Micron is up 10% today to $153 per share after Citi raised its price target to $175 (from $150).

The upcycle in the memory market remains intact thanks to high barriers to entry, thus limited supply, and stronger-than-expected demand — especially from data centers and AI. Micron will report its fiscal Q4 results on September 23. Citi expects results roughly in line with consensus (~$2.62 EPS on $11.2bn revenue), but guidance clearly above expectations, driven by higher DRAM and NAND volumes and pricing. Citi’s FY26 EPS estimate is 26% above consensus.

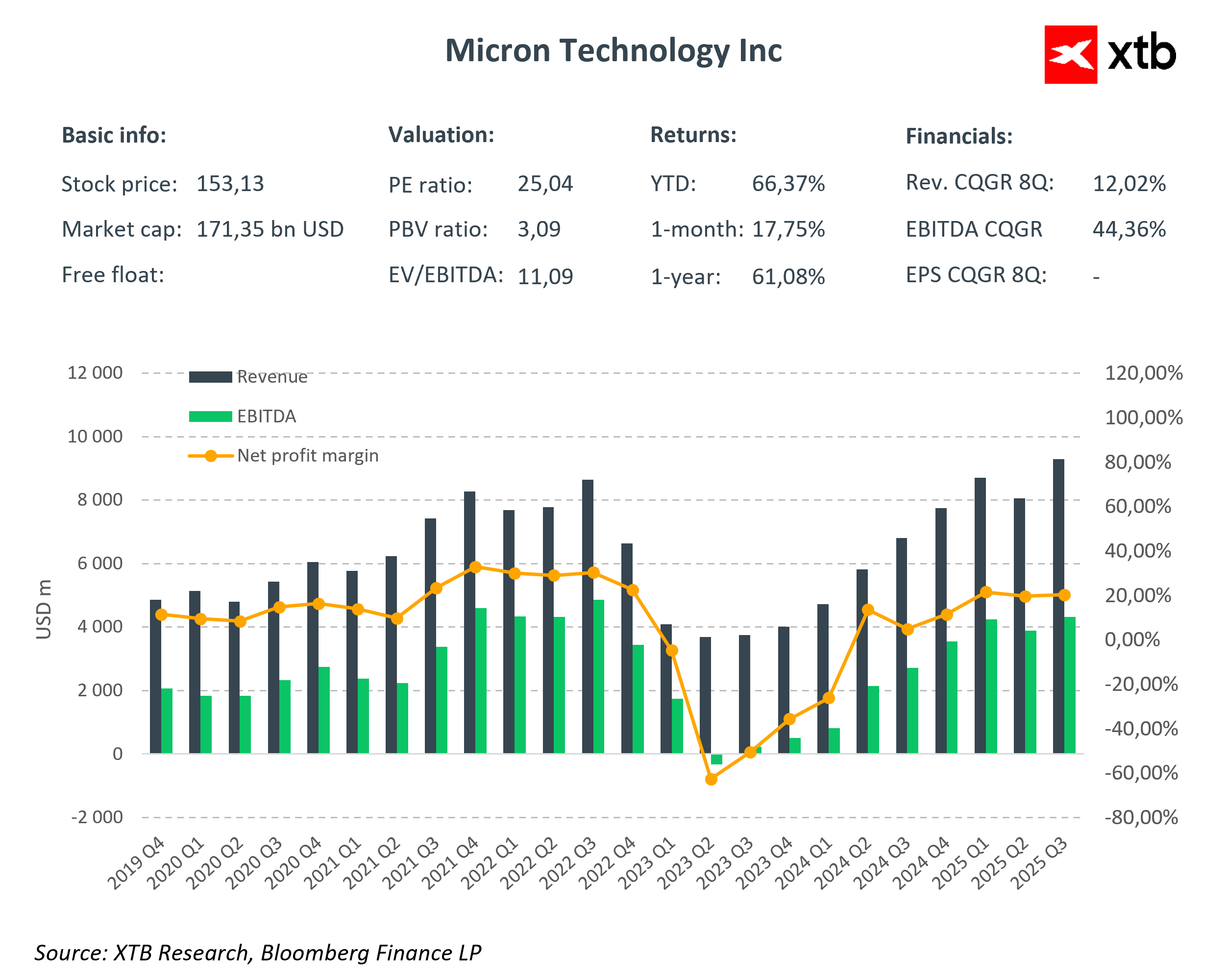

Micron financial dashboard

Morgan Stanley estimates that AI-related NAND demand could reach 34% of the global market by 2029, expanding TAM (total addressable market) by ~$29bn. As a leading NAND supplier, Micron has the opportunity to become a leader in the enterprise SSD segment.

