In the last month of this year, increases in global markets are driven by speculation about upcoming cuts in interest rates and decreasing inflation. Particularly important here are data from the USA, which drive the rest of the markets and to some extent dictate the policy of other central banks. The last meeting of the Fed was received by the markets exceptionally dovishly and was a catalyst for increases. Indices are quoted around or above historical highs, all in the hope of the first Fed cuts as early as March, and certainly before the middle of next year. New projections indicated a total of 75 basis points of cuts in 2024. However, for the Fed's narrative to be maintained, inflation in the USA must continue its current downward trend. Let's look at a few charts to learn more about the possible direction in the coming months.

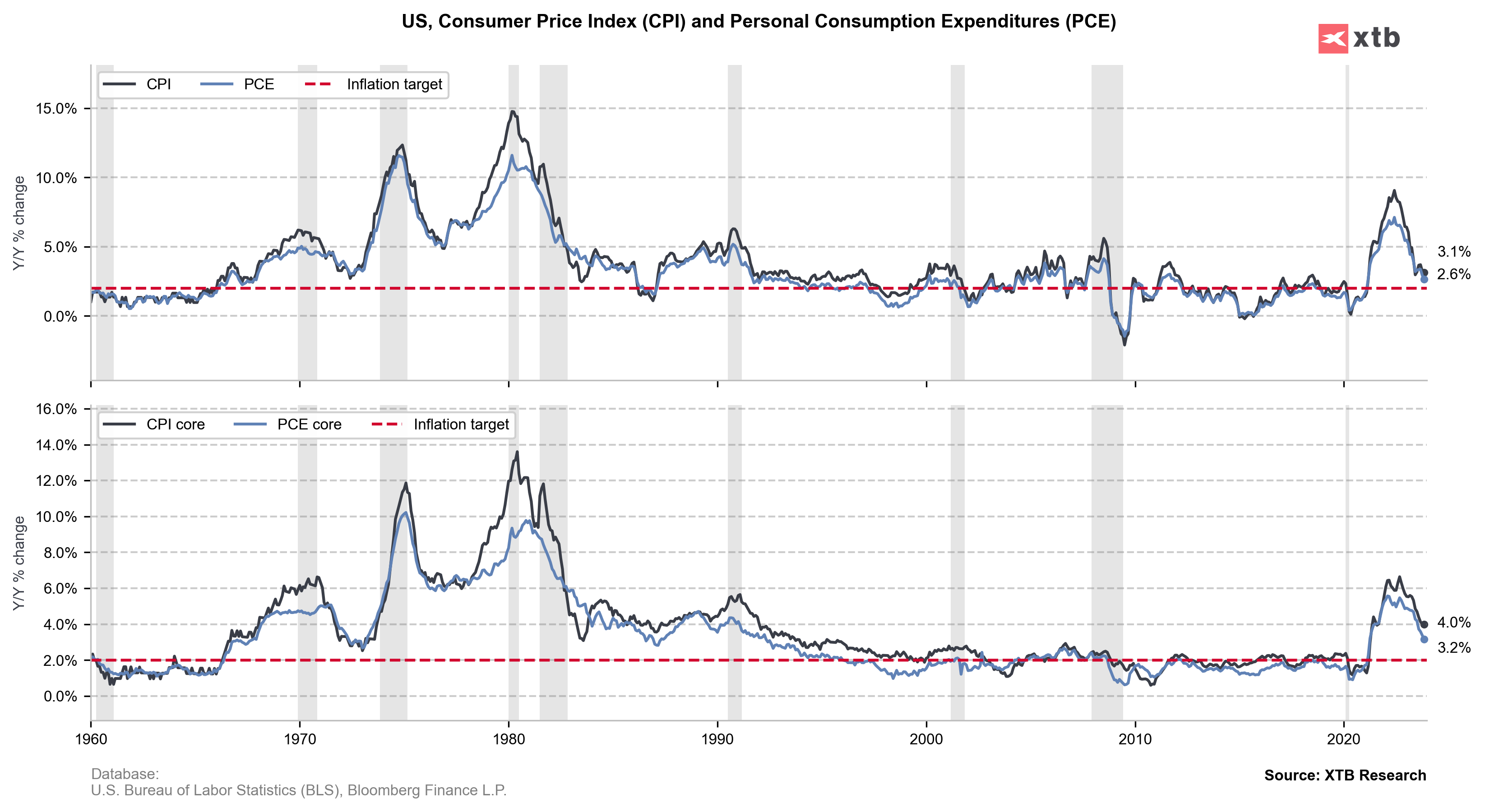

Today's PCE inflation report from the USA confirmed the continuing downward trend. Overall prices last month rose by just 2.6% year-over-year, which is simultaneously very close to the historical average of the last decade. It's important to remember that the Personal Consumption Expenditures (PCE) index is a preferred measure of inflation by the Fed, therefore its decline, higher than expected, should support the scenario of policy easing.

