-

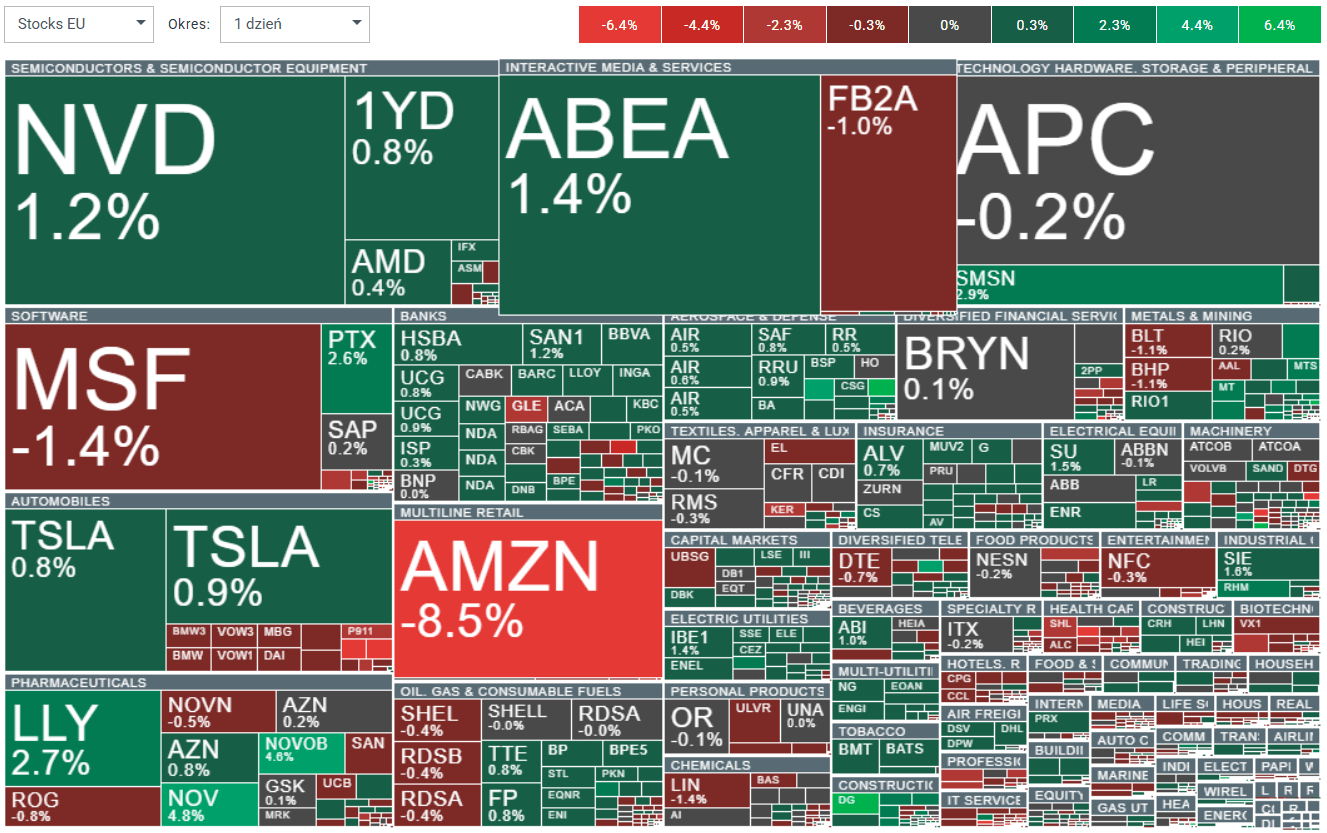

European stocks and indices started Friday with a mildly positive tone. Futures on the Euro Stoxx 600 are up 0.40%, reflecting a calmer mood after a volatile US session.

-

The broader global backdrop remains fragile following a weak close on Wall Street. US equities saw a very sharp selloff on Thursday, and moves across asset classes pointed more to heightened volatility than to a clear risk-on or risk-off environment.

-

BNP Paribas noted that quality stocks are no longer expensive and could begin to outperform if economic growth holds up. The bank highlighted that valuations have retraced toward long-term averages.

-

The MSCI Europe Quality Index is trading around its long-term average forward P/E, while the Stoxx 600 appears slightly more expensive on that basis. The valuation premium for top-quality companies has fallen to around 20%, close to the lower end of its range over the past 12 years.

-

Barclays, however, is cooling enthusiasm around a return of quality stocks as market leaders, arguing that a clear catalyst is still needed. The bank points out that capital positioning in the sector remains elevated while sentiment is weak.

-

Barclays also stresses that macro fundamentals continue to favor value stocks. Stabilizing real interest rates, improving macro data, and fiscal stimulus keep the risk-reward profile for value attractive, despite the recent rise in valuations.

-

JPMorgan’s models indicate an “early recovery” phase, which typically benefits value stocks, small caps, and higher-risk strategies. The bank believes that easing monetary policy and a weaker dollar will continue to support cyclical stocks at the expense of defensives, with value leading the market.

-

German macro data highlighted how difficult it remains to revive industrial momentum. Industrial production fell 1.9% m/m in December, well below expectations.

-

Weakness was concentrated in cyclically sensitive segments. Output excluding energy and construction dropped 3.0%, driven mainly by autos (-8.9%) and machinery and equipment (-6.8%). Energy production fell 1.8%, while construction rose 3.0%.

-

Despite the weak December print, the quarterly picture still suggested a small positive contribution to growth. Output in Q4 2025 was about 1% above the previous quarter’s average, consistent with GDP growth of roughly 0.3% q/q — with full details due on February 25.

-

There were also signs of improving demand that could support a gradual recovery in the second half of 2026. Industrial orders jumped 7.8% in December, the strongest increase in two years, and the Ifo business climate index for manufacturing improved at the start of 2026, although it remains at low levels.

-

Bloomberg Economics expects only modest growth in early 2026 before fiscal spending delivers a stronger boost later in the year. Forecasts point to 0.2% GDP growth in Q1 2026 and 0.3% in Q2 2026, with a sharper acceleration in the second half driven by infrastructure and defense investment.

Three markets to watch next week (27.02.2026)

Daily summary: The beginning of the end of disinflation?

Wheat at its highest level in 8 months 📈

Jane Street: Legendary market maker in the court

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.