing streak since late April/early May. The precious metal is down almost 1% today, testing a critical support level.

The current downturn in gold is largely attributed to a prevailing risk-on sentiment in the broader market, despite equity indices not currently ascending from historical peaks. This optimism is also fueling a continued recovery in the oil market. Furthermore, weakening demand for gold jewelry in China and India, driven by elevated prices, has been noted as a contributing factor.

The third significant element is a strengthening US dollar. This dollar appreciation follows a reduction in perceived risk surrounding the Federal Reserve chairman's position and robust economic data from the United States. Looking ahead, next week will be pivotal with the release of the Fed's interest rate decision, alongside key macroeconomic indicators such as GDP, ISM indices, and the Non-Farm Payrolls report.

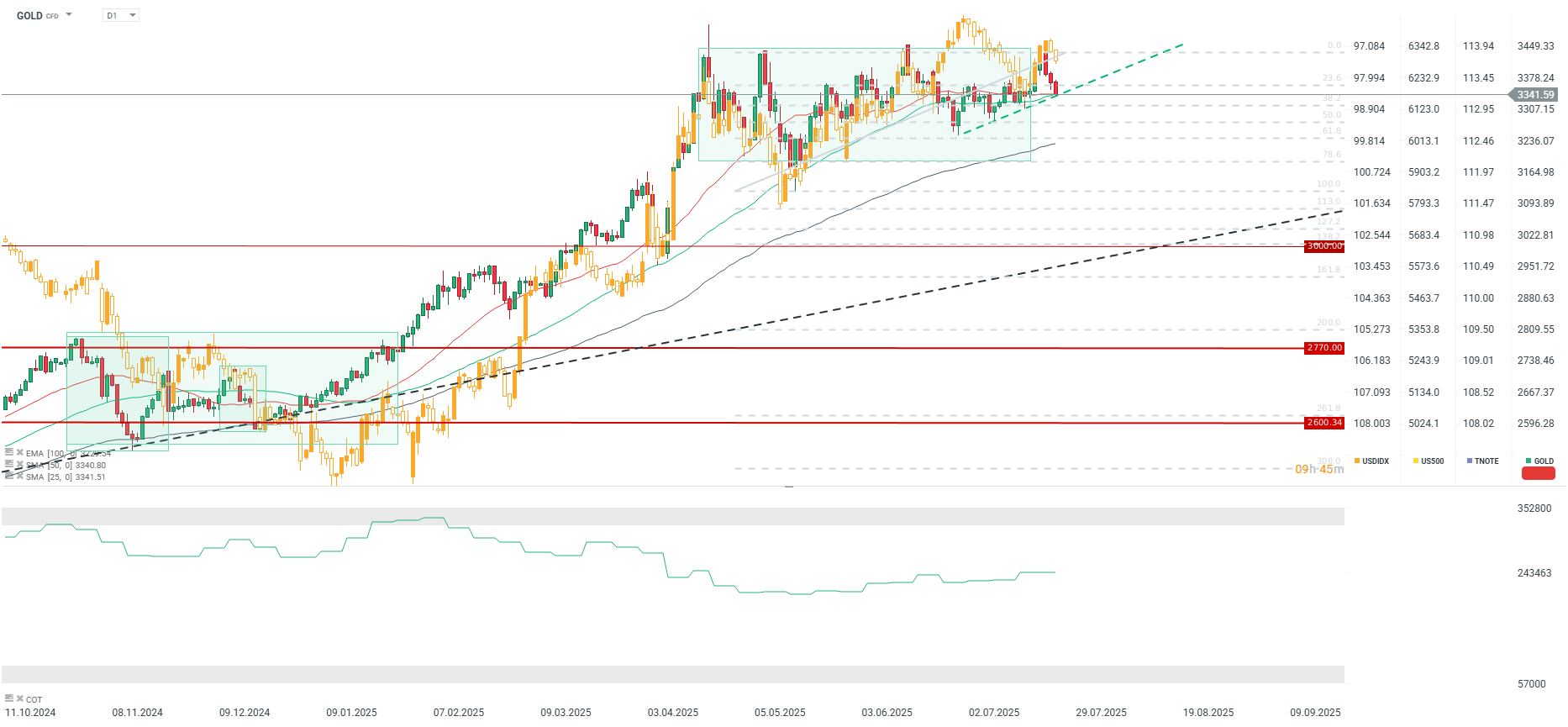

Gold is currently testing support defined by an uptrend line and the 25- and 50-period Simple Moving Averages (SMA). A decisive break below this support could see gold decline to the 3250-3280 range. However, if this support holds today, a return above the 23.6% Fibonacci retracement cannot be ruled out early next week. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.