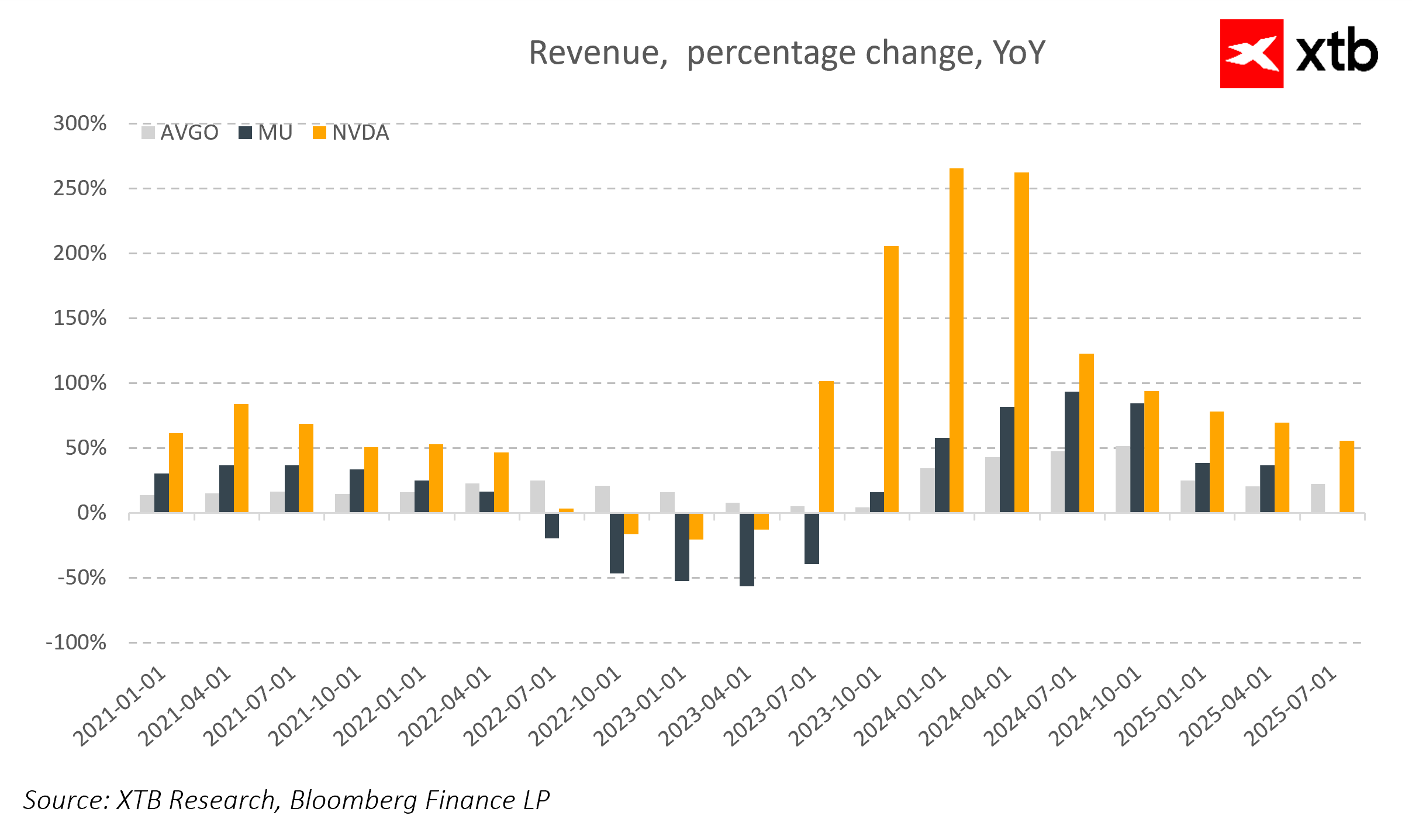

Micron’s revenue momentum has been significantly stronger in recent quarters, though still far below Nvidia in absolute terms. However, forecasts for 2026 appear optimistic for the company.

