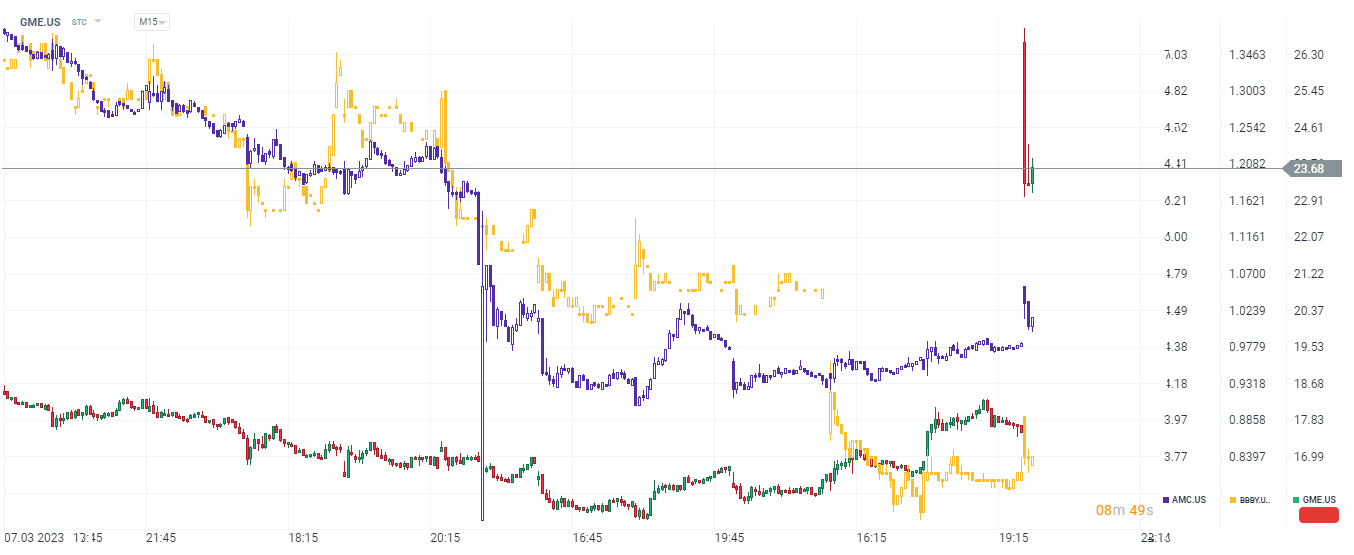

GameStop's (GME.US) better-than-expected financial results caused the company's shares to open today with a huge upward gap of more than 50%. The increased optimism on GME also brought the bulls back to other stocks that have been targeted by Reddit forum investors in the past, i.e. AMC (AMC.US), and even financially troubled BedBath&Beyond (BBBY.US). Demand, however, is clearly having trouble sustaining the dynamic rebound; a good portion of the gains were erased moments after the opening:

- Gamestop's Q1 sales amounted to $2.22 billion, beating the consensus of $2,18 billion; they turned out to be slightly lower on a like-for-like basis in 2022. Thanks to lower costs, the company reported an increase in operating margin and a net profit of $48.2 million, compared to a net loss of $147.5 million a year earlier;

- Risk aversion may persist ahead of the Fed meeting, and the dominance of bulls looking to realize gains may make the rise in 'meme stocks' appear only temporary. However, if Jerome Powell is surprisingly dovish today, we can expect speculators to want to return to 'meme stocks', potentially pushing their prices higher.

- Another 'meme company', AMC recently approved a 10-for-1 reverse stock split for AMC shares and will soon likely cease trading in single digits (investors will receive 1 share in exchange for the 10 they hold). Shareholders have also decided to convert APE (AMC Preffered Equity) shares into common shares, which will potentially 'dilute' existing shareholders and is not positive for stockholders;

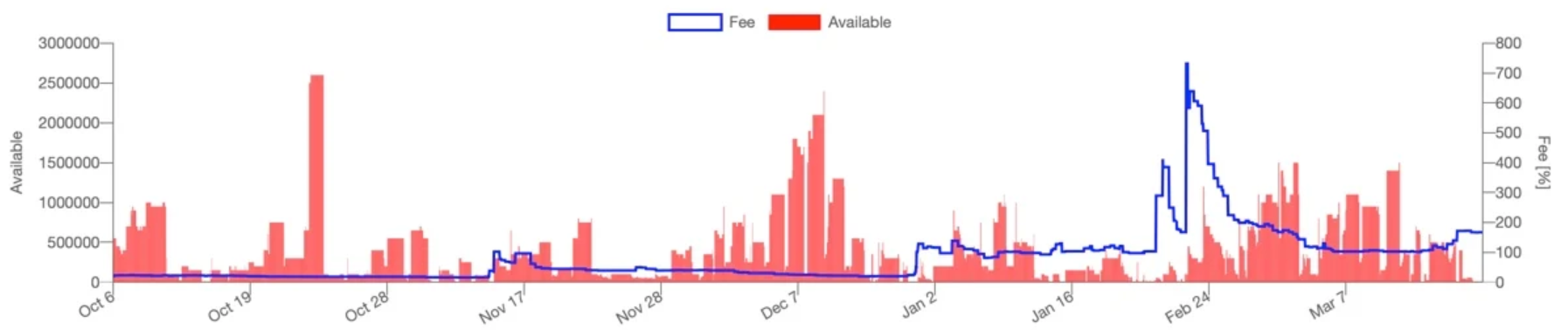

- According to VandaTrack, retail investors added an average of $1.5 billion to U.S. equities each day during the first two months of this year. This was a record level of inflows. With retail investors returning to speculative assets, institutions holding short positions on AMCs were forced to cover their positions by jacking up prices for borrowing shares.

Fees for borrowing AMC shares are still very high. They depend on supply and demand - the greater the demand for short positions, the more difficult it is to find available shares to borrow, which drives up fees. To short AMCs, institutions betting on declines currently have to pay very high fees. The value of all AMC shares sold short is currently $576 million, and represents about 25% of AMC shares admitted to trading (free float). Retail investors would have to make a significant effort to create an analogous 'corner' by 2021.

The high prices for borrowing ACM shares show that demand for short positions is still very high despite declines in the price of the stock. Source: Barrons 'Meme stocks' didn't maintain the bullish momentum from the beginning of trading. Profit realization pressure is coming back. Source: xStation5

'Meme stocks' didn't maintain the bullish momentum from the beginning of trading. Profit realization pressure is coming back. Source: xStation5

Boeing gains amid news about potential huge 737 MAX order from China 📈

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%

Brent tops $90 per barrel

RyanAir shares under pressure amid Middle East conflict 📉

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.