Gold is performing exceptionally well today, up nearly 3% and continuing its climb toward record levels near $5100 per ounce. Prices recently posted their strongest single-day gain since 2008, rising more than 5.2% in one session, highlighting both the strength of buyers and the scale of inflows into the market. Data from China suggests investors are still accumulating physical bullion ahead of the Chinese New Year holiday, scheduled for February 16.

Interestingly, gold buying has continued despite weak sentiment in U.S. equities and appears to be breaking through many traditional correlations, indicating that the fundamental backdrop for precious metals has not materially changed despite last week’s panic. Global capital continues to flow into bullion, with additional upside support coming from the U.S. dollar index, which is posting a second consecutive day of moderate declines.

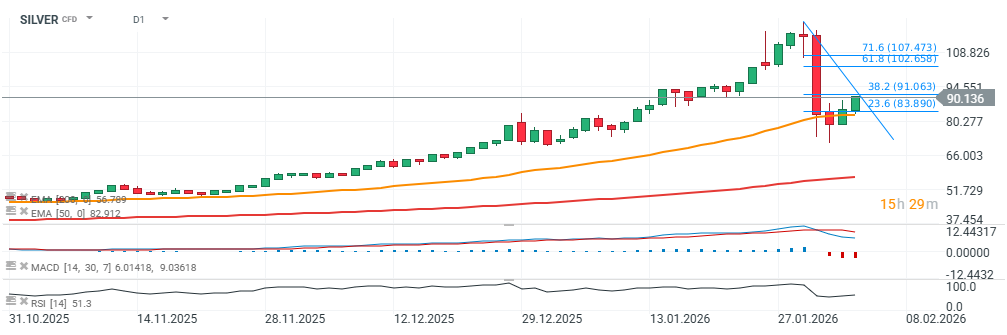

(GOLD, SILVER charts, D1 timeframe)

From a technical perspective, gold has moved above the 38.2% Fibonacci retracement of Friday’s sell-off and is now heading toward the 61.8% level near $5,150 per ounce. Key momentum support has held at the EMA50 (orange moving average). Friday’s bearish candle also left a long lower wick, as price ultimately closed above the moving average, and on Monday it successfully defended the $4,700 area as a key support zone.

Source: xStation5

Silver has joined the rebound as well, recovering toward $90 per ounce. The price held its key momentum support at the EMA50 (orange line) and is now approaching an important resistance level: the 38.2% Fibonacci retracement of Friday’s decline, located near $91 per ounce.

Source: xStation5

Three markets to watch next week (27.02.2026)

Daily summary: The beginning of the end of disinflation?

Wheat at its highest level in 8 months 📈

Jane Street: Legendary market maker in the court

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.