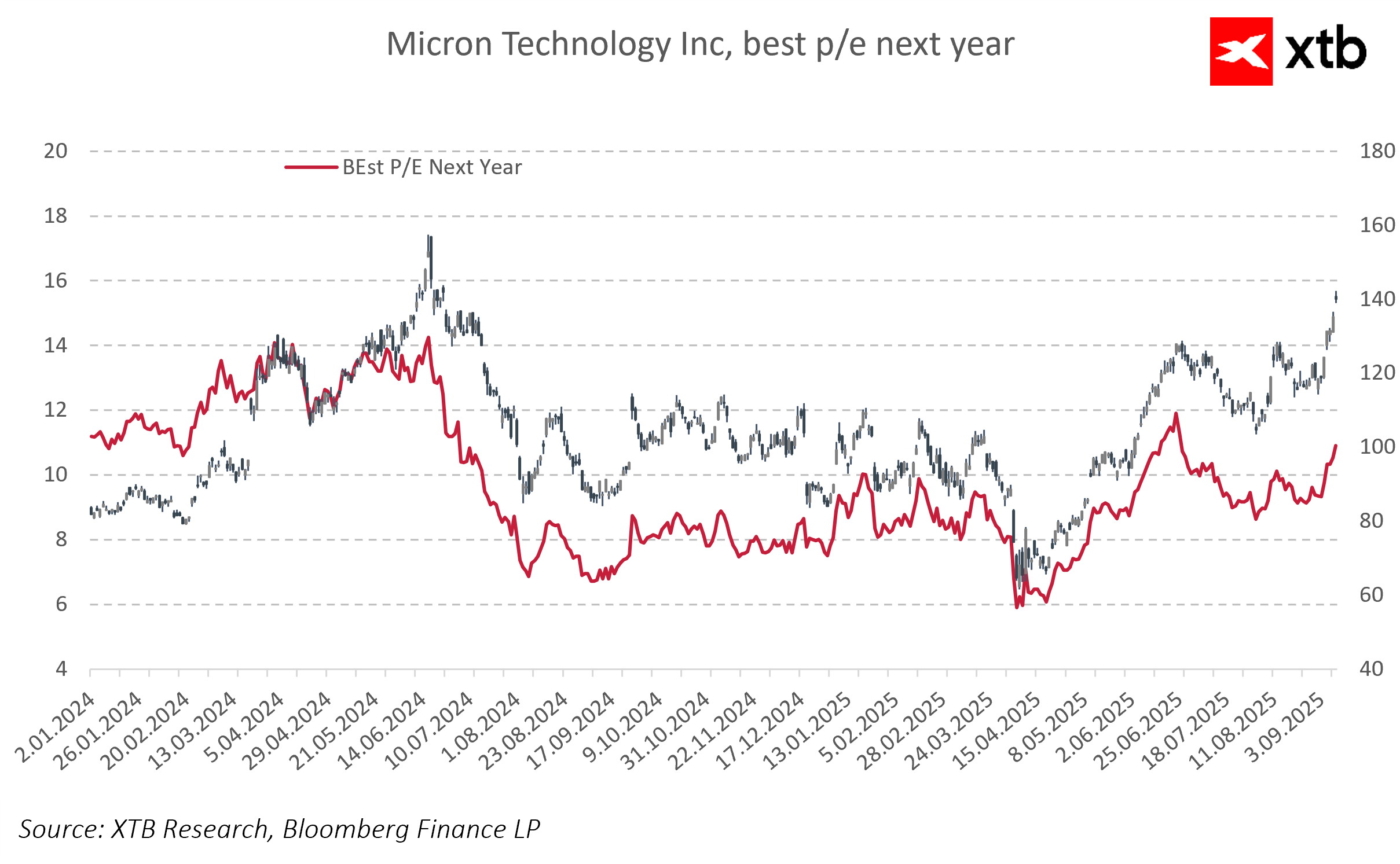

Valuation also does not appear overly stretched. Forward PE for next year stands at just around 11 compared with the current PE above 25.

