-

Wall Street finished yesterday's trading higher as market odds for Fed rate hike in May dropped following another streak of disappointing data from US jobs market

-

Market now sees around 50% chance of 25 bp rate hike in May and around 50% chance of Fed leaving rate unchanged and pausing rate hike cycle

-

S&P 500 gained 0.36%, Dow Jones traded flat, Nasdaq rallied 0.76% and Russell 2000 moved 0.13% higher

-

Indices from Asia-Pacific traded higher today - Nikkei gained 0.1%, Kospi added 1.3% and indices from China traded up to 0.8% higher

-

Liquidity during today's European trading session is expected to be very thin as majority of stock exchanges from the Old Continent will be shut in observance of Good Friday

-

Japanese household spending increased 1.6% YoY in February (exp. 4.2% YoY)

-

Major cryptocurrencies trade mixed - Bitcoin drops 0.1%, Litecoin gains 0.1%, Ethereum trades 0.3% higher and Dogecoin slumps 2.8%

-

AUD and NZD are the best performing major currencies while JPY and CAD lag the most

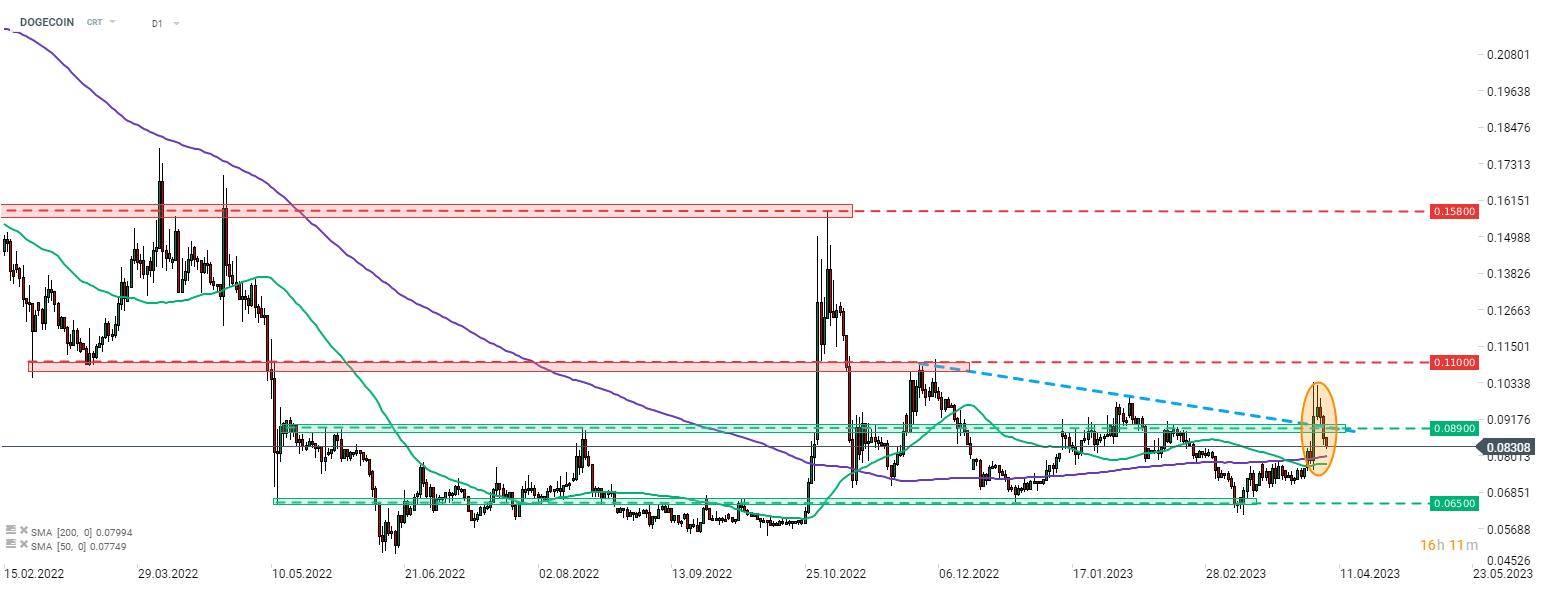

DOGECOIN is one of the worst performing cryptocurrencies today. The coin has almost fully erased the price jump triggered by Elon Musk changing Twitter logo to Shiba Inu. Source: xStation5

DOGECOIN is one of the worst performing cryptocurrencies today. The coin has almost fully erased the price jump triggered by Elon Musk changing Twitter logo to Shiba Inu. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.