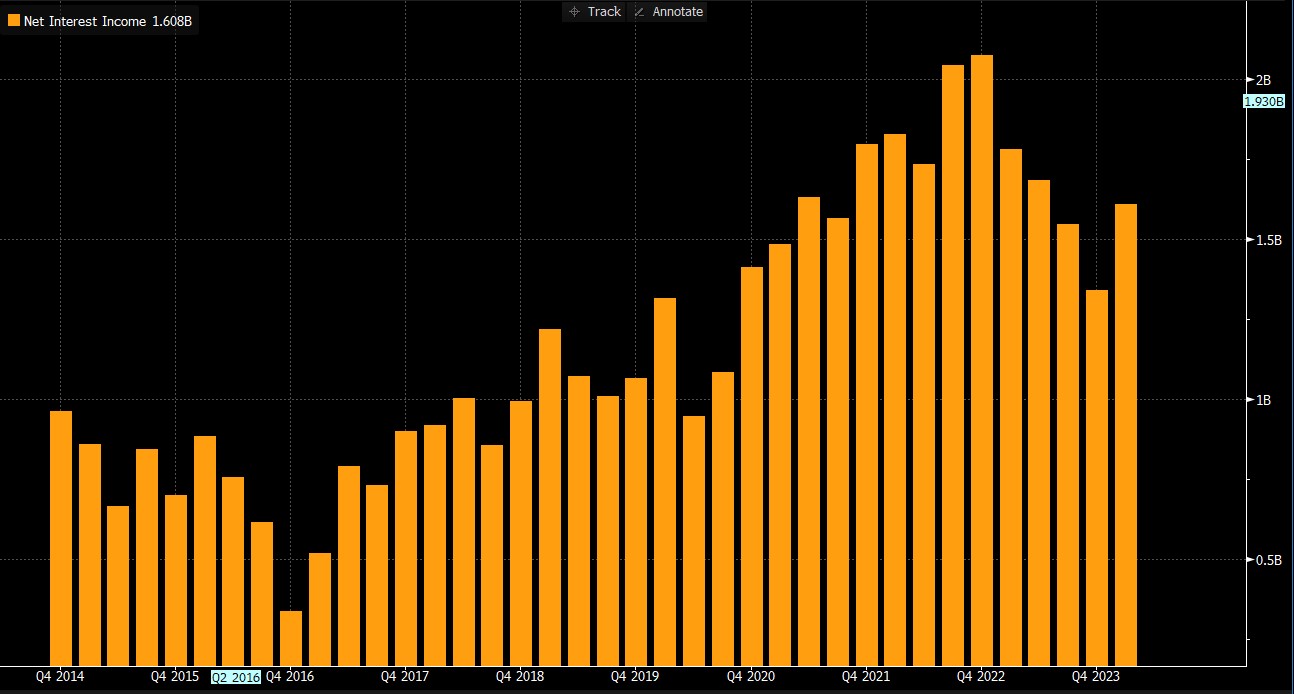

Goldman Sachs' 1Q24 results significantly exceeded expectations. Strong EPS, coupled with robust revenue dynamics, as well as a substantial decrease in credit loss provision, provide a solid foundation for potential stock price increases. For the first time in 4 quarters, the company recorded a QoQ increase in net interest income, reaching a level close to 2Q23.

Net interest income Goldman Sachs. Source: Bloomberg Finance L.P.

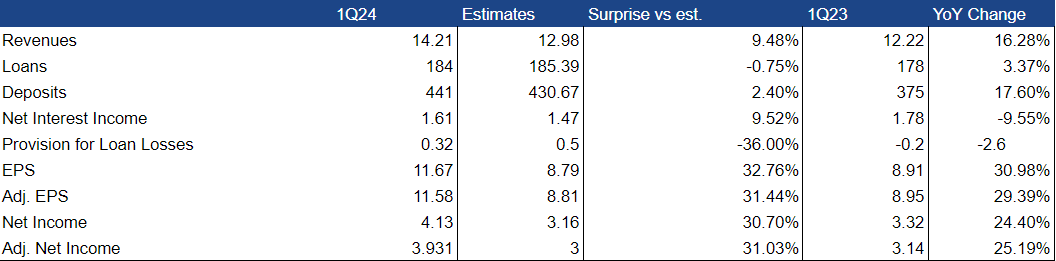

Improvements in every segment (particularly in investment banking) propelled revenues to a record level over the past two years, reaching $14.2 billion (+16.3% y/y).

In the key Banking and Markets segment, Goldman Sachs reported revenues of $9.73 billion, surpassing market expectations by 15%, thereby exceeding even the most optimistic scenarios. Particularly notable was the significant increase in investment banking fee revenues (+32% y/y), driven by a rise in successfully executed M&A transactions in the global market.

The company reduced its credit loss provision to $318 million (compared to $577 million in 4Q23) on a q/q basis. A year earlier, during the same period, it reported a result of -$171 million, stemming from a one-off event, namely the partial sale of the Marcus portfolio. This year's reserve value was significantly below market expectations (-36% compared to expectations).

The company achieved a net income of $4.13 billion, surpassing expectations by 30.7%. On a y/y basis, net income increased by 24.4%. EPS rose to $11.67 (+31% y/y growth). After adjustment, its value stood at $11.58. Both values exceeded analysts' expectations by approximately 32%.

The company also announced a dividend of $2.75 per share. The dividend date was set for May 30th, with the dividend payment scheduled for June 27th.

Goldman Sachs' 1Q24 results (in bln $, except for EPS) Source: Company's financial report, Bloomberg Finance L.P.

After Goldman Sachs' results, there has been a strong increase in the stock price in pre-market trading. The price has risen by over 4% so far. Source: xStation.

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.