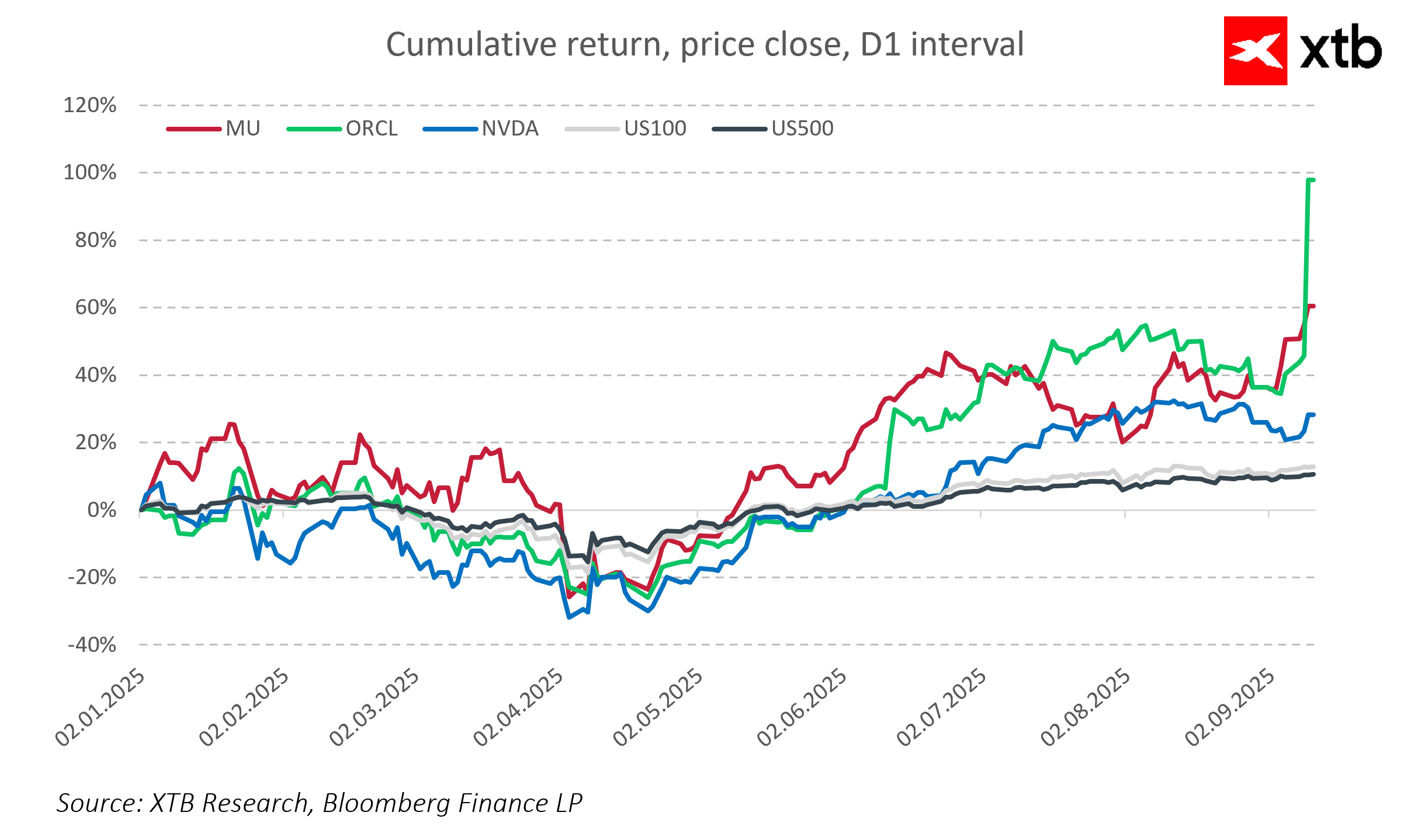

Micron is up 10% today and already more than 60% year-to-date — comparable to other semiconductor peers and clearly outperforming the US500 and US100 indices.

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.