-

US indices finished yesterday session lower as conflict in Ukraine threatens supply chains and drives commodity prices higher. S&P 500 dropped 1.55%, Dow Jones moved 1.76% lower and Nasdaq declined 1.59%. Russell 2000 dropped 1.93%

-

Stocks in Asia traded mixed. Nikkei dropped 1.68% and indices in China traded 0.1-1.6% lower. S&P/ASX 200 gained 0.3% while Kospi moved 0.2% higher

-

DAX futures point to a lower opening of the European session

-

Intense shelling of Kharkiv was reported overnight. Russian attacks on residential areas and civilian buildings become more frequent

-

Turkey delivered more of its combat drones to Ukraine

-

Joe Biden announced in his State of the Union address that United States will close its airspace to Russian flights and will begin to identify assets of selected Russian officials and elites to freeze them

-

Sberbank, Russia's largest bank, informed that it will be shutting its European market business as it is no longer able to supply liquidity to its units in Europe

-

There won't be a stock and derivatives trading session in Moscow today as well

-

ExxonMobil announced that it will halt its operations in Sakhalin in Russia and will refrain from making any new investments in the country

-

Australian GDP growth reached 3.4% QoQ in Q4 2021 (exp. 3.0% QoQ)

-

API report pointed to a 6.1 million barrel draw in US oil stockpiles (exp. +2.8 mb)

-

In spite of the US announcing release of strategic reserves, oil prices continued to gain. Brent trades at $111 while WTI broke above $109

-

Precious metals trade mostly lower. Gold, silver and platinum drop while palladium gain

-

AUD and NZD are the best performing major currencies while JPY and GBP lag the most

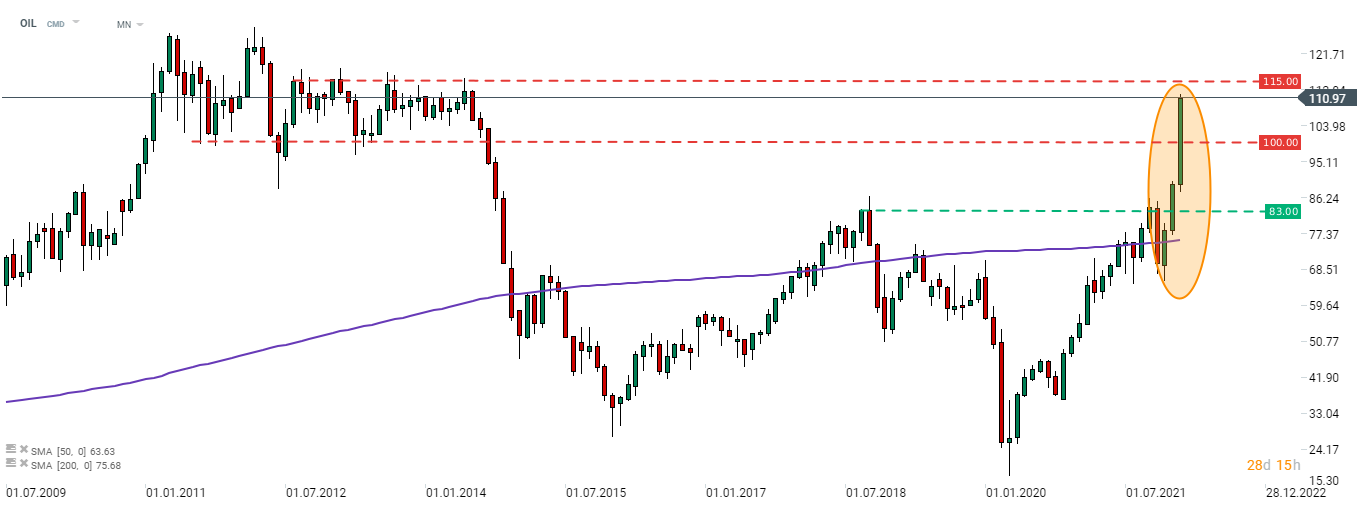

Concerns over possible disruptions on the oil market are sending Brent prices into the sky. OIL is trading almost 60% year-to-date higher and it may not be over. SPR release did little to ease upward pressure and OPEC+ is unlikely to decide on a bigger than 400k hike today. Source : xStation5

Concerns over possible disruptions on the oil market are sending Brent prices into the sky. OIL is trading almost 60% year-to-date higher and it may not be over. SPR release did little to ease upward pressure and OPEC+ is unlikely to decide on a bigger than 400k hike today. Source : xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.