Although the labor market has begun to stabilize a bit, wages remain high. However, the data are no longer as high as at the turn of 2021-2022. Inflation is falling, and so far, the progress is really noticeable. However, a decrease in wage growth from 4.0% to around 2.0% historically may already be much more difficult to achieve in such a short term.

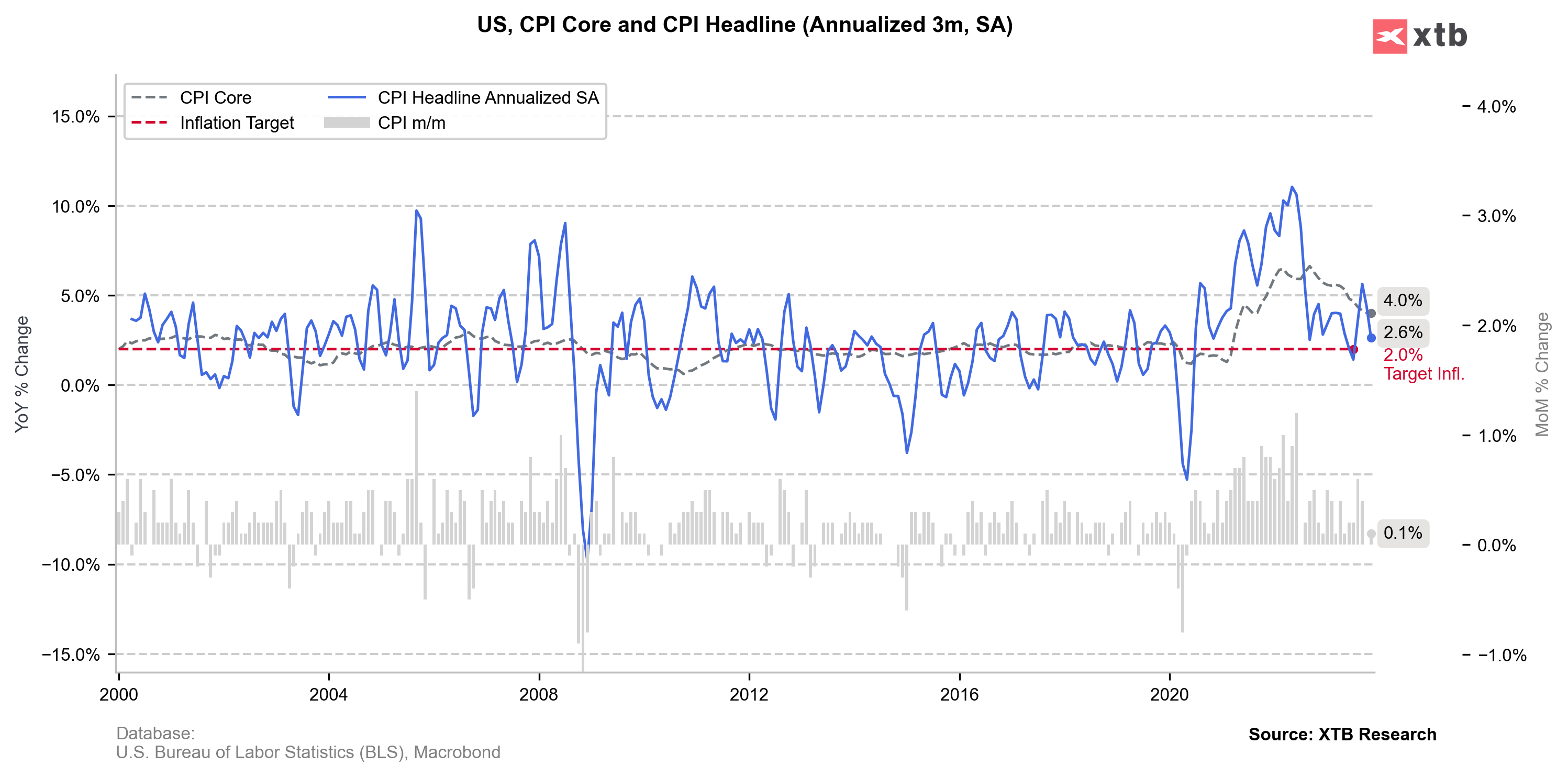

Annualized inflation based on price changes over the last 3 months also indicates a potentially good direction. Monthly changes show satisfying dynamics. Although there are still higher readings caused by the base effect and other factors, the direction is clear.

