- Sentiment on the European stock market at the start of the second phase of today's session remains relatively mixed. The Euro Stoxx 50 index is up 0.54%, while Germany's DAX is down 0.2% and France's CAC40 is down 0.36%. The UK's FTSE100 is performing better, rising 0.45%.

- Nasdaq futures broke a three-day losing streak, rebounding from the 30-day exponential moving average thanks to renewed optimism around AI following record results from semiconductor giant TSMC.

- Sentiments are also improving after President Donald Trump told Iran that he does not want war and will not launch an attack, according to Iran's ambassador to Pakistan. He also asked Tehran not to attack US assets.

- In light of this information, crude oil is performing poorly today, losing ground amid declining concerns about turmoil in the global distribution sector.

- Richemont (CFR.CH), a Swiss luxury goods group (jewelers such as Cartier and Van Cleef & Arpels, and watchmakers such as IWC, Jaeger-LeCoultre, and Vacheron Constantin) has once again proven its business position, surprising the market with higher results for the period September-December 2025.

- According to macroeconomic data published today, Germany's GDP growth in 2025 was only 0.2% y/y (forecast: 0.2%). This is the first growth after two years of recession.

- At the same time, the Polish stock market is dominated by gains driven by the appreciation of CD Projekt (CDR.PL) shares. The WIG20 index is up 0.4%, and the shares of the aforementioned company are up as much as 5%.

- The producer and publisher of computer games has announced that The Witcher 4 will not be released in 2026 in order to avoid competition from Grand Theft Auto 6.

- Inflation in Poland for December ultimately remained at 2.4% y/y, which represents a decline compared to November, when the reading was 2.5% y/y. There was no monthly inflation, meaning that the rate was 0.0% m/m, in line with the initial reading.

- The company closed the year with record revenues exceeding $122 billion, representing an increase of over 35% year-on-year and the highest result in the company's history. Net income in the fourth quarter alone rose 35% to $16 billion, significantly exceeding analysts' expectations.

- According to Nikkei reports, China is developing rules for purchasing NVIDIA (NVDA) H200 chips, seeking to strike a balance between supporting domestic chip development and the needs of Chinese technology companies.

Morgan Stanley claims that Nokia has become a more efficient company after a long period of restructuring and has raised its rating of the telecommunications equipment manufacturer to "overweight."

- On the Forex market, the Australian and US dollars are currently performing best. Declines are most noticeable in the British pound and the Canadian dollar.

- Precious metals such as gold and silver are recording intraday declines. However, their scale is relatively limited, with the exception of silver, where discounts reach nearly 2.5%.

- Later in the day, investors will focus on US macro data and the publication of quarterly results by companies such as Blackrock, Goldman Sachs, and Morgan Stanley.

- At 2:30 p.m., we will learn about unemployment benefits and data from NY Empire and Philadelphia FED. Throughout the day, we can also expect numerous speeches from FED bankers.

- In Poland, attention will focus at 3:00 p.m. on a press conference by President Glapiński, who will comment on the MPC's decision to maintain interest rates in Poland.

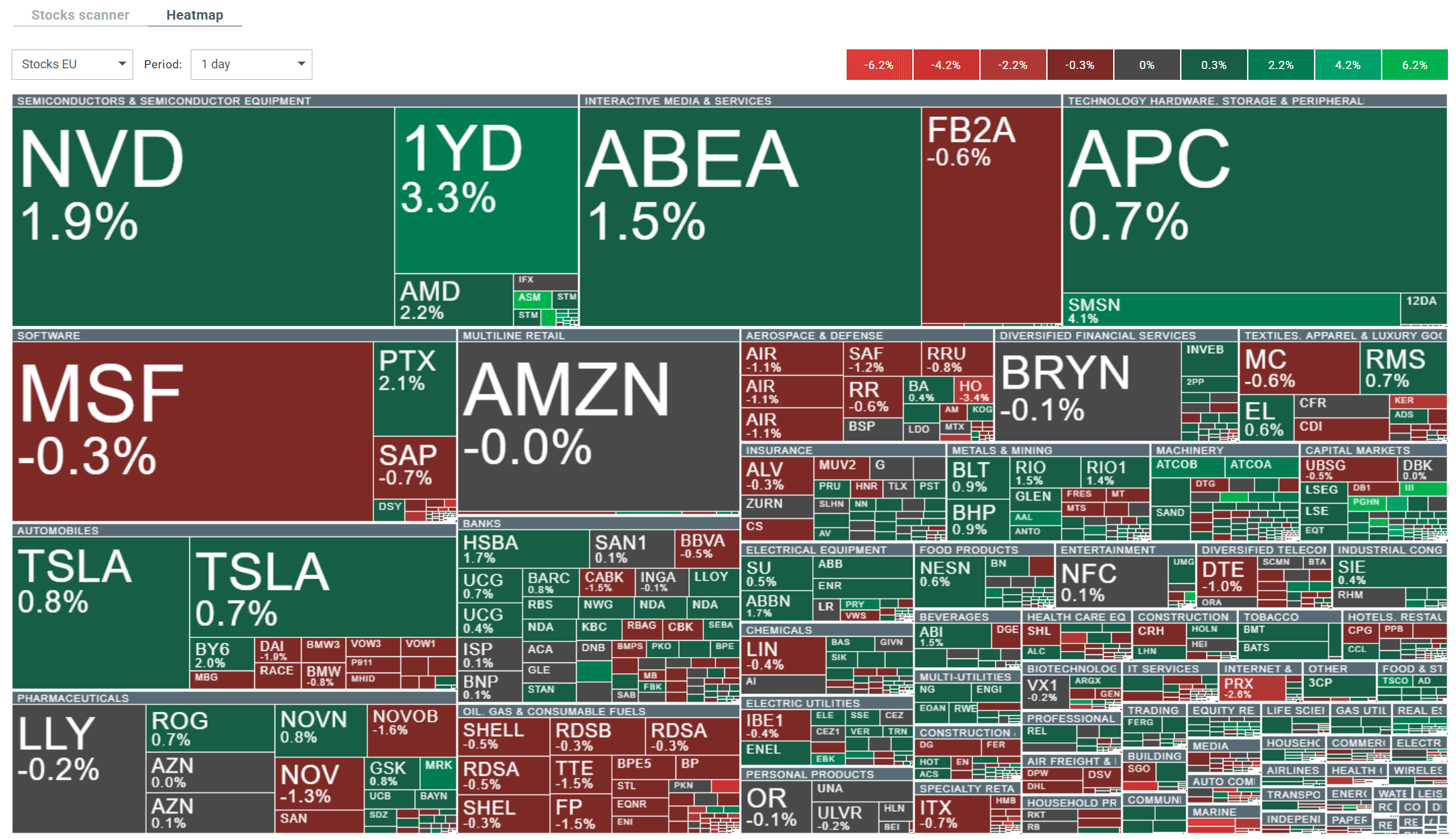

Below is a heat map showing the volatility currently visible on the European stock market.

Daily summary: Markets capitulate under the influence of the Persian Gulf

Paramount Skydance shares under pressure after S&P warning

Broadcom as the Last of the Big Tech. What Can Markets Expect from the Earnings?

Nvidia Faces New H200 Limits in China

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.