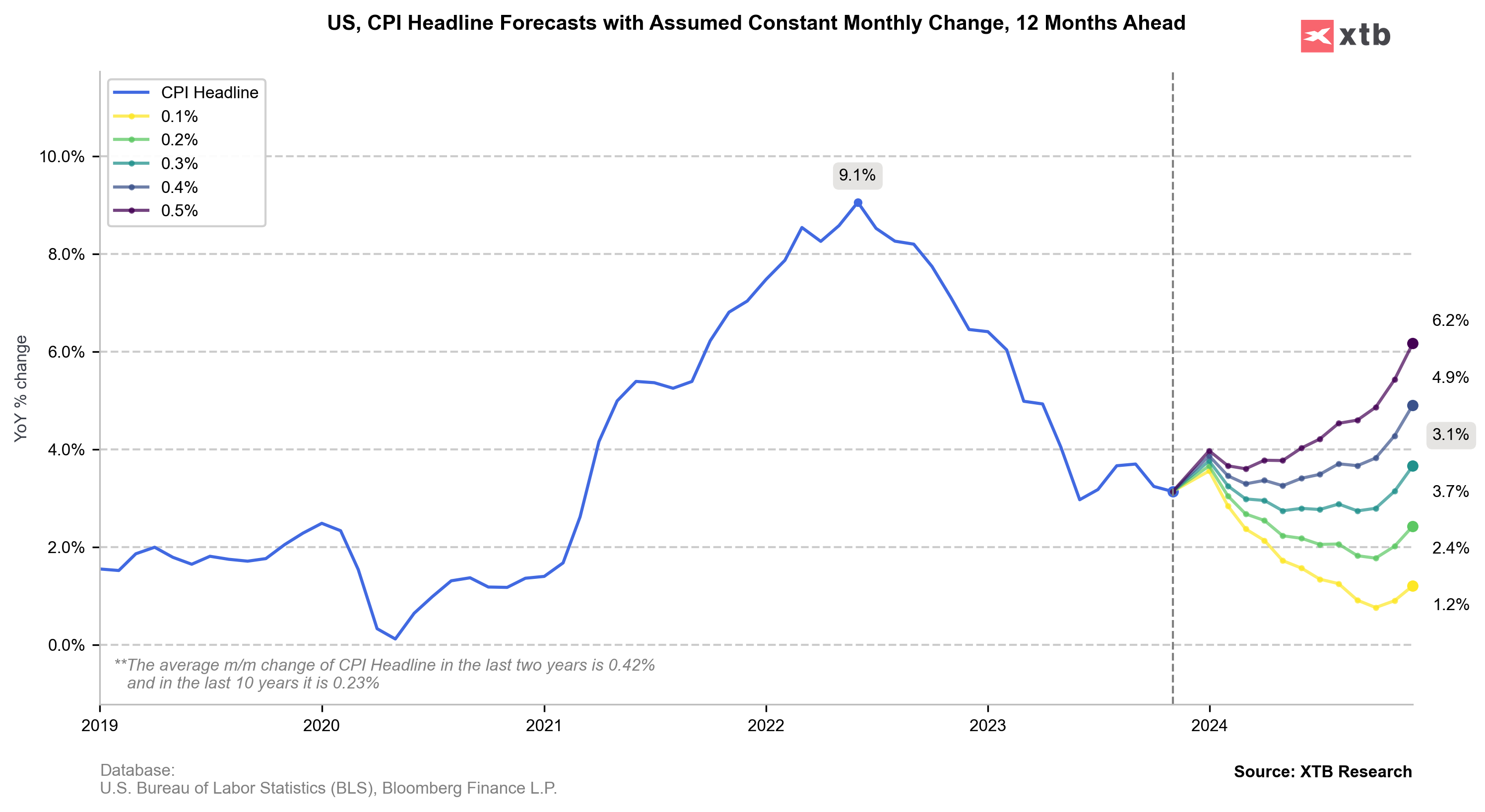

The above chart allows us to analyze how annual inflation readings would shape up, assuming constant month-over-month changes. Here, assuming a historical average of about 0.23% (green path), inflation in 2024 would maintain a downward trend. The exception might be the beginning of this year when, due to the base effect, we might see slightly higher readings.

The data show that the US economy is currently heading in the right direction and should gradually ease off. However, it's important to remember that we still remain in an environment of high-interest rates, and their impact on the economy may be visible in 2024.

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.